- United States

- /

- Electric Utilities

- /

- NasdaqGS:EXC

Exelon (NasdaqGS:EXC) Welcomes Cybersecurity Expert David DeWalt to Board of Directors

Reviewed by Simply Wall St

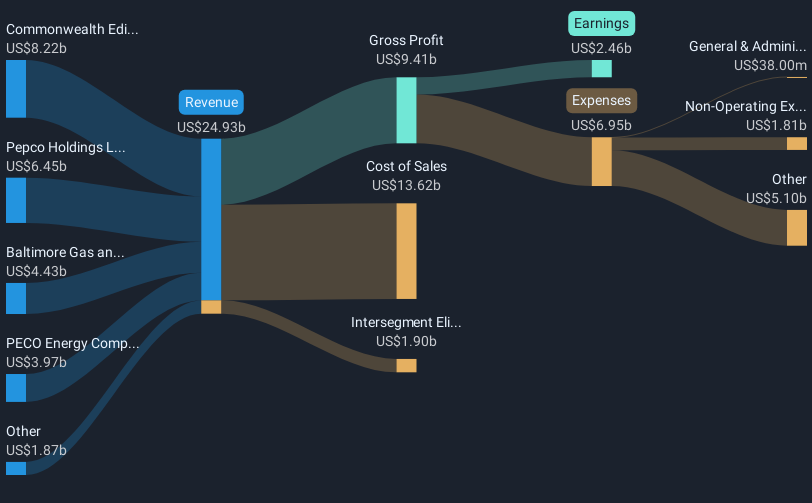

Exelon (NasdaqGS:EXC) experienced a notable 17% price increase over the last quarter, during which it appointed David DeWalt to its Board of Directors. This move underscores the company’s commitment to advancing its focus on technology and cybersecurity. Additionally, Exelon declared a quarterly dividend of $0.40 per share, signaling financial confidence despite a volatile market backdrop marked by a 4.6% market decline. While markets grappled with tariff uncertainties and economic concerns, Exelon showcased strong financial performance, with Q4 sales rising to $5,471 million and annual net income reaching $2,460 million. These earnings align with a broader market expectation of annual earnings growth, evidencing the company's resilience. Despite a challenging market landscape impacted by tariff concerns, these strategic decisions and earnings performance likely contributed to bolstering investor sentiment, driving the stock’s quarterly return amidst broader economic headwinds.

See the full analysis report here for a deeper understanding of Exelon.

The last five years have seen Exelon (NasdaqGS:EXC) achieve a total shareholder return of 140.87%, including share price appreciation and dividends. During this time, several factors have likely supported the company's robust performance. Exelon’s consistent dividend payouts have bolstered investor confidence, with quarterly dividends declared at US$0.40 per share most recently. Moreover, Exelon has been trading at a significant discount to its estimated fair value, suggesting attractive value for investors amidst its business activities.

Key developments, such as the SEC settlement involving a US$46.2 million payment in September 2023, reflect a commitment to resolving past legal issues. Additionally, the opening of the Libertyville Training Center in July 2024 highlights Exelon’s investment in workforce and clean energy. These elements, coupled with competitive price-to-earnings ratios compared to industry averages, have contributed to Exelon's substantial total returns. Despite recent underperformance in earnings growth relative to industry peers, Exelon outpaced the broader US market’s returns over the past year.

- Analyze Exelon's fair value against its market price in our detailed valuation report—access it here.

- Analyze the downside risks for Exelon and understand their potential impact—click to learn more.

- Got skin in the game with Exelon? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exelon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXC

Exelon

A utility services holding company, engages in the energy distribution and transmission businesses.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives