- United States

- /

- Transportation

- /

- NYSE:UBER

Uber Technologies (NYSE:UBER) Partners With Coco Robotics For Emission-Free Deliveries

Reviewed by Simply Wall St

Uber Technologies (NYSE:UBER) saw a notable price move of 12% last week, coinciding with significant new partnerships and expansions. The company's collaboration with Coco Robotics in Miami, utilizing emission-free delivery robots, and its agreement with WeRide in Dubai to advance autonomous vehicles, highlight a focus on innovation and sustainability. These developments, alongside expansions in its retail and restaurant sectors, align with the broader market's positive trajectory of a 5% rise over the same period, suggesting that Uber's strategic moves added weight to its stock performance within a bullish market context.

The recent developments at Uber Technologies, including its partnerships with Coco Robotics and WeRide, could enrich the company’s narrative focused on innovation and operational efficiency. By advancing autonomous vehicle technology and expanding in the retail sector, Uber aims to enhance both revenue and margins, aligning with analyst expectations of future growth. These moves might support revenue growth projections despite uncertainties in AV commercialization.

Over the past five years, Uber's shareholders have witnessed a total return of 158.14%, highlighting a significant long-term price appreciation. In contrast, the company's one-year return has surpassed that of the US Transportation industry, which experienced a 12.5% decline, illustrating robust recent performance despite broader industry challenges.

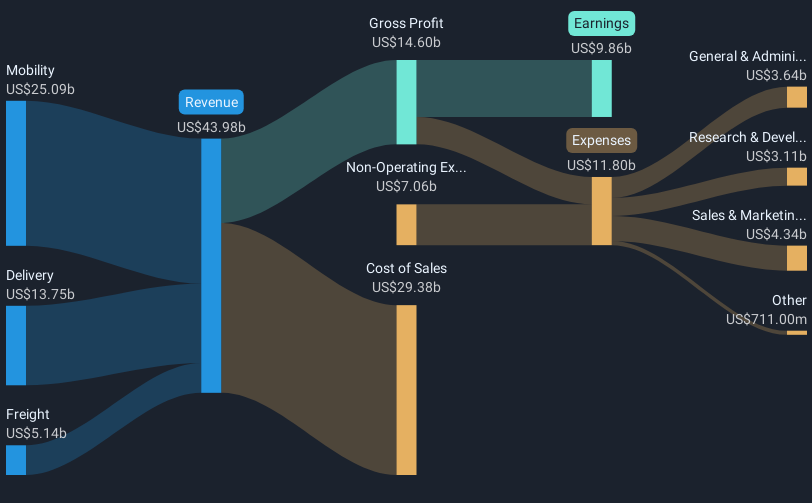

The recent share price increase aligns with Uber's consensus analyst price target of US$88.78, indicating a potential upside of 22.8% from its current price of US$65.07. Analysts expect revenues to grow, albeit at a slower annual rate of 11.9% compared to the market. Meanwhile, earnings are anticipated to decline to US$8.8 billion by 2028, reflecting some divergence from the positive sentiment driven by recent strategic initiatives. As Uber continues to expand its technological and geographic reach, these factors will be crucial in meeting and possibly exceeding financial forecasts.

Examine Uber Technologies' earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Ferrari's Intrinsic and Historical Valuation

Recently Updated Narratives

Looking to be second time lucky with a game-changing new product

Adobe - A Fundamental and Historical Valuation

Probably the best stock I've seen all year.

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Trending Discussion