- United States

- /

- Logistics

- /

- NYSE:UPS

United Parcel Service (NYSE:UPS) Can Afford the Record Dividend Hike

Since the 2020 downturn, few services have grown in importance as much as transportation. The explosion of e-commerce meant opportunity for couriers, with successful ones like United Parcel Service, Inc. (NYSE: UPS) becoming multi-baggers. A remarkable accomplishment for such a mature company.

Read our latest analysis for United Parcel Service

Q4 Earnings Results

- Non-GAAP EPS: US$3.59 (beat by US$0.49)

- Revenue: US$27.77b (beat by US$700m)

- Revenue Growth: +11.5% Y/Y

Other highlights:

- Q4 net income US$3.15b (+35% Y/Y)

- 2022 FY revenue guidance: US$102b

- CAPEX 2022: US$5.5b

- Additional labor expenditures during the holiday season: US$40m

Commenting on the future expectations, CFO Brian Newman noted that they expect the international segment to outperform, with the revenue growth of approx. 7.7%. Furthermore, he announced that the capital expenditure allocation would go 60% to growth and 40% to maintenance. The company remains by its goal to become carbon neutral by 2050.

Meanwhile, the company will be returning value through share repurchases and dividends. Buybacks in 2022 should be at least $1b, while dividend payments will be around US$5.2b.

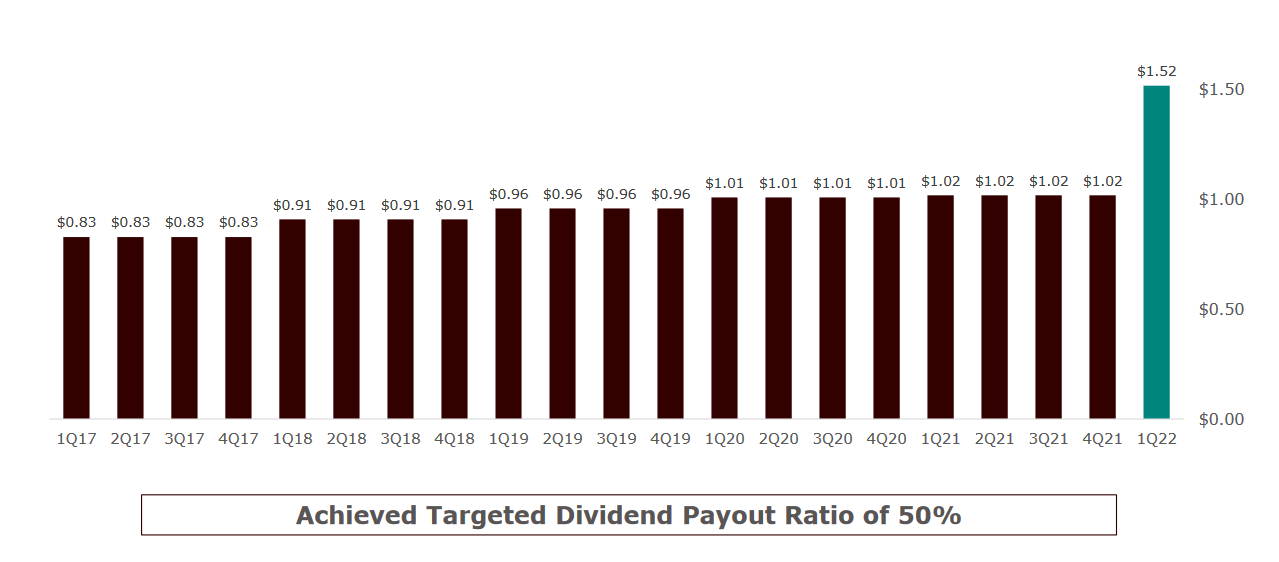

The dividend has been increased by 50%, to US$1.52 per share – the most significant increase in history. While this might look like a sharp increase, the new dividend should be easily affordable as long as the operational cash flow remains healthy. Our last article in December took notice about the dividend concerning FED rate hikes, and it seems that the company heeded that advice.

What's the opportunity in United Parcel Service?

According to our valuation model, United Parcel Service seems to be reasonably priced at around 5.06% above the intrinsic value, which means if you buy United Parcel Service today, you'd be paying a relatively reasonable price for it.

Looking at the current price targets, the Wall Street Journal gives the high price target of US$272 and the average target of US$239, with further ratings:

- Buy: 16

- Overweight: 3

- Hold: 11

- Underweight: 1

- Sell: 1

Is there another opportunity to buy low in the future? Since United Parcel Service's share price is quite volatile, we could potentially see it sink lower (or rise higher) in the future, giving us another chance to buy. This is based on its high beta, which is a good indicator of how much the stock moves relative to the rest of the market.

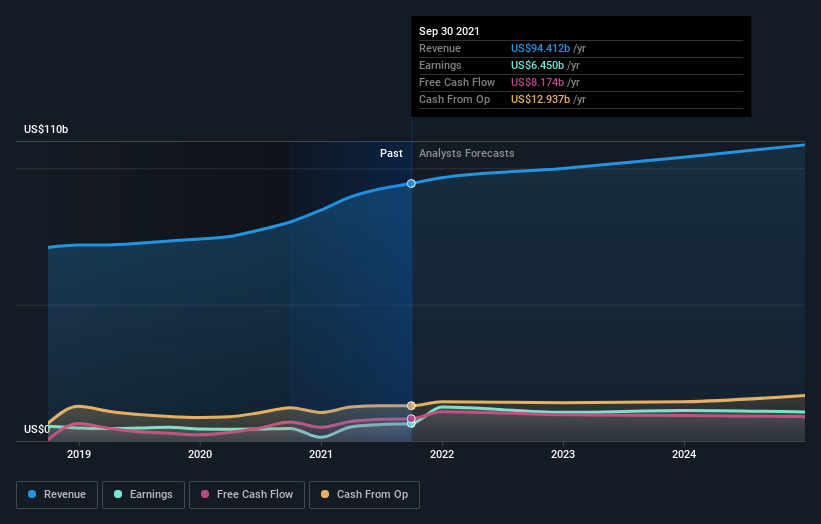

What kind of growth will United Parcel Service generate?

Future outlook is an important aspect when you're buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it's the intrinsic value relative to the price that matters the most, a more compelling investment thesis would be high growth potential at a low price.

With profit expected to grow by 67% over the next couple of years, the future seems bright for United Parcel Service. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

What this means for you:

Are you a shareholder? Congratulations! The stock performance paired with the significant dividend hike will undoubtedly positively impact your portfolio. If you're considering adding to your position on future dips, make sure to keep an eye on the fundamentals like stock's financial health.

Are you a potential investor? Given the latest big rally, if you've been keeping an eye on UPS, now may not be the most advantageous time to buy. Yet, the positive outlook is encouraging for the company, which means it's worth diving deeper into other factors such as the strength of its balance sheet to take advantage of the next price drop. As UPS moves 13% more than the average market, the next market selloff might provide a buying opportunity.

If you want to dive deeper into United Parcel Service, you'd also look into what risks it is currently facing. For example, United Parcel Service has 2 warning signs (and 1 which is significant) we think you should know about.

If you are no longer interested in United Parcel Service, you can use our free platform to see our list of over 50 other stocks with high growth potential.

If you're looking to trade United Parcel Service, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:UPS

United Parcel Service

A package delivery and logistics provider, offers transportation and delivery services.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives