- United States

- /

- Electric Utilities

- /

- NasdaqGS:CEG

Taking Stock of Constellation Energy (CEG) After $1 Billion Three Mile Island Loan and AI Data Center Deals

Reviewed by Simply Wall St

Constellation Energy (CEG) has been on investors’ radar after securing a $1 billion federal loan to restart its Three Mile Island reactor, backed by a 20 year power purchase agreement with Microsoft.

See our latest analysis for Constellation Energy.

Those moves, combined with the Three Mile Island restart and a string of long term AI data center contracts, have helped fuel strong momentum, with the share price up sharply year to date while three year total shareholder returns remain exceptional.

If Constellation’s surge has you thinking about what else could benefit from similar tailwinds, it is worth exploring fast growing stocks with high insider ownership as a way to uncover more under the radar opportunities.

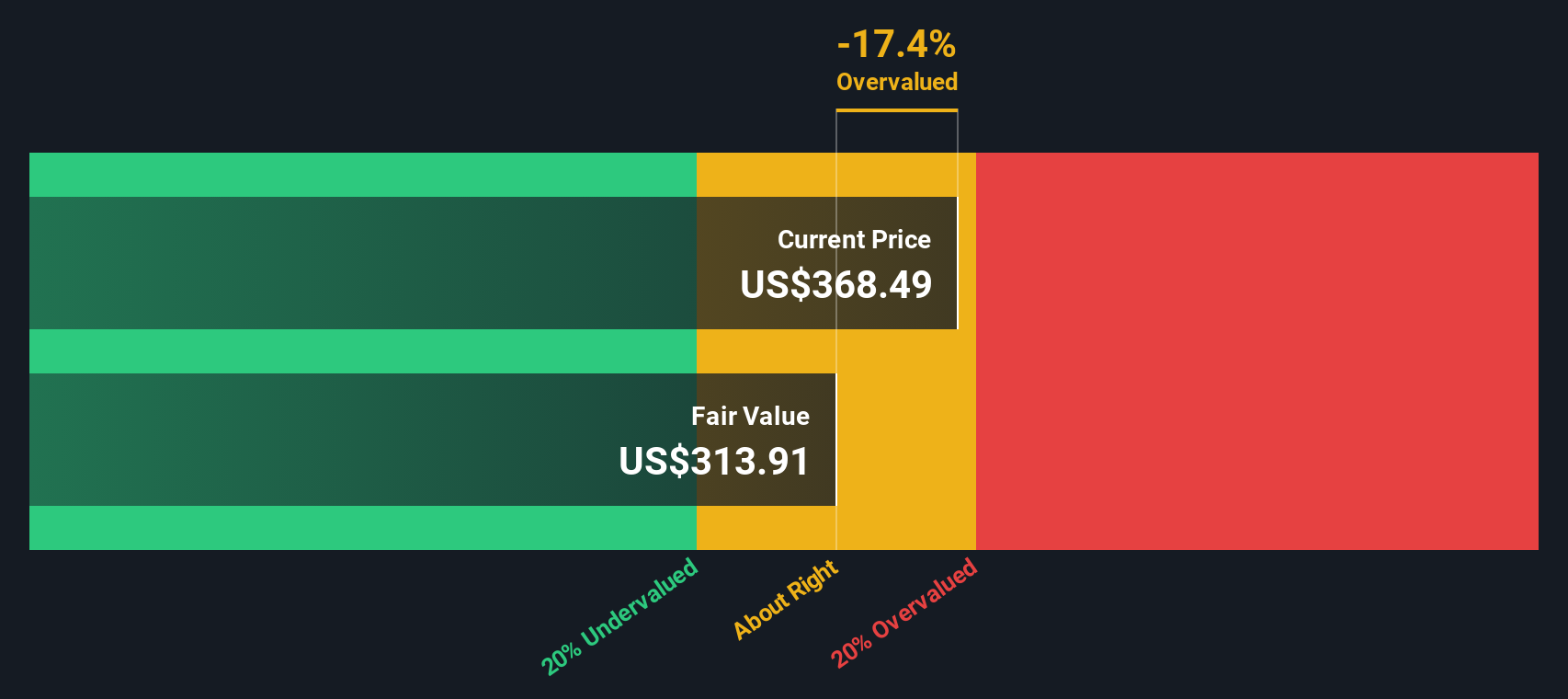

With the shares already up more than 50 percent year to date and trading only modestly below analyst targets despite a hefty intrinsic premium, is Constellation still a smart entry point, or is the market already pricing in years of AI driven growth?

Most Popular Narrative: 8.7% Undervalued

With Constellation Energy last closing at $368.62 against a narrative fair value near $404, the story hinges on how durable its new power economics really are.

Strategic investments and progress in nuclear plant restarts (Crane Clean Energy Center), upgrades (900MW in engineering), and selective M&A (Calpine acquisition) provide visible avenues for substantial capacity additions and operational synergies, enhancing EBITDA and free cash flow over the medium to long term.

Want to see what kind of slow burning revenue build, margin lift, and premium profit multiple are baked into that outlook? The underlying assumptions may surprise you.

Result: Fair Value of $403.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged regulatory costs on aging nuclear assets, or delays to major data center deals, could quickly challenge today’s premium valuation assumptions.

Find out about the key risks to this Constellation Energy narrative.

Another Angle on Valuation

Our SWS DCF model paints a far bolder picture, suggesting Constellation is trading about 25 percent below its fair value of roughly $492 per share. That is a much deeper discount than the 8.7 percent narrative view. Which story do you trust when volatility returns?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Constellation Energy Narrative

If you see the numbers differently, or simply want to dig into the details yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Constellation Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not leave your capital standing still when you could be uncovering the next wave of opportunities using targeted stock ideas from the Simply Wall St Screener.

- Capture potential multi baggers early by scanning these 3574 penny stocks with strong financials that pair tiny share prices with real balance sheet strength and improving fundamentals.

- Ride powerful technology trends by zeroing in on these 26 AI penny stocks positioned at the heart of AI adoption across software, infrastructure, and enabling hardware.

- Identify possible value opportunities today by targeting these 913 undervalued stocks based on cash flows where cash flow strength and market pessimism may be contributing to unusual pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CEG

Constellation Energy

Produces and sells energy products and services in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)