- United States

- /

- Transportation

- /

- NYSE:UBER

Uber Technologies (NYSE:UBER) Partners With Petco For Seamless Pet Supplies Delivery

Reviewed by Simply Wall St

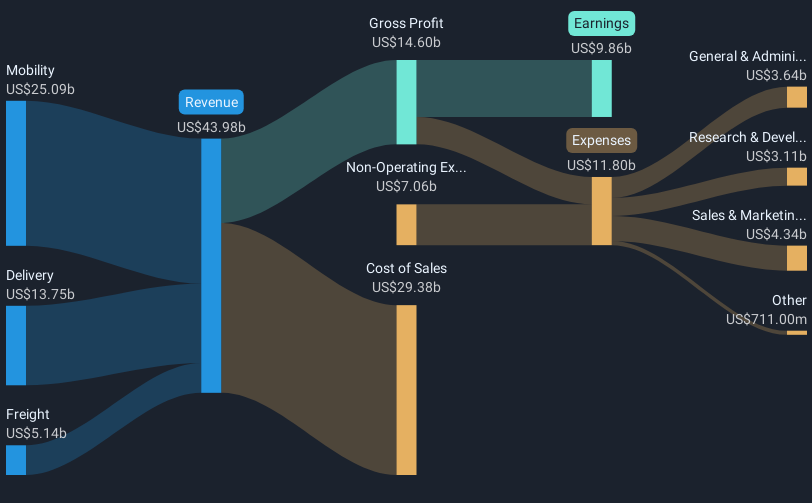

Uber Technologies (NYSE:UBER) recently announced a partnership with Petco, expanding Uber Eats to include more than 15,000 pet care products, and offering promotions for both new and existing users. Such expansion into retail aligns with Uber's strategy to diversify its offerings, also marked by similar collaborations with Sally Beauty and FreshDirect. Despite broader market pressures due to inflation concerns, the company's agile responses likely supported its stock price increase of 22% over the last quarter. Additionally, robust Q4 2024 earnings, exhibiting significant revenue and net income growth, further bolster investor confidence amidst market turbulence.

We've spotted 2 possible red flags for Uber Technologies you should be aware of.

Over the past five years, Uber Technologies' total shareholder returns have climbed by 216.13%, reflecting the company's focus on diversifying and enhancing its service offerings. This impressive growth comes as Uber has aggressively expanded into various segments, including autonomous vehicles and fleet electrification. In particular, Uber's investment in autonomous vehicle technology positions it as a key market player, likely boosting future revenue and reducing operational costs. The rapid growth of its Uber One membership program, which increased by 60% year-on-year, continues to strengthen consumer loyalty and generate recurring revenue streams.

However, challenges persist, notably in managing high insurance costs and potential foreign exchange impacts due to its extensive international footprint. Despite these hurdles, Uber's recent earnings reflect robust growth, with a substantial net income increase to US$9.86 billion in 2024. The market's confidence in Uber is further supported by significant share buybacks totaling US$1.25 billion, signaling strong future prospects. Despite slightly underperforming the US market's 7.8% return over the past year, Uber outpaced the Transportation industry's return of 6.6% decline.

Evaluate Uber Technologies' historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives