- United States

- /

- Transportation

- /

- NYSE:UBER

Are Uber Shares Attractive After Groundbreaking Growth Forecast for 2025 Deliveries?

Reviewed by Bailey Pemberton

If you have found yourself looking at Uber Technologies’ chart and debating whether now is the right moment to jump in, add more, or take some profits, you are not alone. The stock has had quite a ride recently, and investors are weighing both opportunities and risks amid a swirl of headlines. Uber’s shares closed recently at $93.4, just a hair off their recent highs. While there was a dip of 3.3% over the past week and a slight pullback of 0.9% for the past month, the year-to-date return stands at a robust 47.9%. Stretch that timeline out to three years, and Uber has racked up a staggering 278% gain, with an impressive 177% return over five years. Clearly, long-term believers have been rewarded for their patience.

But this ride has not been smooth. The news cycle is buzzing about new investigations into safety practices and ongoing litigation concerning passenger discrimination. Meanwhile, Uber is projecting massive growth in its non-restaurant delivery segment, aiming for $12.5 billion in gross bookings by 2025, which is a full 25% higher than just a few months ago. On top of this, shifts in the competitive landscape and evolving regulations for self-driving vehicles are reshaping what the future could hold.

All these factors influence investor sentiment and, more importantly, company valuation. On that front, Uber currently boasts a value score of 5 out of 6, meaning it passes the undervaluation test in nearly every metric you could want. In the next section, we will break down how that score is calculated across different valuation approaches. There is also an even more insightful way to judge Uber’s true worth that we will cover at the end of this article.

Approach 1: Uber Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. Essentially, the DCF model addresses what Uber Technologies is worth now, based on the value of what it is expected to generate in the future.

For Uber, the latest Free Cash Flow comes in at $8.5 Billion. Analysts estimate that this figure will continue growing, with projections reaching $16.2 Billion by 2029. Actual analyst estimates extend for around 5 years, and any numbers beyond that are conservatively extrapolated. The 10-year outlook suggests Uber’s annual cash generation could exceed $23 Billion by 2035, reflecting both analyst input in the early years and forecast modeling in the longer term.

