- United States

- /

- Logistics

- /

- NYSE:UPS

Will U.S. Customs Rule Changes Reshape UPS’s (UPS) International Logistics and Investment Outlook?

Reviewed by Sasha Jovanovic

- United Parcel Service (UPS) recently faced significant operational disruptions due to changes in U.S. customs rules, resulting in delays, suspended money-back guarantees for international shipments, and customer complaints about unprocessed or disposed packages.

- These disruptions, coupled with cautious analyst commentary and market concerns ahead of the upcoming earnings report, underscore heightened risks and changing dynamics in UPS's international logistics operations.

- We will explore how the operational impact of customs rule changes is reshaping UPS's investment narrative and outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

United Parcel Service Investment Narrative Recap

To consider United Parcel Service (UPS) as a long-term investment, you need confidence in its ability to adapt and thrive in a complex global logistics environment, even during periods of trade and operational disruption. This month’s customs rule changes have amplified short-term risks, potentially overshadowing cost-saving and network optimization catalysts ahead of the upcoming earnings report, the most critical near-term event for the stock. For now, these disruptions are material to the current risk profile, particularly in the international segment.

One of the most relevant recent company developments is UPS's launch of the UPS Global Checkout platform, which promises greater transparency on international shipping duties and fees. This service was designed to address some pain points in cross-border transactions, but the immediate customs challenges underscore just how quickly the operating environment can shift and alter even recent initiatives. Investors will be closely watching whether these technological updates can ease current bottlenecks or if further disruption looms.

However, before considering an investment, you should know that alongside traditional risks, the loss of the de minimis exemption could highlight...

Read the full narrative on United Parcel Service (it's free!)

United Parcel Service's outlook anticipates $94.5 billion in revenue and $7.1 billion in earnings by 2028. This implies a 1.5% annual revenue growth rate and a $1.4 billion increase in earnings from the current level of $5.7 billion.

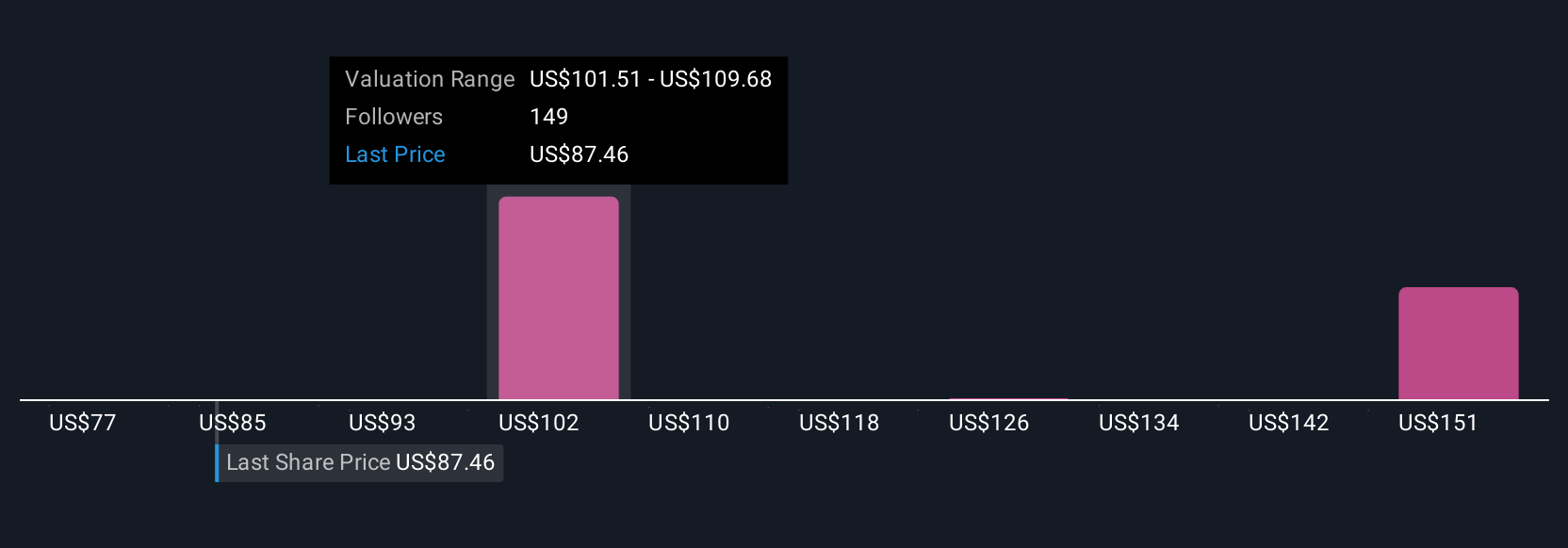

Uncover how United Parcel Service's forecasts yield a $101.43 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Some bullish analysts were forecasting US$8.0 billion in earnings by 2028, citing aggressive automation and global trade expansion as catalysts, but recent events remind us that these optimistic views could be challenged by regulatory shocks or competitive disruption. Analyst expectations often differ greatly, take time to understand both the upside and the vulnerabilities before deciding where you stand.

Explore 27 other fair value estimates on United Parcel Service - why the stock might be worth as much as 95% more than the current price!

Build Your Own United Parcel Service Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Parcel Service research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free United Parcel Service research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Parcel Service's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UPS

United Parcel Service

A package delivery and logistics provider, offers transportation and delivery services.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives