- United States

- /

- Logistics

- /

- NYSE:UPS

UPS Labor Settlements With Teamsters Might Change The Case For Investing In United Parcel Service (UPS)

Reviewed by Simply Wall St

- In August 2025, United Parcel Service reached several labor settlements with the International Brotherhood of Teamsters after credible strike threats at major hubs including Louisville's Worldport and Chicago, prompting the company to resolve long-standing worker grievances and finalize new contracts for administrative and specialist staff.

- This labor resolution not only addressed workplace and seniority grievances but also secured UPS’s compliance with union agreements, highlighting the power of organized labor in shaping operational priorities at key logistics centers across the United States.

- We'll explore how UPS's swift settlements to avoid major strike disruptions could influence its investment narrative and operational outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

United Parcel Service Investment Narrative Recap

To be a UPS shareholder, you need to believe in the company's ability to create margin improvement by shifting away from low-margin business, optimizing its massive logistics network, and managing labor relations at scale. The August 2025 labor settlements resolved significant union grievances, lowering the likelihood of dangerous strike disruptions in the near term. While labor costs may still pressure short-term margins, successful negotiations reduce immediate operational risk without materially altering the primary catalyst: UPS’s focus on higher-margin deliveries.

One of the most relevant recent announcements is UPS's confirmation of $3.5 billion in annual cost reductions for 2025, underpinned by their vast network reconfiguration and automation efforts. These cost initiatives remain pivotal to the investment story, aiming to counteract risks from shifting Amazon volumes and supply chain adjustments, and reinforcing UPS’s ability to sustain margins amid ongoing labor and trade uncertainties.

But in contrast, labor settlements can sometimes mask emerging operational headwinds that investors should watch for...

Read the full narrative on United Parcel Service (it's free!)

United Parcel Service's narrative projects $94.5 billion in revenue and $7.1 billion in earnings by 2028. This requires 1.5% yearly revenue growth and an increase of $1.4 billion in earnings from the current $5.7 billion.

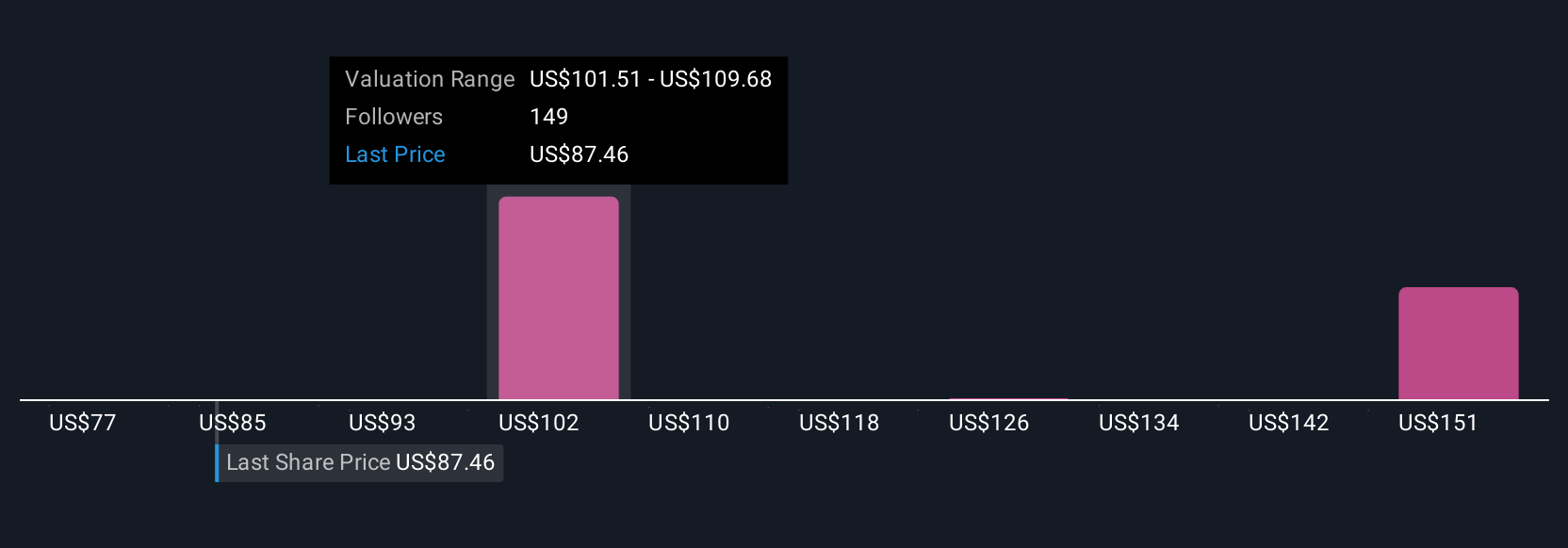

Uncover how United Parcel Service's forecasts yield a $104.63 fair value, a 18% upside to its current price.

Exploring Other Perspectives

While consensus analysts focused on efficiency gains, more optimistic experts previously anticipated US$8.0 billion in annual earnings by 2028, betting that rapid automation could outpace labor cost inflation. That bullish narrative may now face fresh questions; it’s a reminder opinions can be wide ranging, and your view matters.

Explore 23 other fair value estimates on United Parcel Service - why the stock might be worth 13% less than the current price!

Build Your Own United Parcel Service Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Parcel Service research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free United Parcel Service research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Parcel Service's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UPS

United Parcel Service

A package delivery and logistics provider, offers transportation and delivery services.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives