- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) Could Be Riskier Than It Looks

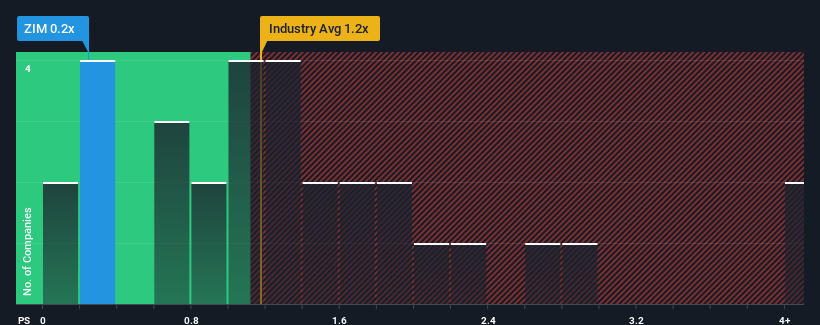

When you see that almost half of the companies in the Shipping industry in the United States have price-to-sales ratios (or "P/S") above 1.2x, ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) looks to be giving off some buy signals with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for ZIM Integrated Shipping Services

What Does ZIM Integrated Shipping Services' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, ZIM Integrated Shipping Services' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on ZIM Integrated Shipping Services will help you uncover what's on the horizon.How Is ZIM Integrated Shipping Services' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as ZIM Integrated Shipping Services' is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 59%. Regardless, revenue has managed to lift by a handy 29% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth will show minor resilience over the next three years growing only by 3.3% per annum. While this isn't a particularly impressive figure, it should be noted that the the industry is expected to decline by 0.3% each year.

With this in consideration, we find it intriguing that ZIM Integrated Shipping Services' P/S falls short of its industry peers. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

What Does ZIM Integrated Shipping Services' P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of ZIM Integrated Shipping Services' analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for ZIM Integrated Shipping Services with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on ZIM Integrated Shipping Services, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives