- United States

- /

- Marine and Shipping

- /

- NYSE:SB

3 US Penny Stocks With Market Caps Below $2B To Consider

Reviewed by Simply Wall St

As the Nasdaq Composite leads the U.S. stock market higher, investors are navigating new tariff threats with cautious optimism. In such a climate, identifying opportunities in lesser-known areas like penny stocks can be appealing for those seeking growth potential outside of major indices. Although the term "penny stock" may seem outdated, these smaller or newer companies can still offer significant opportunities when backed by solid financials and strategic positioning.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.896 | $6.46M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $125.23M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.25 | $10.23M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.95 | $89.18M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.42 | $46.86M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.78 | $46.67M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.44 | $25.01M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8975 | $79.45M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.64 | $384.4M | ★★★★☆☆ |

Click here to see the full list of 711 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Marqeta (NasdaqGS:MQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Marqeta, Inc. operates a cloud-based open application programming interface platform providing card issuing and transaction processing services, with a market cap of approximately $1.88 billion.

Operations: The company generates revenue primarily from services provided to financial companies, amounting to $490.03 million.

Market Cap: $1.88B

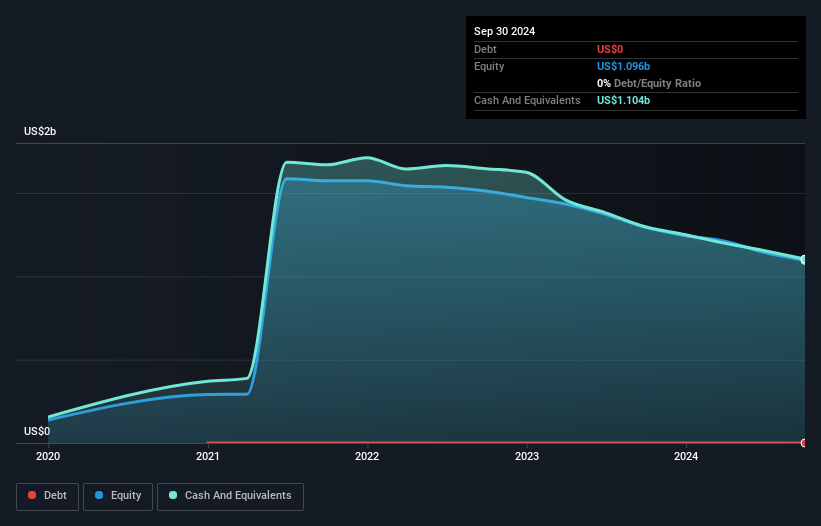

Marqeta, Inc. has recently become profitable, with a market cap of US$1.88 billion and revenue of US$490.03 million from its card issuing platform. The company is debt-free and has sufficient short-term assets to cover liabilities, but faces challenges with low return on equity at 1.3% and forecasted earnings decline by 21.6% annually over the next three years. Recent legal issues have affected its stock price significantly, while Marqeta continues to explore strategic acquisitions to enhance program management capabilities without disrupting its profitability path amidst ongoing M&A interest from major financial firms and fintechs.

- Click here and access our complete financial health analysis report to understand the dynamics of Marqeta.

- Examine Marqeta's earnings growth report to understand how analysts expect it to perform.

PHX Minerals (NYSE:PHX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PHX Minerals Inc. is a natural gas and oil mineral company based in the United States with a market cap of $146.18 million.

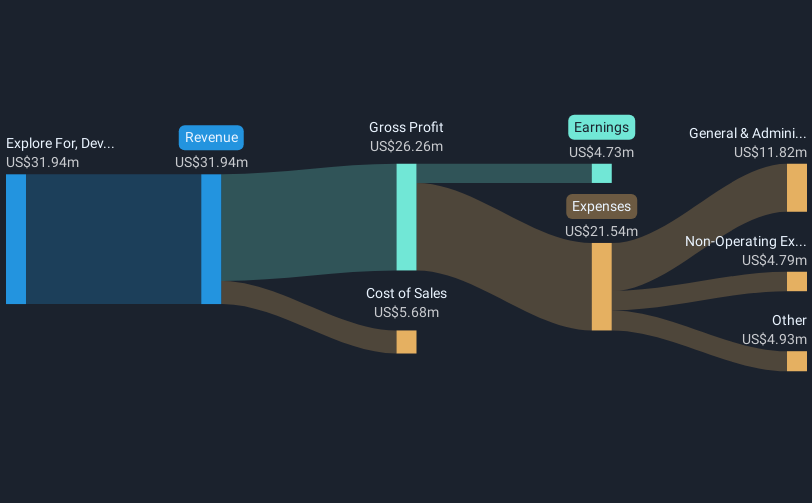

Operations: The company generates revenue of $31.94 million from its activities in exploring, developing, producing, and selling oil, natural gas liquids (NGL), and natural gas.

Market Cap: $146.18M

PHX Minerals Inc., with a market cap of US$146.18 million, generates US$31.94 million in revenue from its oil and gas operations, yet faces challenges with negative earnings growth over the past year and declining profit margins. Despite this, the company's debt is well-managed, with a satisfactory net debt to equity ratio of 20.3% and operating cash flow covering 66.9% of its debt obligations. Recent developments include exploring strategic alternatives such as mergers or sales to maximize shareholder value, while investor activism highlights ongoing discussions about management and corporate governance improvements.

- Get an in-depth perspective on PHX Minerals' performance by reading our balance sheet health report here.

- Learn about PHX Minerals' future growth trajectory here.

Safe Bulkers (NYSE:SB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Safe Bulkers, Inc., along with its subsidiaries, offers marine drybulk transportation services and has a market cap of $384.40 million.

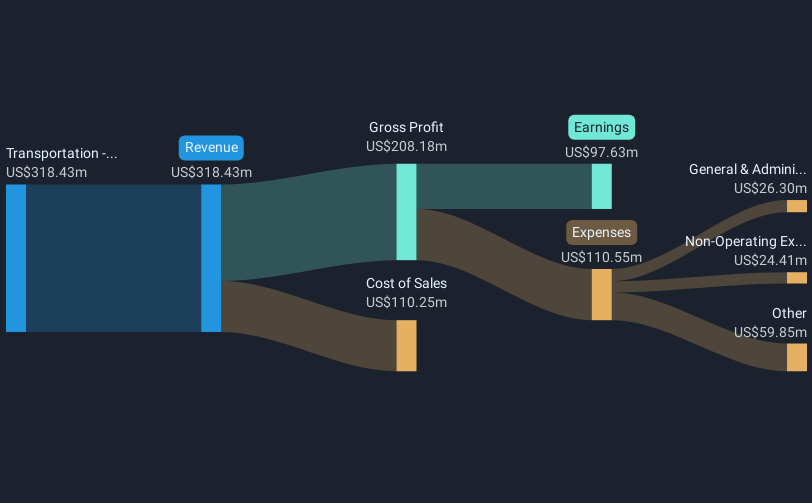

Operations: The company generates revenue of $318.43 million from its marine drybulk transportation services.

Market Cap: $384.4M

Safe Bulkers, Inc., with a market cap of US$384.40 million, has shown strong financial performance, reporting earnings growth of 27.4% over the past year and revenue of US$318.43 million from its marine drybulk transportation services. Despite this growth, the company faces challenges with high debt levels and a net debt to equity ratio of 49%. Its short-term assets exceed short-term liabilities by US$30.5 million, providing some liquidity cushion. Recent activities include a share repurchase program and dividends on preferred shares, reflecting management's confidence in the company's financial stability amidst industry volatility.

- Click here to discover the nuances of Safe Bulkers with our detailed analytical financial health report.

- Assess Safe Bulkers' future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Investigate our full lineup of 711 US Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SB

Safe Bulkers

Provides marine drybulk transportation services internationally.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives