- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

ZIM Integrated Shipping Services (NYSE:ZIM) Boosts Strategic Alliance with MSC for Asia-US Trade Expansion

Reviewed by Simply Wall St

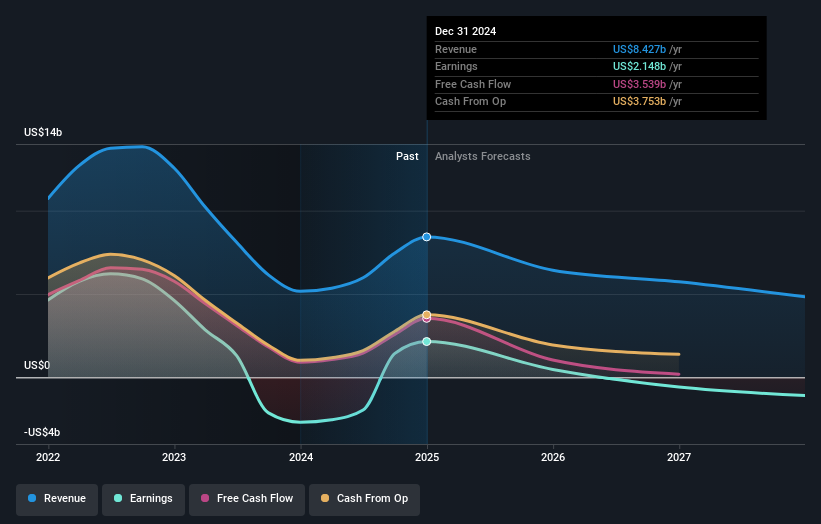

ZIM Integrated Shipping Services (NYSE:ZIM) is making waves with its recent strategic partnership with Mediterranean Shipping Company, set to enhance its service quality and operational efficiency across key trade routes. Despite a solid financial performance in the second quarter, marked by a net income of $371.3 million, the company faces challenges such as declining revenue forecasts and negative return on equity. As ZIM navigates these hurdles, investors should watch for potential growth opportunities arising from its strategic initiatives and expanding market presence in the Asia-Pacific region.

Unlock comprehensive insights into our analysis of ZIM Integrated Shipping Services stock here.

Competitive Advantages That Elevate ZIM Integrated Shipping Services

With ZIM Integrated Shipping Services trading at a significant discount to its estimated fair value, the company appears undervalued, presenting a potential investment opportunity. Its favorable Price-To-Sales Ratio of 0.5x, compared to peers and industry averages, further underscores this. The company's leadership, with an average tenure of 6.5 years, brings stability and strategic insight, crucial for navigating the competitive shipping industry. Recent earnings reports highlight a strong financial performance, with net income of $371.3 million for the second quarter, a turnaround from a loss the previous year. This growth trajectory is supported by strategic alliances, such as the new cooperation with Mediterranean Shipping Company (MSC), enhancing service quality and operational efficiencies.

To dive deeper into how ZIM Integrated Shipping Services's valuation metrics are shaping its market position, check out our detailed analysis of ZIM Integrated Shipping Services's Valuation.Challenges Constraining ZIM Integrated Shipping Services's Potential

ZIM faces notable challenges. It remains unprofitable, with a negative Return on Equity of -67.52%, and revenue is forecasted to decline by 5.1% annually over the next three years. This financial instability is compounded by unreliable dividend payments not covered by earnings or cash flow, signaling potential investor concerns. Rising operational costs have also impacted margins, necessitating tighter cost controls to safeguard profitability. The company's share price volatility further reflects market instability, potentially affecting investor confidence.

Learn about ZIM Integrated Shipping Services's dividend strategy and how it impacts shareholder returns and financial stability.Areas for Expansion and Innovation for ZIM Integrated Shipping Services

Opportunities for ZIM lie in its expected profitability over the next three years, which aligns with above-average market growth. The potential reversal of the declining revenue trend could be bolstered by strategic initiatives like the MSC partnership, which expands port coverage and enhances service offerings. Such alliances and product-related announcements position ZIM to capitalize on emerging market opportunities, particularly in the Asia-Pacific region, where strategic initiatives have already increased market share.

To gain deeper insights into ZIM Integrated Shipping Services's historical performance, explore our detailed analysis of past performance.External Factors Threatening ZIM Integrated Shipping Services

External threats include economic headwinds that pose risks to sustained growth, as noted by CEO Eliyahu Glickman. The competitive environment is intensifying, with new entrants challenging ZIM's market position. Additionally, supply chain vulnerabilities remain a concern, necessitating vigilant management and alternative strategies to mitigate risks. Addressing these external pressures will be crucial for maintaining ZIM's competitive edge and ensuring long-term success.

See what the latest analyst reports say about ZIM Integrated Shipping Services's future prospects and potential market movements.Conclusion

ZIM Integrated Shipping Services presents a compelling investment opportunity, trading at a significant discount with a Price-To-Sales Ratio of 0.5x, indicating potential for value realization. While the company demonstrates strong leadership and strategic alliances, such as with MSC, enhancing operational efficiencies, it faces challenges like unprofitability and declining revenue forecasts. However, the expected profitability over the next three years, bolstered by strategic initiatives and market expansion, particularly in the Asia-Pacific region, offers a promising outlook. Addressing external threats and financial instability will be crucial for sustaining growth and maintaining investor confidence, with no specific valuation summary provided to further guide investment decisions.

Seize The Opportunity

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives