- United States

- /

- Transportation

- /

- NYSE:R

Ryder System (R): Assessing Valuation After Toyota Award and Dividend Boost

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 4.5% Undervalued

According to the most widely followed narrative, Ryder System is currently undervalued by 4.5%, with analysts projecting meaningful growth and steady earnings ahead.

Expanding sustainability initiatives, including fleet electrification and greener solutions, position Ryder to capture new customer spend as environmental regulations intensify and shippers increase focus on decarbonizing their supply chains. This supports both revenue growth and competitive differentiation.

Curious about why analysts think Ryder deserves a higher valuation, even while peers tread carefully? The consensus narrative hinges on ambitious plans for growth, sustainable margins, and big bets on electrification. Want to see which numbers get Ryder over the finish line? The underlying blueprint reveals assumptions about future profits, contract wins, and efficiency gains. Discover what makes this narrative tick.

Result: Fair Value of $196.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing weakness in the freight market or extended downturns in used vehicle sales could quickly challenge these optimistic assumptions and shift analyst expectations lower.

Find out about the key risks to this Ryder System narrative.Another View: What Does Our DCF Model Say?

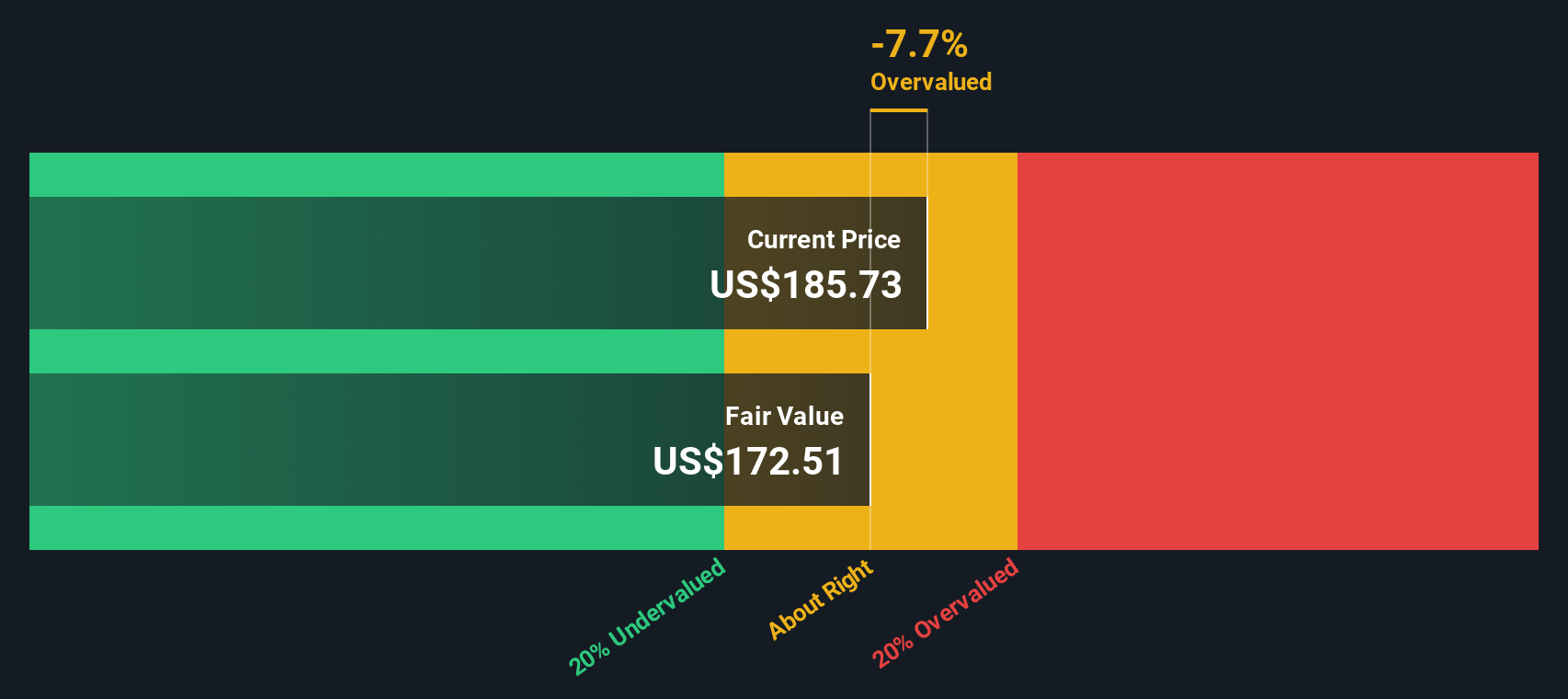

While analysts suggest Ryder is undervalued based on its earnings outlook, our SWS DCF model presents a different perspective. It indicates the shares might be trading above what future cash flows justify. Which method better reflects reality in today’s market?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ryder System Narrative

If you want to test these assumptions for yourself or prefer to dive deeper into Ryder’s numbers, you can build your own view in just a few minutes. Do it your way.

A great starting point for your Ryder System research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Markets reward those who think ahead. Don’t limit yourself to just one sector or story. Expand your opportunities with a few tailored shortcuts to tomorrow’s market leaders.

- Boost your yield potential and secure steady income streams by scanning for dividend stocks with yields > 3% that deliver attractive payments and financial strength.

- Uncover rising tech disruptors shaping tomorrow’s breakthroughs. Scan for AI penny stocks and get in on the drivers of the AI revolution.

- Capitalize on market mispricing now by pinpointing undervalued stocks based on cash flows that offer the strongest upside based on robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:R

Ryder System

Operates as a logistics and transportation company worldwide.

Established dividend payer with acceptable track record.

Market Insights

Community Narratives