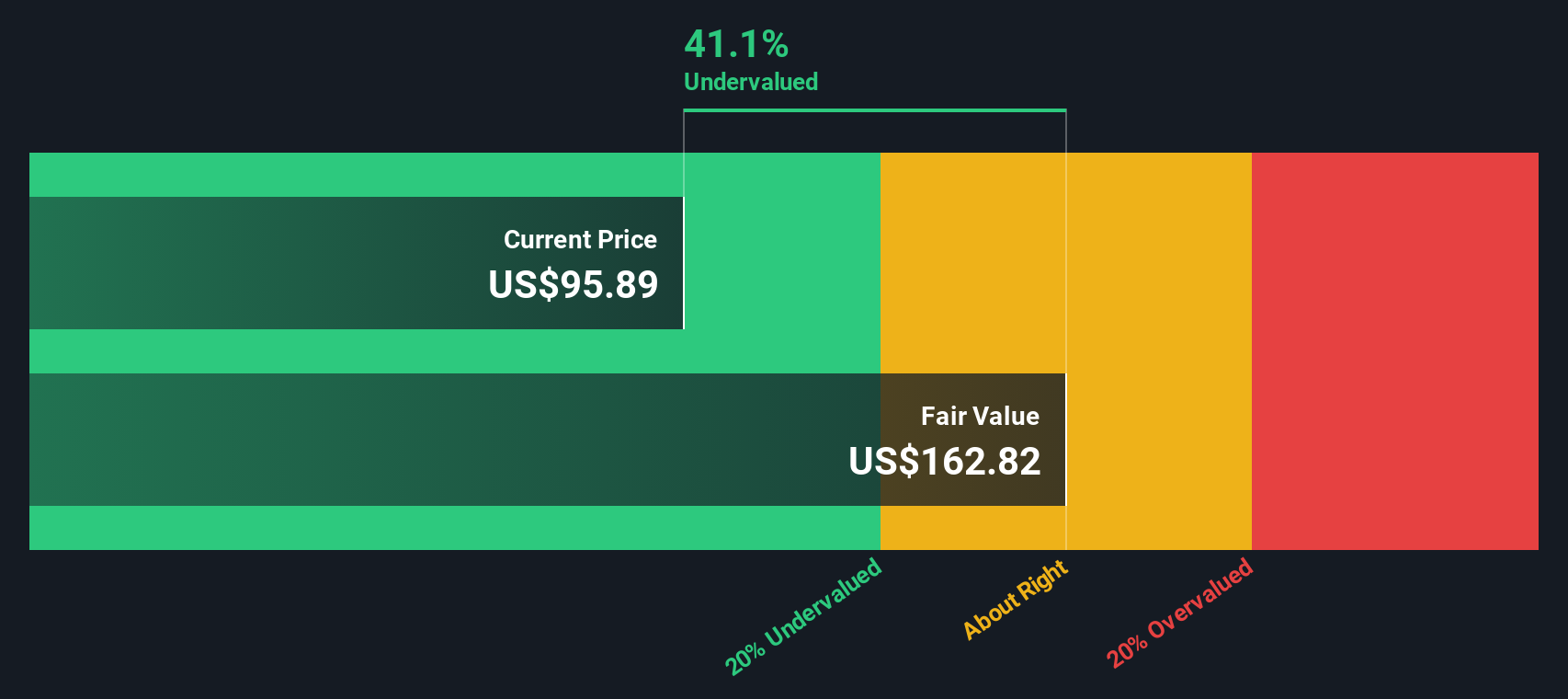

Based on these cash flow projections and applying the discounting process, the model arrives at an estimated intrinsic value of $159.75 per share. Compared to the recent share price of $93.40, this implies Uber is trading at a 41.5% discount to its fair value according to the DCF approach. This outcome suggests considerable upside potential for investors who believe in these projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Uber Technologies is undervalued by 41.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Uber Technologies Price vs Earnings

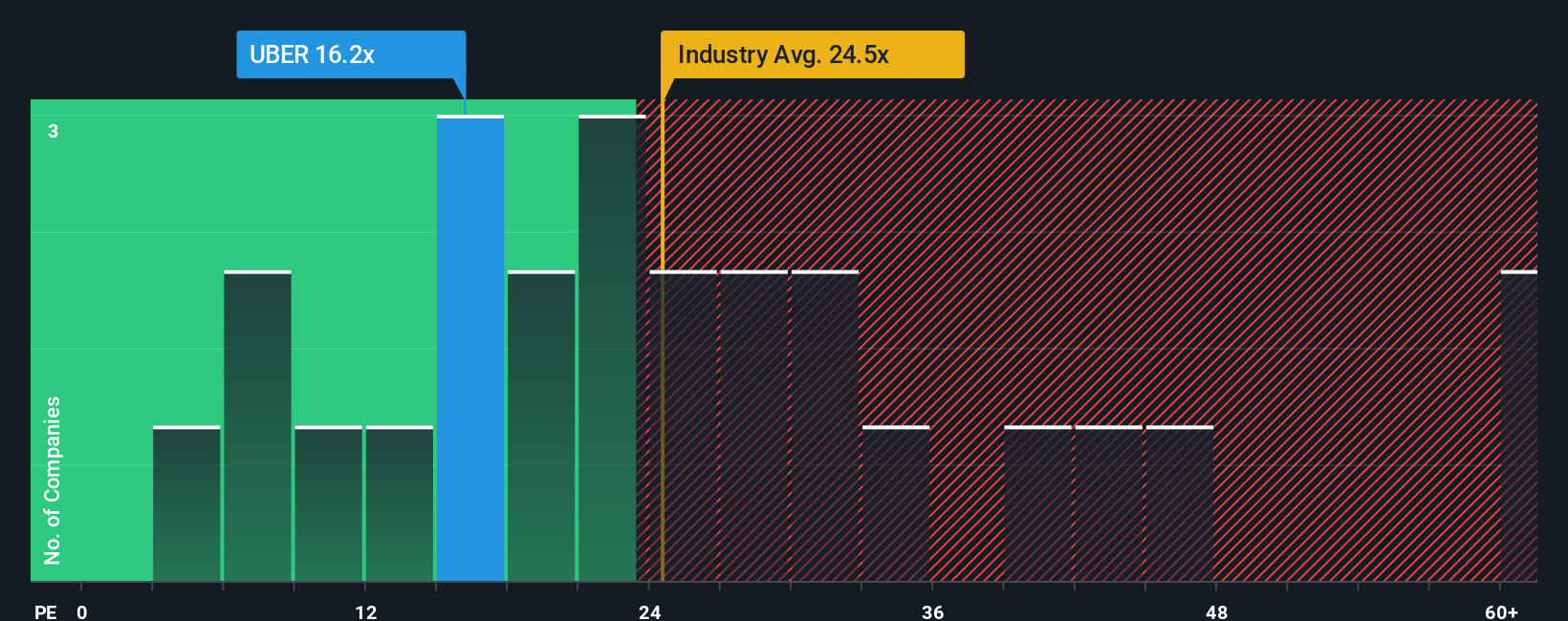

For companies that are consistently profitable, the price-to-earnings (PE) ratio is a trusted metric for investors because it lets you see how much the market is willing to pay today for a dollar of current earnings. The PE ratio reflects not just current profitability but also expectations for future growth and the perceived risks of achieving that growth. A higher ratio suggests confidence in growth, while a lower one often signals caution or skepticism.

Uber Technologies currently trades at a PE ratio of 15.43x. To put this in context, that is well below both the Transportation industry average of 24.92x and the peer group average of 36.20x. On the surface, this could indicate that Uber is undervalued compared to similar companies or the broader sector. However, simple averages do not account for important company-specific factors like profit margins, earnings growth rates, or risk profile.

This is where Simply Wall St's proprietary Fair Ratio comes in. The Fair Ratio (here, 16.82x) factors in Uber’s projected earnings growth, profitability, industry dynamics, size, and risks to set a benchmark multiple that is tailored to the company’s unique position. It offers a more nuanced perspective than a broad industry average. Comparing Uber's actual PE ratio of 15.43x with the Fair Ratio of 16.82x, the gap is meaningful but not extreme. This suggests the stock trades at a slight discount to what would be considered "fair" for its profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Uber Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple yet powerful tool that let you define your own story for a company like Uber Technologies, combining your expectations about their business performance with financial forecasts to arrive at a fair value rooted in your unique perspective.

With Narratives, you do not just accept the numbers; you actively shape the assumptions about future revenue growth, margins, and risks, linking Uber's story to a financial forecast and then to a fair value. This makes investing not just about statistics but about your vision for where the company is headed, making the process more accessible, engaging, and tailored to you.

On Simply Wall St’s platform, you can find Narratives within the Community page, where millions of investors share and compare their views. Narratives help you decide when to buy or sell by showing how your fair value compares to the current price, and they update automatically as new news or earnings are released, keeping your insights up to date at all times.

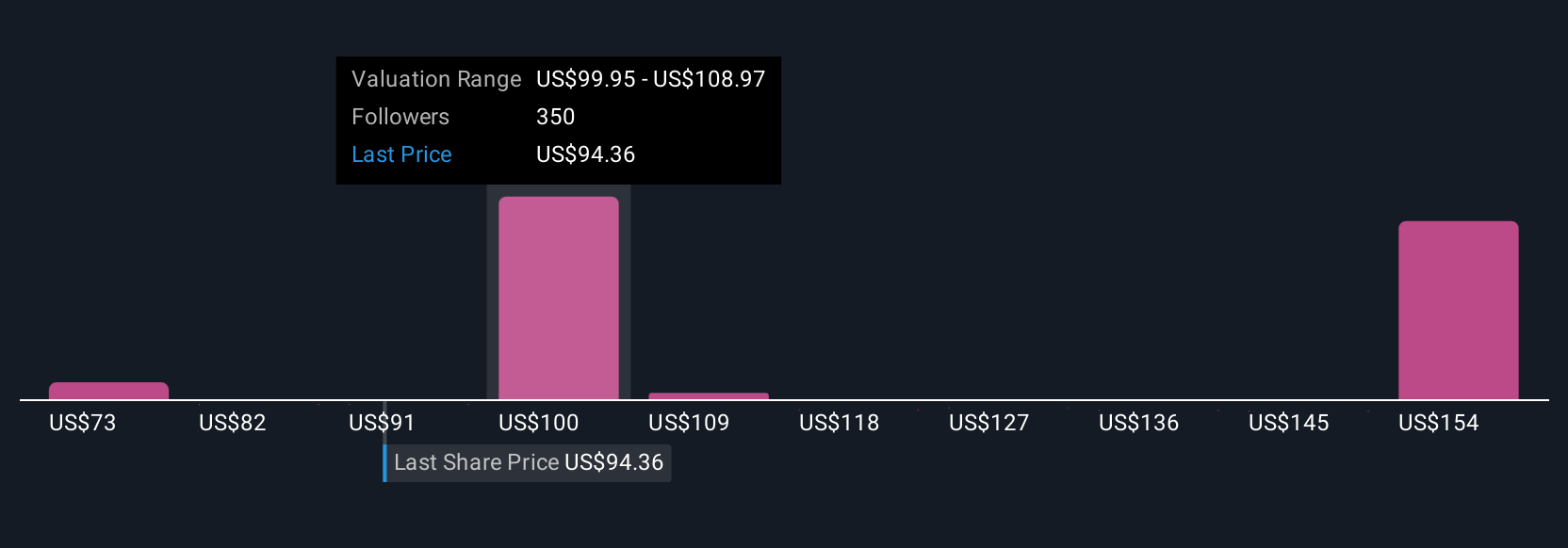

For example, one Uber Technologies Narrative estimates a fair value at just $75 per share (seeing risks outweigh growth), while another forecasts upside to $108 based on robust user growth and strategic investments. This demonstrates there is no single “correct” answer, only your own best-informed Narrative.

For Uber Technologies, we’ll make it straightforward for you with previews of two leading Uber Technologies Narratives:

Fair Value: $107.62

Current Market Price is 13.2% below narrative fair value

Revenue Growth Rate: 14.6%

- Growth is driven by user expansion, product diversification, and deeper customer engagement through cross-platform integration and targeted promotions.

- Investments in autonomous vehicles, electrification, and high-margin services support profitability. However, high investment and operational complexity pose risks.

- Analysts forecast earnings of $9.7 billion by 2028, requiring a future PE ratio of 28.1x, with a consensus price target 10.3% above current market pricing.

Fair Value: $75.00

Current Market Price is 24.5% above narrative fair value

Revenue Growth Rate: 4.2%

- Uber has achieved strong profitability and free cash flow, with sustainable net income and robust balance sheet metrics.

- Estimates for 2030 forecast $65–70 billion in revenue. However, analysis finds the current $192 billion market cap represents a 40%+ premium to intrinsic value.

- This suggests fair value is $65–75 per share and recommends caution, stating the current valuation offers no margin of safety despite excellent business fundamentals.

Do you think there's more to the story for Uber Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives