- United States

- /

- Logistics

- /

- NYSEAM:RLGT

Update: Radiant Logistics (NYSEMKT:RLGT) Stock Gained 56% In The Last Five Years

When you buy and hold a stock for the long term, you definitely want it to provide a positive return. But more than that, you probably want to see it rise more than the market average. Unfortunately for shareholders, while the Radiant Logistics, Inc. (NYSEMKT:RLGT) share price is up 56% in the last five years, that's less than the market return. Over the last twelve months the stock price has risen a very respectable 13%.

View our latest analysis for Radiant Logistics

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

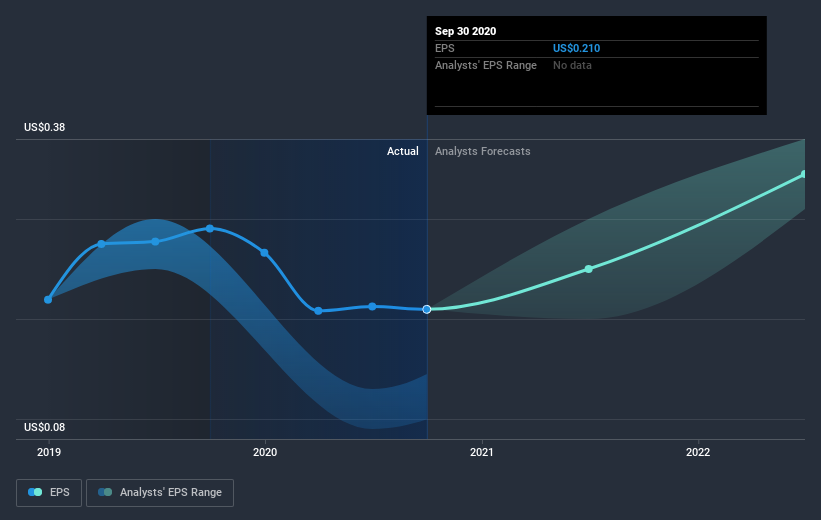

During five years of share price growth, Radiant Logistics achieved compound earnings per share (EPS) growth of 26% per year. The EPS growth is more impressive than the yearly share price gain of 9% over the same period. So one could conclude that the broader market has become more cautious towards the stock.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Radiant Logistics has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Radiant Logistics' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Radiant Logistics shareholders are up 13% for the year. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 9% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Radiant Logistics you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Radiant Logistics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSEAM:RLGT

Radiant Logistics

Operates as a third-party logistics company, provides technology-enabled global transportation and value-added logistics solutions primarily in the United States and Canada.

Flawless balance sheet with reasonable growth potential.