- United States

- /

- Transportation

- /

- NYSE:UNP

Union Pacific (UNP) Valuation Check as BNSF Seeks Review of Southern Pacific Merger Conditions

Reviewed by Simply Wall St

BNSF Railway’s push for a fresh review of the decades old Union Pacific Southern Pacific merger terms has suddenly put Union Pacific (UNP) back under the regulatory spotlight, and that matters for the stock.

See our latest analysis for Union Pacific.

The renewed focus on merger conditions lands at a time when Union Pacific’s 1 month share price return of 7.41 percent and 90 day share price return of 7.71 percent point to building momentum, even as its 5 year total shareholder return of 30.28 percent reflects steadier long term compounding.

If you are weighing how this regulatory twist fits into the wider transport theme, it could be worth comparing Union Pacific with other leading aerospace and defense stocks that may be reshaping how goods and people move globally.

With earnings still growing and the share price sitting roughly 10 percent below consensus targets, is Union Pacific quietly undervalued ahead of a regulatory shake up, or is the market already pricing in every mile of future growth?

Most Popular Narrative Narrative: 8.9% Undervalued

With the narrative fair value sitting modestly above Union Pacific’s last close of $237.29, the story centers on steady growth and resilient margins.

Analysts expect earnings to reach $8.3 billion (and earnings per share of $14.71) by about September 2028, up from $6.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $7.2 billion.

Curious how modest margin shifts, disciplined buybacks, and a future earnings multiple below the sector average can still indicate potential upside? The full narrative lays out the playbook.

Result: Fair Value of $260.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade policy uncertainty and intermodal volume softness could quickly challenge today’s upbeat valuation assumptions and slow the pace of expected earnings growth.

Find out about the key risks to this Union Pacific narrative.

Another Take on Valuation

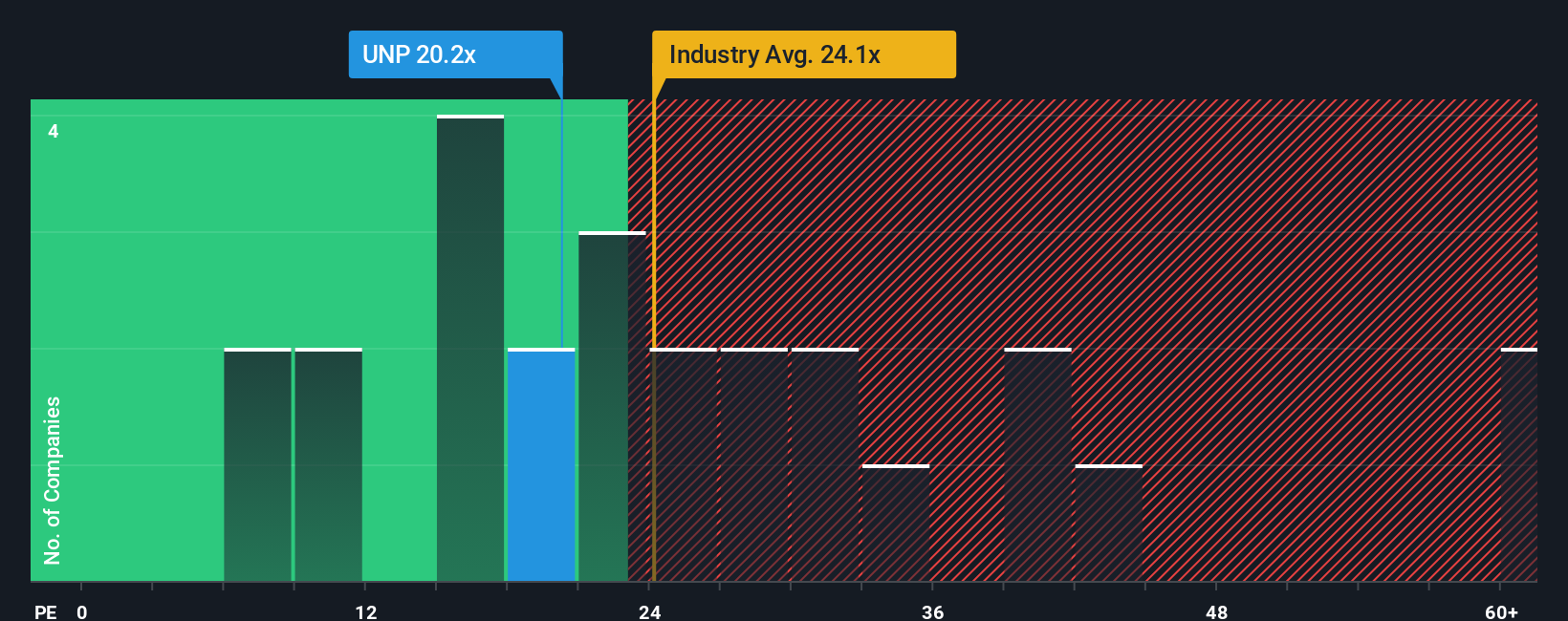

On a simple price to earnings lens, Union Pacific looks less generous. Its 20x multiple is richer than close peers at 17.9x, even if it still trades below the US Transportation average of 30.6x and near a fair ratio of 21.9x. Is that thin gap enough compensation for rail specific risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Union Pacific Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Union Pacific research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single rail story when you can quickly scan fresh opportunities on Simply Wall Street’s Screener and position your portfolio ahead of the crowd.

- Tap into potential mispricings by reviewing these 909 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Ride structural growth trends by checking out these 26 AI penny stocks where intelligent automation and data driven models could power the next leg of market returns.

- Lock in reliable income streams by comparing these 15 dividend stocks with yields > 3% that pair attractive yields with solid underlying business quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNP

Union Pacific

Through its subsidiary, Union Pacific Railroad Company, operates in the railroad business in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026