- United States

- /

- Water Utilities

- /

- NasdaqGS:ARTN.A

3 Prominent US Dividend Stocks Yielding Up To 4.2%

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of cautious anticipation ahead of the Federal Reserve's interest rate decision and major tech earnings reports, investors are keenly observing how these factors might impact broader economic trends. In this environment, dividend stocks offer a compelling option for those seeking steady income, as they can provide a buffer against market volatility while contributing to portfolio stability.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.15% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.58% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.46% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.96% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.66% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.82% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

Click here to see the full list of 134 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

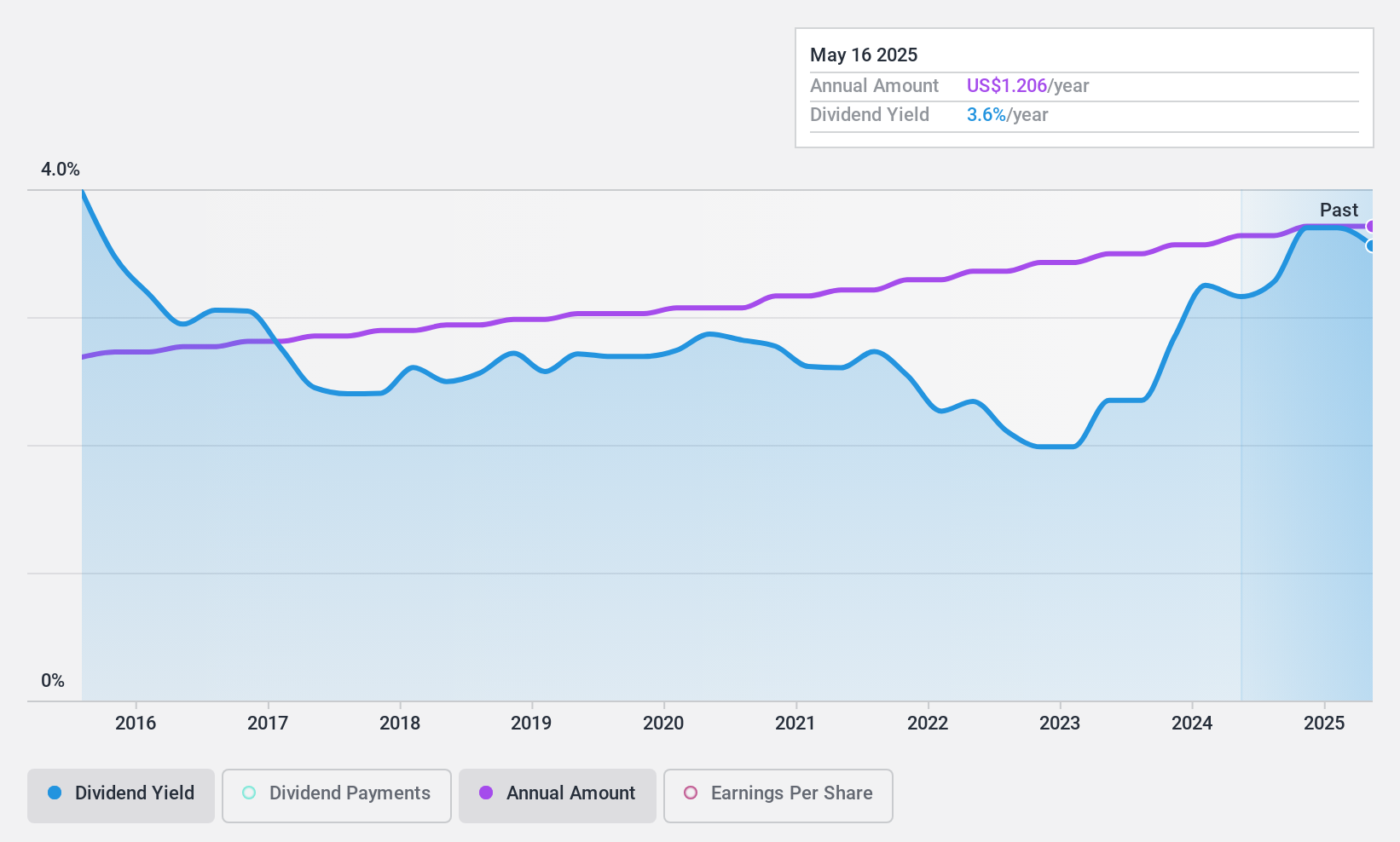

Artesian Resources (NasdaqGS:ARTN.A)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Artesian Resources Corporation, with a market cap of $315.42 million, operates through its subsidiaries to provide water, wastewater, and other services in Delaware, Maryland, and Pennsylvania.

Operations: Artesian Resources Corporation generates revenue primarily from its Regulated Utility segment, amounting to $98.93 million.

Dividend Yield: 3.8%

Artesian Resources has consistently paid dividends for 129 consecutive quarters, recently affirming a quarterly dividend of $0.3014 per share. Despite a stable and growing dividend history over the past decade, concerns exist regarding sustainability as dividends are not covered by free cash flows. The company operates with a reasonable payout ratio of 60.1% and reported strong earnings growth of 28.9% last year, but it carries high debt levels which could impact future payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Artesian Resources.

- The valuation report we've compiled suggests that Artesian Resources' current price could be inflated.

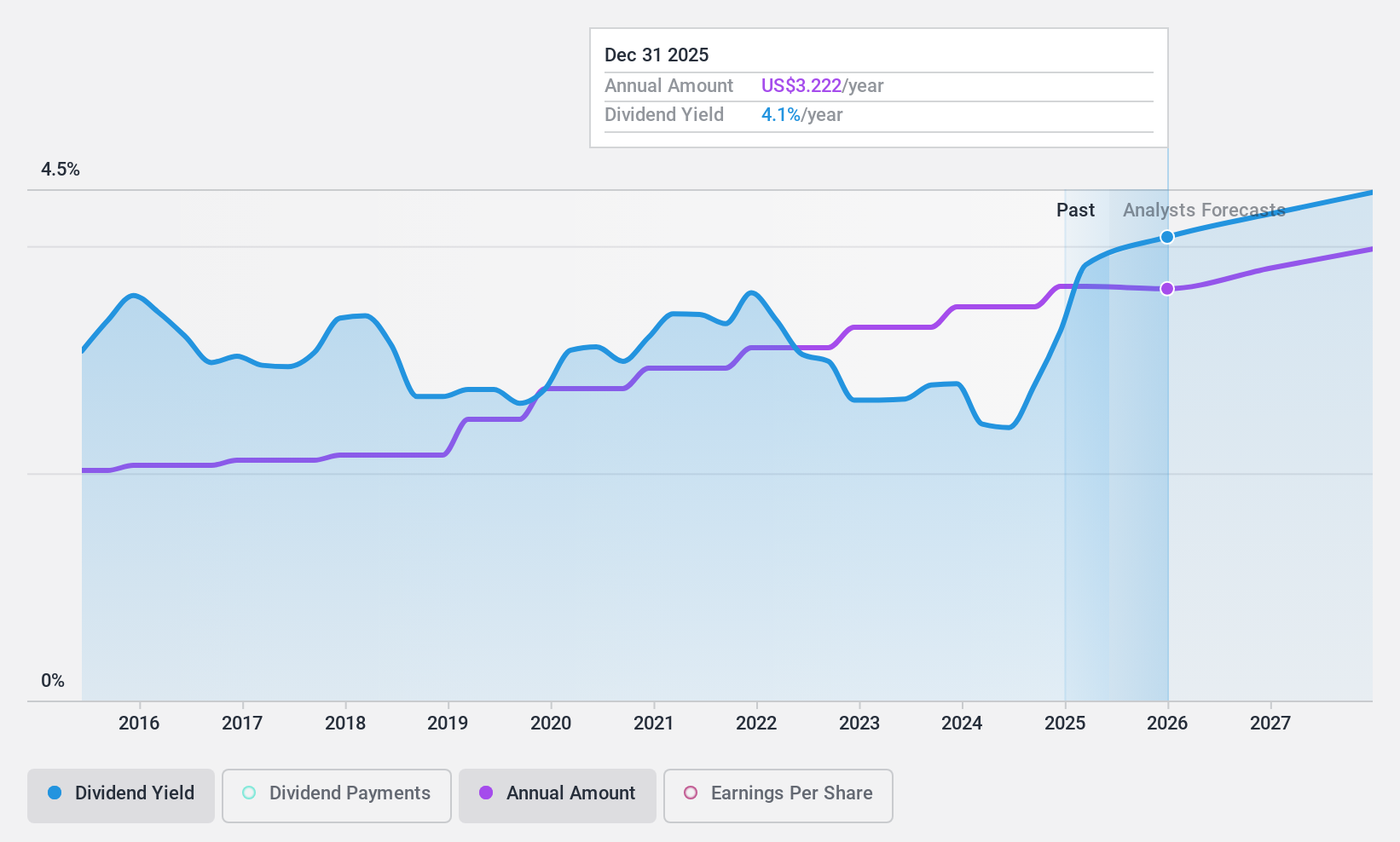

Merck (NYSE:MRK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Merck & Co., Inc. is a global healthcare company with operations worldwide and a market cap of approximately $247.75 billion.

Operations: Merck & Co., Inc. generates revenue primarily from its Pharmaceutical segment, which accounts for $56.50 billion, and its Animal Health segment, contributing $5.76 billion.

Dividend Yield: 3.3%

Merck recently affirmed a quarterly dividend of US$0.81 per share, maintaining its stable and growing dividend history over the past decade. The dividends are well-covered by both earnings and cash flows, with payout ratios of 63.4% and 55.2%, respectively, indicating sustainability. Despite high debt levels, Merck's strong earnings growth last year supports its reliable dividend payments, although its yield of 3.32% is below top-tier U.S. market payers.

- Dive into the specifics of Merck here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Merck is priced lower than what may be justified by its financials.

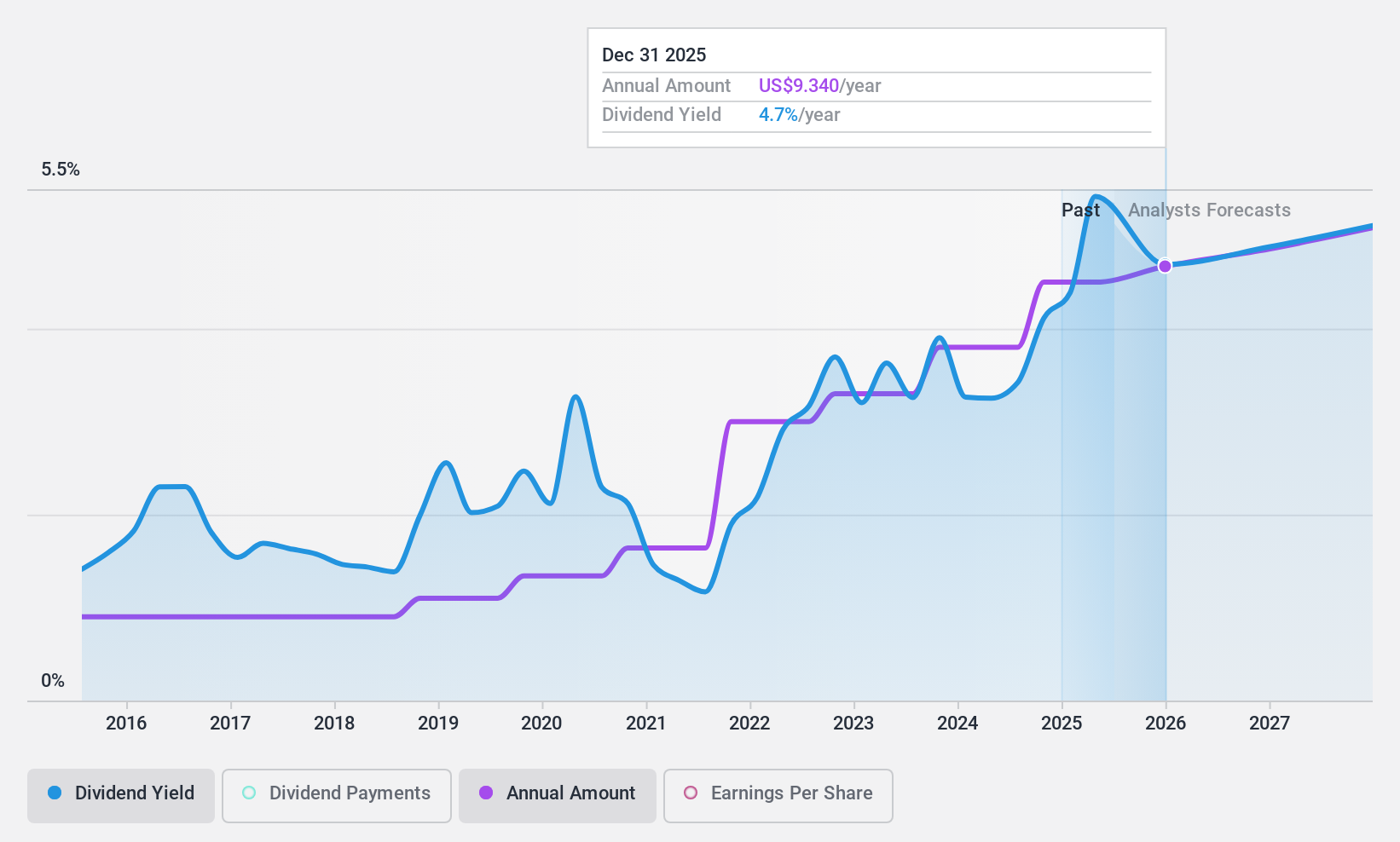

Virtus Investment Partners (NYSE:VRTS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Virtus Investment Partners, Inc. is a publicly owned investment manager with a market cap of approximately $1.48 billion.

Operations: Virtus Investment Partners generates revenue primarily through its asset management services, amounting to $888.04 million.

Dividend Yield: 4.2%

Virtus Investment Partners declared a quarterly dividend of $2.25 per share, reflecting its stable and growing dividend history over the past decade. The dividends are well-covered by earnings and cash flows, with payout ratios of 47.5% and 59.7%, respectively, indicating sustainability despite a yield below top-tier payers at 4.24%. Recent board changes include the addition of John C. Weisenseel to strengthen financial oversight, while expanding ETF offerings enhances product diversification in private credit CLOs.

- Click here to discover the nuances of Virtus Investment Partners with our detailed analytical dividend report.

- The analysis detailed in our Virtus Investment Partners valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Investigate our full lineup of 134 Top US Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARTN.A

Artesian Resources

Provides water, wastewater, and other services in Delaware, Maryland, and Pennsylvania.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives