- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

ZIM Integrated Shipping Services (NYSE:ZIM) Expands Fleet With US$2.3 Billion LNG Vessel Charters

Reviewed by Simply Wall St

ZIM Integrated Shipping Services (NYSE:ZIM) experienced a 11% increase in its share price last week, coinciding with the announcement of major expansions in its fleet through long-term charters of LNG dual-fuel container vessels valued at $2.3 billion. This strategic move could enhance the company's operational capacity and competitiveness. Despite broader market softness, with major indices like the S&P 500 and Dow Jones losing ground, ZIM's robust business developments may have added positive weight to its price movement, setting it apart from the general market trend.

The recent expansion of ZIM Integrated Shipping Services' fleet, driven by the US$2.3 billion investment in LNG dual-fuel container vessels, could bolster its operational capacity, leading to enhanced competitive positioning. While these fleet upgrades may improve cost efficiency and reduce operational expenses, potential new port charges on Chinese vessels pose a risk to increasing operational costs. The anticipated introduction of these charges, alongside possible U.S. trade tensions, could disrupt revenue by affecting shipping volumes. Despite these challenges, ZIM's focus on fuel-efficient fleets might mitigate some cost pressures, potentially supporting its earnings margins.

Over the longer term, ZIM's total return over the past year was a robust 69.91%. In comparison to major indices, ZIM exceeded the US market's 7.5% return and notably outpaced the US Shipping industry's negative 18.6% return during the same period. This indicates a strong position relative to both the market and its industry peers, showcasing its resilience amid broader market softness.

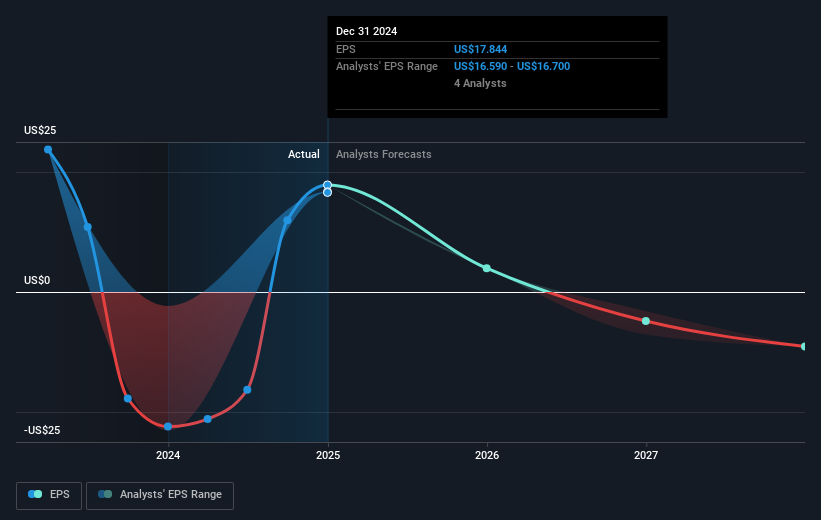

Although the expansion news is promising, revenue is forecast to decline by 16.9% annually over the next three years, and earnings are not expected to reach current profitability, reflecting challenges such as declining freight rates and overcapacity. With the current share price at US$13.48 close to the consensus price target of US$14.68, analysts seem to view the stock as fairly priced, projecting an 8.2% increase. Potential future earnings may depend heavily on how effectively ZIM manages emerging economic challenges and capitalizes on its fleet investments.

Our valuation report here indicates ZIM Integrated Shipping Services may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ZIM Integrated Shipping Services, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives