- United States

- /

- Commercial Services

- /

- NasdaqCM:LNZA

3 Intriguing US Penny Stocks Under $22B Market Cap

Reviewed by Simply Wall St

The U.S. stock market has shown a mixed performance recently, with the Nasdaq rising for its fifth consecutive session amid a wave of quarterly earnings reports. In this context, penny stocks—though often considered an outdated term—continue to capture investor interest due to their potential for growth at lower price points. Typically associated with smaller or newer companies, these stocks can offer significant opportunities when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.786075 | $5.8M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.33 | $517.9M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $3.83 | $43.2M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.63 | $2.06B | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.42 | $147.91M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.75 | $114.35M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.57 | $51.81M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.62 | $136.12M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.07 | $98.03M | ★★★★★☆ |

Click here to see the full list of 754 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

LanzaTech Global (NasdaqCM:LNZA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LanzaTech Global, Inc. is a nature-based carbon refining company operating in the United States and internationally with a market cap of $361.94 million.

Operations: LanzaTech Global generates revenue primarily from its Chemicals segment, which amounts to $67.69 million.

Market Cap: $361.94M

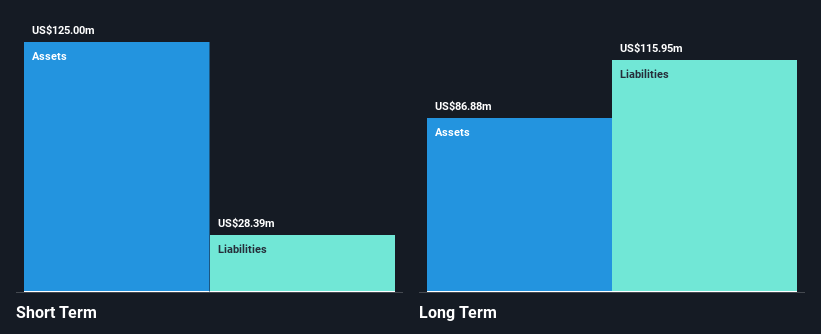

LanzaTech Global, Inc., with a market cap of US$361.94 million, is expanding its biorefining platform to produce LanzaTech Nutritional Protein (LNP), targeting the growing alternative protein market. Recent amendments to increase authorized shares from 400 million to 600 million could indicate potential capital raising activities. Despite being unprofitable and having negative return on equity, LanzaTech's revenue is forecasted to grow significantly, supported by strategic agreements like the one with SEKISUI CHEMICAL CO., LTD. The company remains debt-free and has sufficient short-term assets to cover liabilities, though management and board experience are relatively new.

- Jump into the full analysis health report here for a deeper understanding of LanzaTech Global.

- Examine LanzaTech Global's earnings growth report to understand how analysts expect it to perform.

Dingdong (Cayman) (NYSE:DDL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dingdong (Cayman) Limited operates as an e-commerce company in China with a market cap of $675.87 million.

Operations: The company generates revenue primarily from its online retail operations, amounting to CN¥20.76 billion.

Market Cap: $675.87M

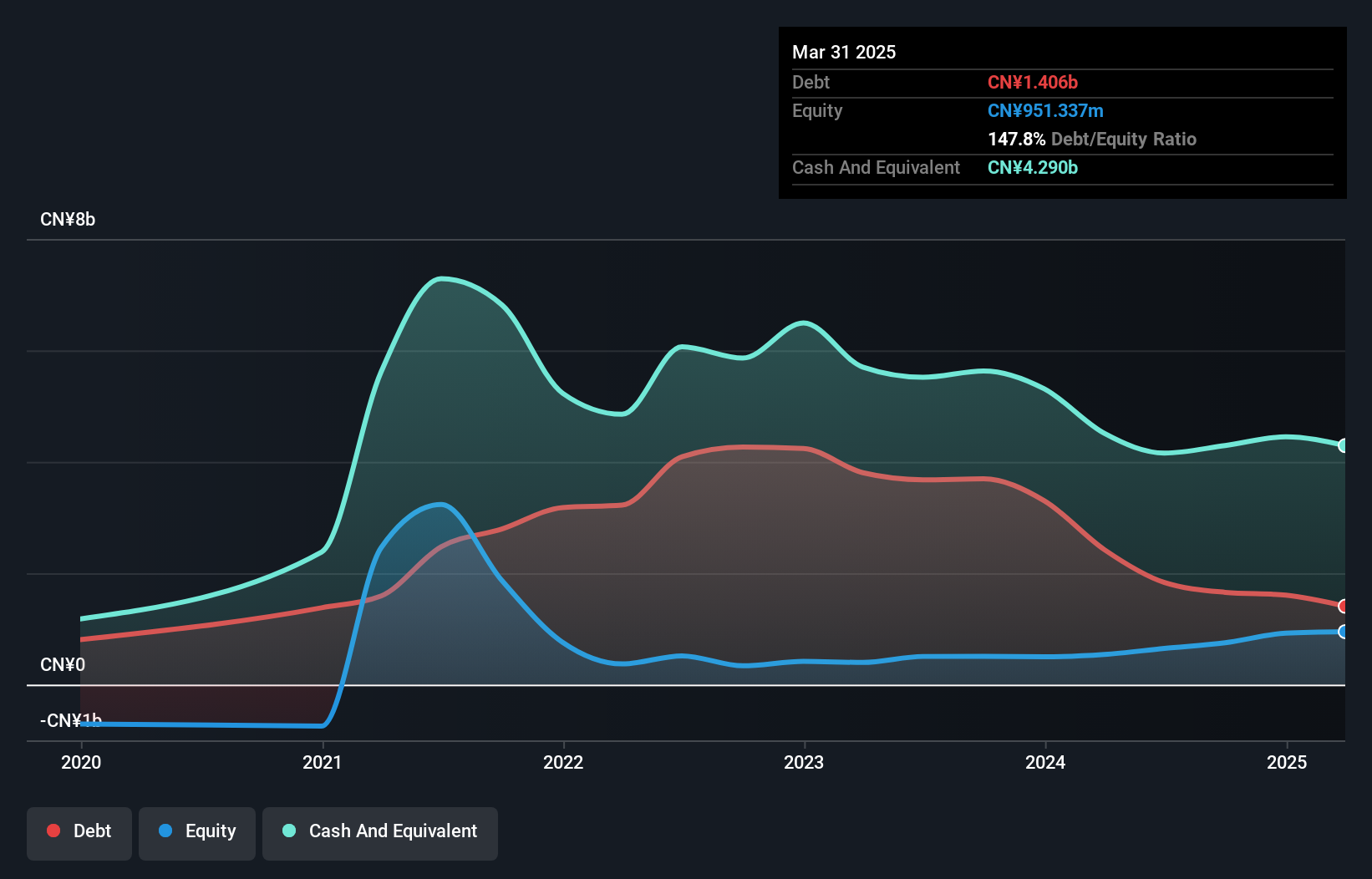

Dingdong (Cayman) Limited, with a market cap of $675.87 million, has shown significant progress in financial performance, reporting CN¥5.6 billion in revenue for Q2 2024 and achieving profitability with a net income of CN¥67.13 million. The company's earnings growth has accelerated, supported by strong interest coverage and operating cash flow that adequately covers debt. Despite high share price volatility and short-term liabilities slightly exceeding assets, Dingdong's strategic guidance anticipates considerable year-over-year growth for 2024. Recent board changes may influence governance dynamics as the company continues to trade below estimated fair value while maintaining stable long-term liability coverage.

- Take a closer look at Dingdong (Cayman)'s potential here in our financial health report.

- Explore Dingdong (Cayman)'s analyst forecasts in our growth report.

DiDi Global (OTCPK:DIDI.Y)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DiDi Global Inc. operates a mobility technology platform offering various services in China, Brazil, Mexico, and internationally, with a market cap of approximately $21.79 billion.

Operations: The company's revenue is primarily derived from China Mobility at CN¥181.67 billion, followed by Other Initiatives at CN¥9.72 billion and International operations at CN¥9.36 billion.

Market Cap: $21.79B

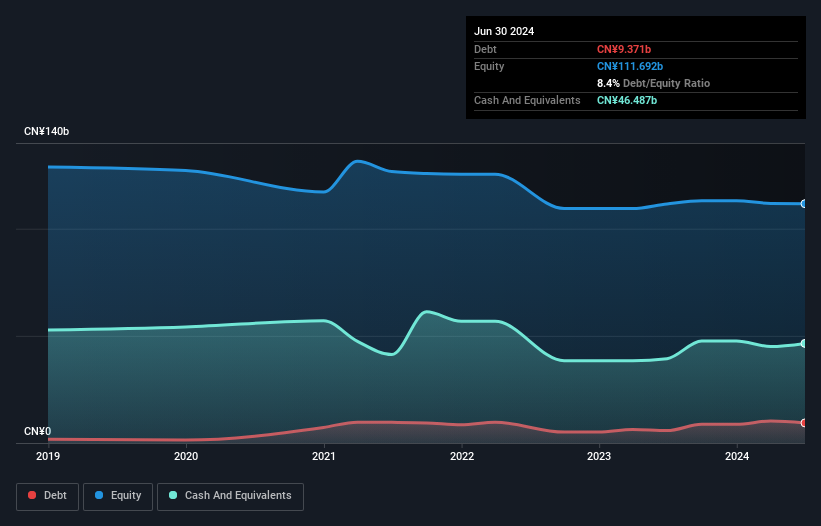

DiDi Global Inc., with a market cap of approximately $21.79 billion, has transitioned to profitability, reporting net income of CN¥1.69 billion for Q2 2024, compared to a net loss the previous year. The company is trading at 56.7% below its estimated fair value and offers good relative value within its industry. Despite low return on equity at 1.9%, DiDi's short-term assets significantly exceed both short and long-term liabilities, indicating strong liquidity positions. However, financial results have been impacted by large one-off items, including a CN¥1.2 billion loss in the past year ending June 30, 2024.

- Unlock comprehensive insights into our analysis of DiDi Global stock in this financial health report.

- Evaluate DiDi Global's prospects by accessing our earnings growth report.

Next Steps

- Explore the 754 names from our US Penny Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LNZA

LanzaTech Global

Operates as a nature-based carbon refining company in the United States and internationally.

Slight and slightly overvalued.