- United States

- /

- Electric Utilities

- /

- NasdaqGS:AEP

Evaluating American Electric Power (AEP) After Its Strong Recent Share Price Gains

Reviewed by Simply Wall St

American Electric Power Company (AEP) has quietly outpaced the broader utilities sector this year, and that steady climb has investors asking whether the recent pullback is a chance to buy rather than bail.

See our latest analysis for American Electric Power Company.

At around $116.07 per share, AEP’s solid year to date share price return of 26.25 percent and strong 1 year total shareholder return of 28.29 percent suggest steady, income focused momentum rather than a speculative surge.

If AEP’s consistency has you thinking about how other utilities are positioned, it could be worth scanning for stable growth stocks screener (None results) that offer similar resilience with different risk and return profiles.

With earnings still growing, a double digit upside to analyst targets, but a slight premium to some intrinsic value estimates, investors now face a key question: Is AEP genuinely undervalued or already priced for future growth?

Most Popular Narrative Narrative: 9.7% Undervalued

With American Electric Power Company closing at $116.07 against a narrative fair value near $128.56, the story assumes more upside is still on the table.

The company has a substantial capital investment plan of $54 billion over the next 5 years, with an additional potential of $10 billion, primarily aimed at expanding transmission and distribution, indicating future growth in earnings. AEP’s proactive regulatory approach, including recent approvals for large load tariffs in multiple states and ongoing regulatory proceedings, is likely to enhance revenue stability through fair cost allocation and timely recovery of investments.

Curious how steady revenue growth, shifting margins and a richer future earnings multiple all combine to justify that higher value tag? Unlock the full playbook behind this narrative and see which long term assumptions really drive the upside case.

Result: Fair Value of $128.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside rests on smooth execution, with regulatory setbacks in key states or cost overruns on the $70 billion plus capex plan as potential spoilers.

Find out about the key risks to this American Electric Power Company narrative.

Another Lens on Value

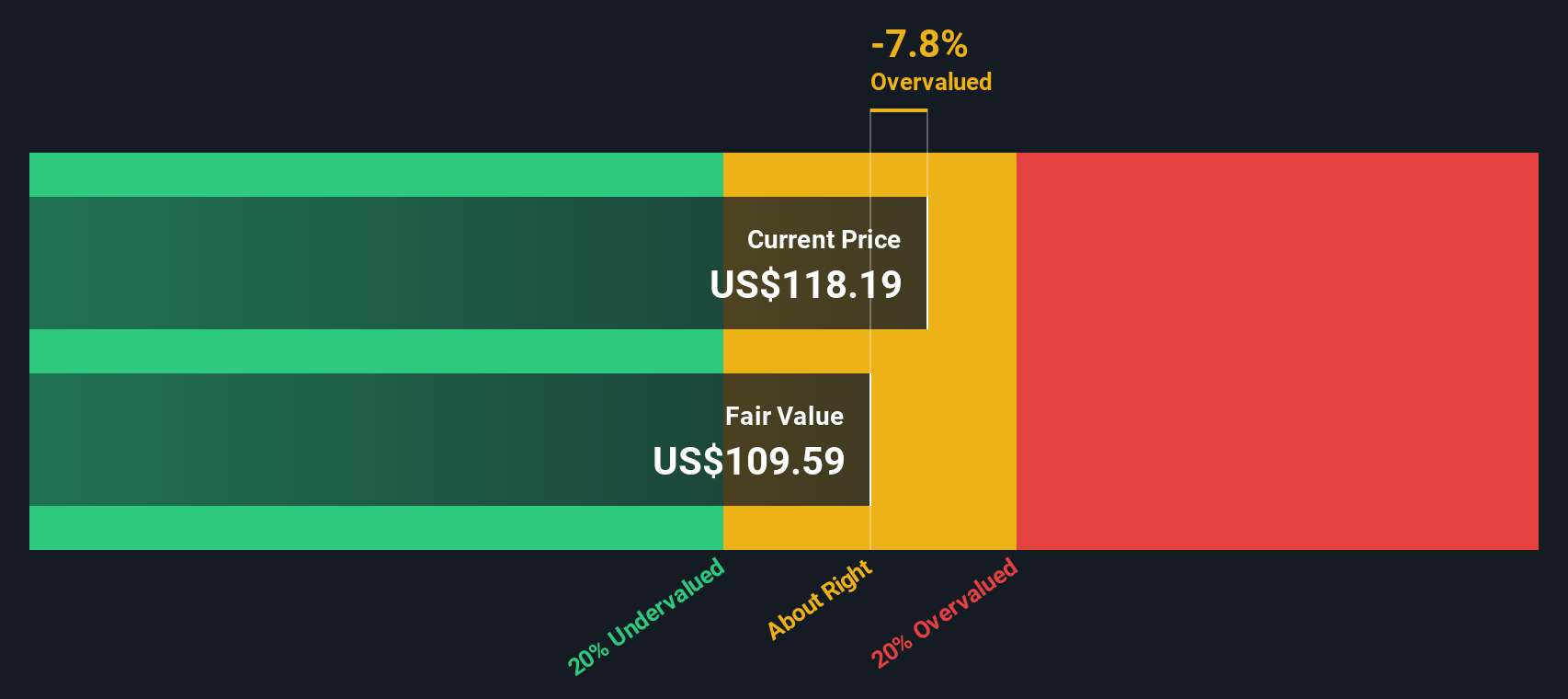

While the narrative fair value suggests upside, the SWS DCF model is more cautious, putting fair value nearer $105.64, which is below today’s $116.07 price and implies the shares may be slightly overvalued. Is the market already paying up for flawless execution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Electric Power Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 899 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Electric Power Company Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can shape a custom narrative in just a few minutes: Do it your way.

A great starting point for your American Electric Power Company research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with one idea when a world of opportunities is at your fingertips, use the Simply Wall Street Screener now to stay ahead of the crowd.

- Capitalize on potential mispricing by reviewing these 899 undervalued stocks based on cash flows that could offer stronger upside than mature utilities.

- Position yourself for the next tech wave by targeting these 27 AI penny stocks at the intersection of innovation and accelerating earnings power.

- Boost your income game by scanning these 15 dividend stocks with yields > 3% that combine meaningful yields with solid underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEP

American Electric Power Company

An electric public utility holding company, engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)