- United States

- /

- Consumer Finance

- /

- NYSE:YRD

Artesian Resources And 2 Other Undiscovered Gems In The US Market

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has seen a significant 31% increase over the past year, with earnings projected to grow by 15% annually. In this dynamic environment, discovering stocks that are not only resilient but also poised for growth can be key to capitalizing on these favorable conditions, making companies like Artesian Resources intriguing prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Nanophase Technologies | 40.87% | 24.19% | -9.71% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Artesian Resources (NasdaqGS:ARTN.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Artesian Resources Corporation, with a market cap of $344.15 million, operates through its subsidiaries to provide water, wastewater, and other services in Delaware, Maryland, and Pennsylvania.

Operations: Artesian Resources generates revenue primarily through its water and wastewater services in specific U.S. states. The company's financial performance is reflected in its market cap of $344.15 million, with a focus on efficient service delivery impacting cost structures and profitability metrics.

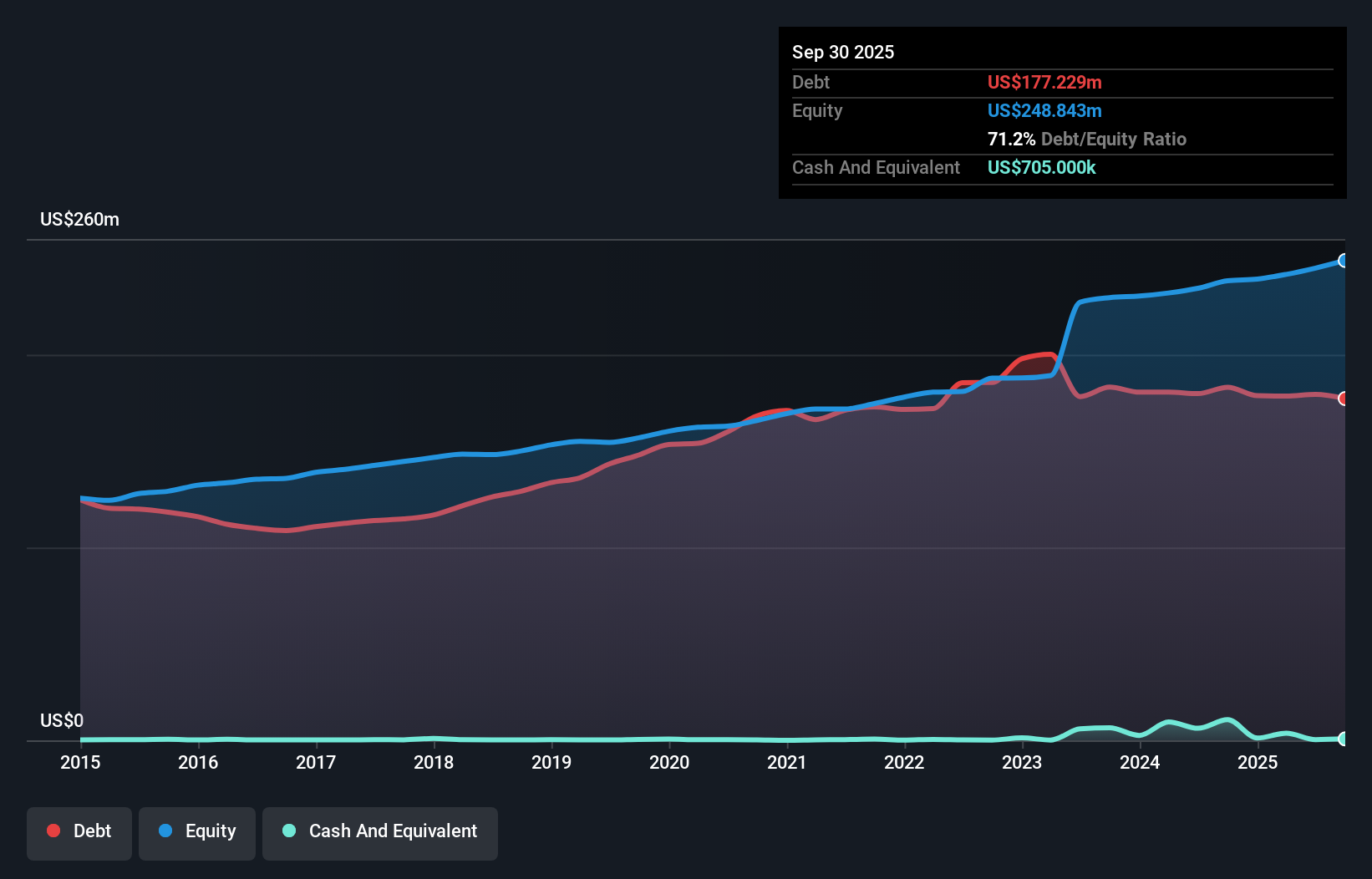

Artesian Resources, a notable player in the water utilities sector, has demonstrated robust financial health with earnings growth of 28.9% over the past year, outpacing the industry average of 9.7%. The company's debt to equity ratio has improved from 94.3% to 74.2% over five years, although its net debt to equity remains high at 71.6%. Recent results show third-quarter net income reaching US$6.81 million from US$5.07 million last year, and basic earnings per share rising to US$0.66 from US$0.49 a year ago, reflecting strong performance and promising prospects for future growth within its market niche.

REX American Resources (NYSE:REX)

Simply Wall St Value Rating: ★★★★★★

Overview: REX American Resources Corporation, along with its subsidiaries, is involved in the production and sale of ethanol in the United States and has a market capitalization of approximately $802.12 million.

Operations: REX American Resources generates revenue primarily from ethanol and by-products, totaling $718.08 million. The company's financial performance is influenced by the cost structure associated with ethanol production and market conditions affecting its sales.

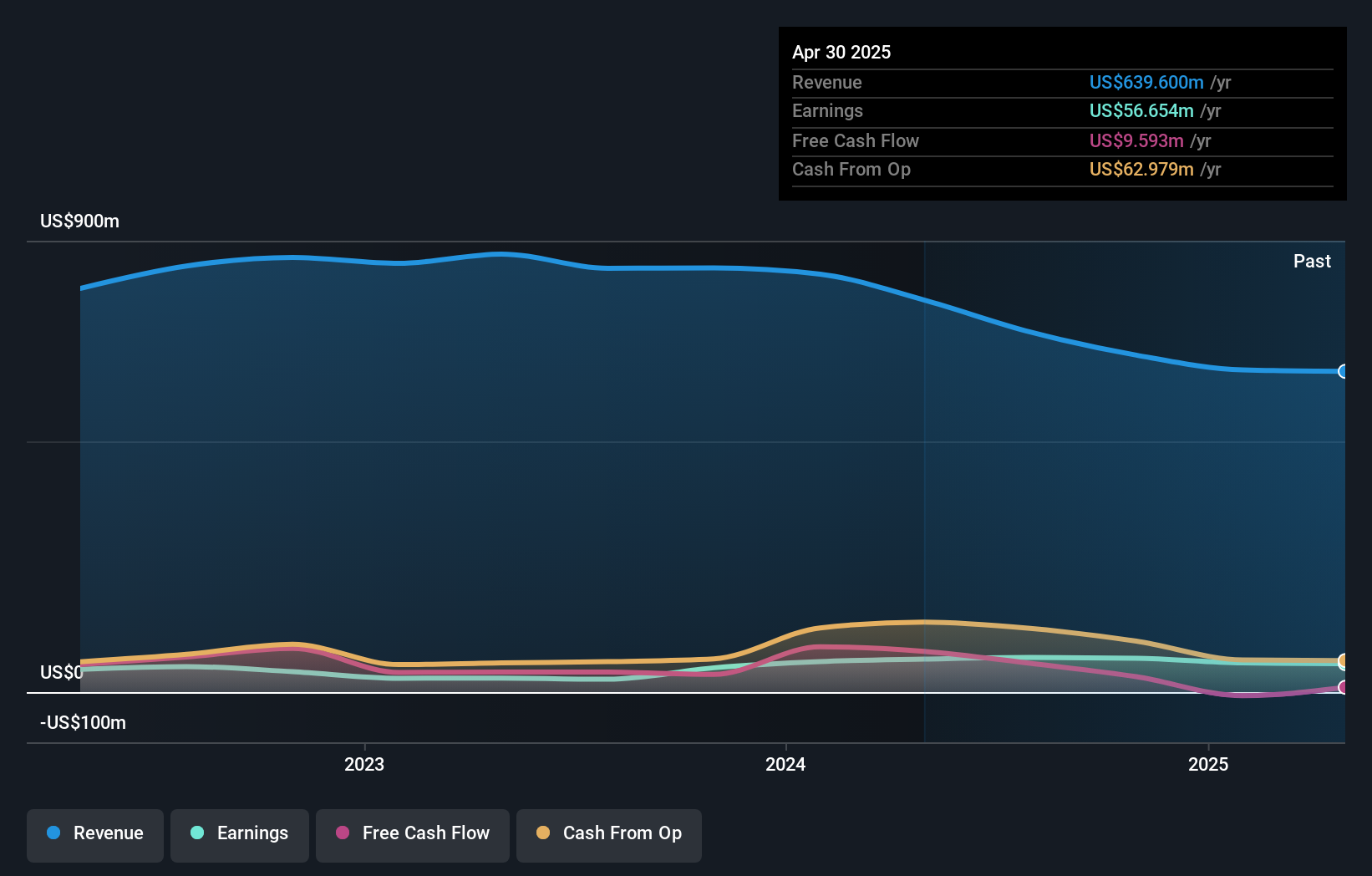

REX American Resources, a smaller player in the energy sector, has shown impressive earnings growth of 170% over the past year, outpacing the broader oil and gas industry. Despite sales dropping to US$148 million in Q2 2024 from US$212 million a year ago, net income rose to US$12 million from US$9 million. The company operates debt-free and trades at a notable discount of 86% below its estimated fair value. With ongoing investments in ethanol production and carbon capture projects totaling around US$91 million, REX is strategically positioned for future growth but faces regulatory uncertainties that could impact timelines and returns.

Yiren Digital (NYSE:YRD)

Simply Wall St Value Rating: ★★★★★★

Overview: Yiren Digital Ltd. operates an AI-powered platform offering financial services in China, with a market cap of $506.83 million.

Operations: Yiren Digital generates revenue primarily from its Financial Services Business (CN¥3.04 billion), followed by the Consumption & Lifestyle Business (CN¥1.84 billion) and Insurance Brokerage Business (CN¥579.22 million).

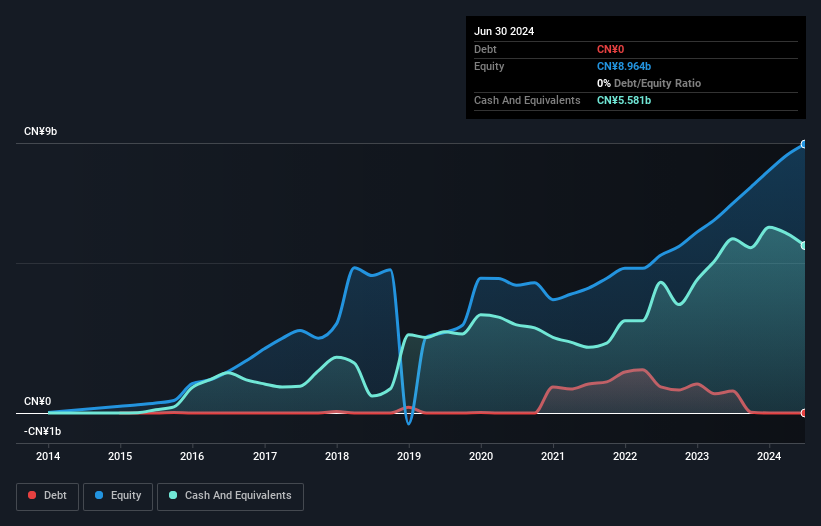

Yiren Digital is making waves with its impressive 18% earnings growth over the past year, outpacing the Consumer Finance industry's -5.6%. The company stands debt-free, eliminating concerns about interest payments and showcasing high-quality earnings. Trading at 75% below estimated fair value, it presents an intriguing investment opportunity. Recent developments include a $4 million share repurchase of 815,522 shares between April and June 2024, reflecting confidence in its market position. Additionally, Yiren Digital has initiated a semi-annual dividend policy to enhance shareholder value further. With these dynamics in play, Yiren Digital seems well-positioned for future prospects.

Taking Advantage

- Click through to start exploring the rest of the 222 US Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YRD

Yiren Digital

Provides financial services through an AI-powered platform in China.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)