- United States

- /

- Transportation

- /

- NYSE:XPO

XPO (XPO): Assessing Valuation Following Ratings Upgrades and Sustainability Expansion

Reviewed by Kshitija Bhandaru

Benchmark has just placed XPO (NYSE:XPO) on its Best Ideas List, while Moody’s upgraded the company’s outlook to positive due to expected operational progress and strong cash flow prospects. XPO’s new collaboration to roll out electric and HVO-powered fleets further highlights its push for sustainability and efficient operations, adding another layer of interest for investors evaluating the stock’s direction.

See our latest analysis for XPO.

XPO’s recent inclusion on Benchmark’s Best Ideas List and the positive ratings momentum have caught investors’ attention. With its strong push into sustainable fleets, there has been a noticeable boost in market confidence. Over the past year, XPO delivered a solid 19.7% total shareholder return, showing the kind of longer-term momentum that often follows operational upgrades and strategic new partnerships.

If these moves have you thinking about what’s next in transport and logistics, this could be your sign to expand your search and discover fast growing stocks with high insider ownership

With the stock trading just below analyst price targets and recent upgrades boosting sentiment, is XPO an undervalued pick ready for more gains, or has the market already accounted for its future growth potential?

Most Popular Narrative: 9% Undervalued

With the narrative’s fair value pegged at $139.38, XPO’s last close at $126.84 puts it below the consensus target, raising fresh questions about how much upside remains. Let’s take a closer look at the key drivers and expectations shaping this target.

XPO's ongoing investments in AI-powered optimization and proprietary technology are driving measurable productivity gains, even in a weak freight market, by reducing linehaul miles, improving labor efficiency, and cutting maintenance costs. As industry shipping volumes recover and these technology benefits compound, this should drive sustained margin expansion and higher net income.

Want to unlock what’s fueling this optimistic valuation? The secret lies deep in future earnings, smart tech moves, and some daring profit forecasts. Think game-changing assumptions about the entire transport sector. Curious which growth levers analysts are betting on for XPO’s next act? The full narrative breaks it all down. See what could really move this stock.

Result: Fair Value of $139.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent freight market slowdowns or rising labor costs could quickly erode margin gains and challenge the current optimistic outlook on XPO.

Find out about the key risks to this XPO narrative.

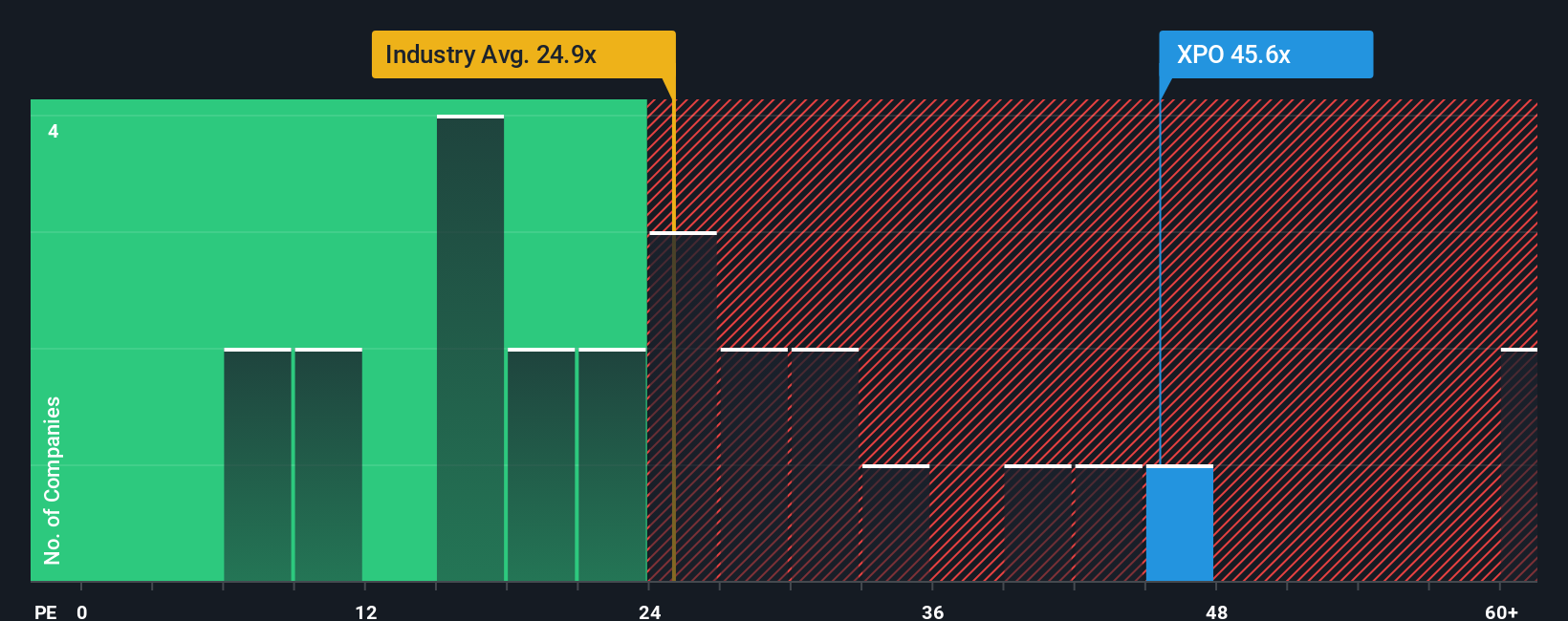

Another View: Earnings Multiple Raises Caution

While fair value estimates suggest XPO is undervalued, its current price-to-earnings ratio stands at 43.3x, which is markedly higher than the US Transportation industry average of 23.2x and the peer average of 27.5x. The fair ratio is just 17.3x, so the stock commands a notable premium. Is XPO’s future growth potential worth paying that much above the industry, or are investors taking on extra valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own XPO Narrative

If you see things differently or like to dig into the numbers yourself, you can build your perspective and shape a narrative in just a few minutes with Do it your way.

A great starting point for your XPO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Want even more opportunities to put your money to work? Broaden your outlook with handpicked stocks filtered for innovation, value, and future earnings potential.

- Harness powerful trends and tap into future disruptors by scanning these 24 AI penny stocks, which are poised for major breakthroughs in artificial intelligence and automation.

- Target reliable income streams by pursuing these 19 dividend stocks with yields > 3%, featuring yields above 3 percent and designed for stability in all market conditions.

- Capitalize on emerging tech with these 26 quantum computing stocks, positioned at the forefront of next-generation computing and scientific discovery.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPO

XPO

Provides freight transportation services in the United States, North America, France, the United Kingdom, and rest of Europe.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives