- United States

- /

- Electric Utilities

- /

- NasdaqGS:EXC

Does Exelon’s Recent 23.7% Rise Signal a Fair Price in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Exelon stock lives up to its buzz, or if the current price actually offers value? You are not alone. Investors are watching closely to decide if now is the right moment to get in or hold back.

- Stocks do not move for no reason. Exelon certainly caught attention with a 2.2% gain in the last week, helping power an impressive 23.7% year-to-date climb and a striking 87.5% surge over the past five years.

- That momentum did not appear out of thin air. Recent sector-wide optimism and updated utility regulations have drawn renewed interest to Exelon, while environmental policy shifts have brought fresh debate on its future. With analysts weighing in on the implications for energy providers, the mood among investors has shifted in Exelon's favor.

- If you are looking at value, Exelon currently scores a 4 out of 6 on our valuation checks, giving it an edge but leaving plenty to dig into. We are about to break down the major valuation frameworks. Stay tuned, because there is a smarter way to judge value that might surprise you by the end of this article.

Approach 1: Exelon Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) focuses on valuing a stock by projecting its future dividend payments and discounting them back to their present value. This approach is especially useful for established companies that have a history of paying consistent dividends, such as Exelon.

For Exelon, the DDM uses a projected dividend per share of $1.75, paired with a return on equity of 9.23% and a payout ratio of about 61.6%. The expected dividend growth rate is capped at 3.26%, which reflects a conservative but sustainable outlook for future payouts. The calculations rely on the company’s ability to grow its dividends steadily while maintaining a healthy payout ratio.

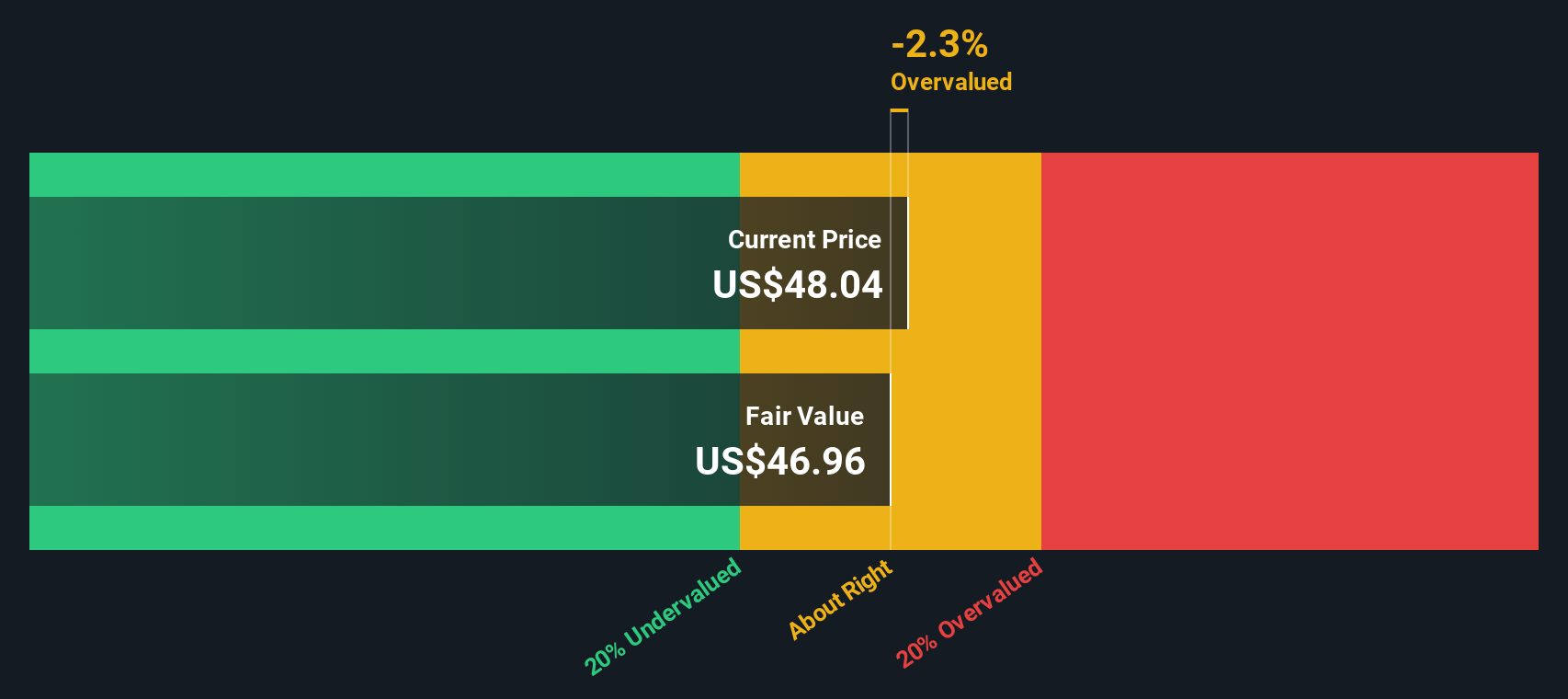

Based on these inputs, the model estimates Exelon's intrinsic value at $47.32 per share. With the current share price sitting just 1.6% below this intrinsic value, the stock is considered to be trading close to fair value. The modest discount suggests the market’s pricing is largely in line with the company’s fundamental outlook at this time.

Result: ABOUT RIGHT

Exelon is fairly valued according to our Dividend Discount Model (DDM), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Exelon Price vs Earnings

The price-to-earnings (PE) ratio is a popular valuation metric for profitable companies like Exelon, as it tells investors how much they are paying for each dollar of earnings. Since Exelon generates steady profits, the PE ratio provides insight into how the market values its current earnings power compared to peers.

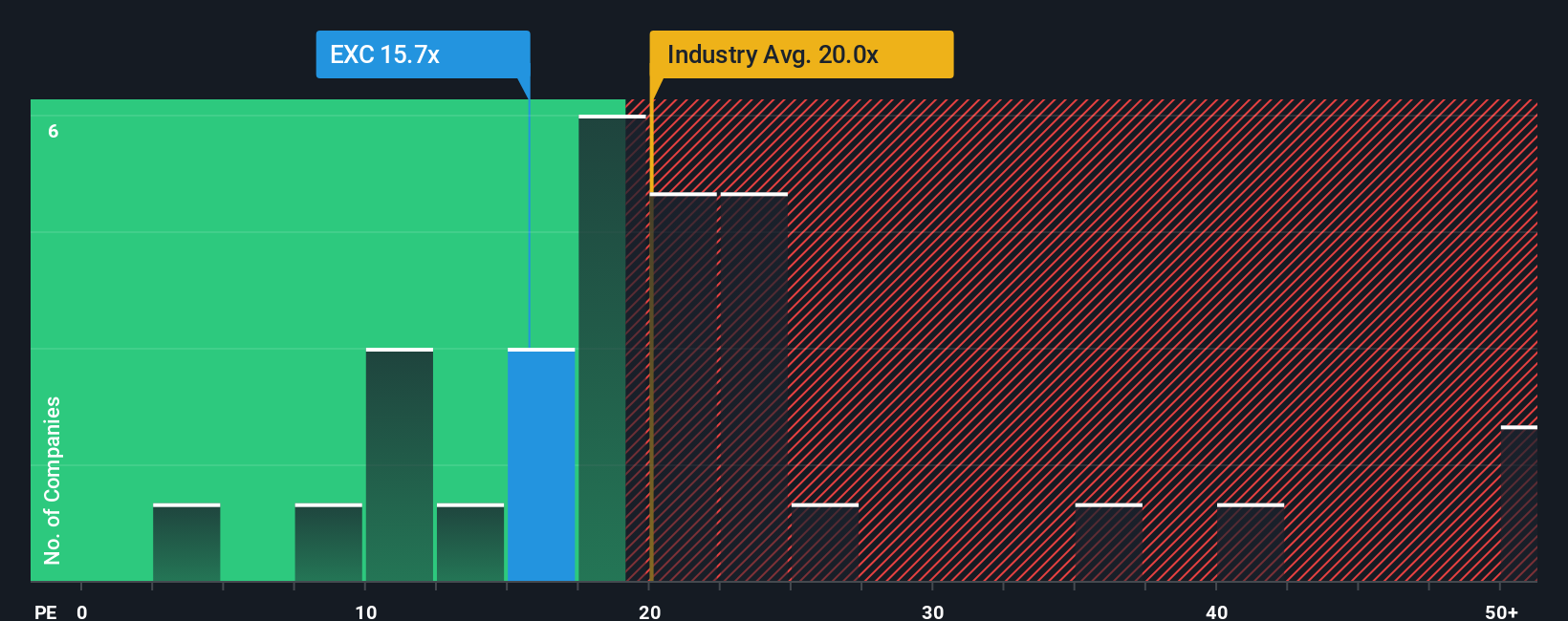

What counts as a "normal" or "fair" PE often depends on factors like expected earnings growth and risk. Faster-growing or lower-risk companies typically command higher PE ratios, while more mature or riskier businesses see lower multiples. Comparing Exelon’s current PE ratio of 16.7x to its electric utility peers and industry benchmarks provides a first look at relative valuation. The industry average PE ratio is 20.9x, and its peer group averages 20.2x, suggesting Exelon trades at a notable discount to both.

To refine this assessment, Simply Wall St’s proprietary “Fair Ratio” is considered. This metric adjusts the benchmark PE by factoring in Exelon’s specific profile, including growth prospects, profit margins, market cap, and business risks. By integrating these influences, the Fair Ratio (21.1x for Exelon) delivers a valuation target that goes beyond simple averages.

When comparing Exelon's actual PE ratio of 16.7x to its Fair Ratio of 21.1x, the stock appears undervalued on this metric. The sizable gap suggests the market may be undervaluing Exelon’s future earnings potential relative to its business fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Exelon Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a personalized, story-driven approach to investing, where you define your own perspective on a company by connecting the dots between your assumptions about fair value, future revenue, earnings, margins, and the underlying business drivers. Narratives bring context to the numbers, linking Exelon's story to a financial forecast and resulting fair value, so you can see not just what the market thinks, but what you believe based on your insights.

This approach is accessible and interactive for all users on the Simply Wall St Community page, allowing millions of investors to build and share their investment stories. As the environment changes, whether through earnings updates or major news, Narratives are updated dynamically, ensuring your outlook remains relevant and informed. Narratives empower you to make buy or sell decisions by quickly comparing your Fair Value with the current Price, all supported by your chosen story and data.

For example, some investors expect Exelon’s grid investments and favorable policy trends to drive its fair value as high as $52, while others see risks like regulatory uncertainty pulling fair value down to $37. Narratives let you decide which story you believe, so you can act with real conviction.

Do you think there's more to the story for Exelon? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Exelon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXC

Exelon

A utility services holding company, engages in the energy distribution and transmission businesses.

Solid track record and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)