- United States

- /

- Airlines

- /

- NYSE:LUV

Does Going Digital With FAA Certificates Give Southwest Airlines (LUV) an Edge in Aviation Security?

Reviewed by Sasha Jovanovic

- Boeing, in partnership with Southwest Airlines and Aeroxchange Ltd., recently completed the aerospace industry's first shipment using a digital FAA 8130-3 certificate, providing secure, encrypted verification of aircraft parts’ airworthiness and authenticity.

- This marks a significant step forward in enhancing supply chain security and may set a new industry standard for preventing unapproved parts from entering the aviation aftermarket.

- We'll look at how Southwest Airlines' role in this milestone for digital airworthiness certification might influence its broader growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Southwest Airlines Investment Narrative Recap

To hold Southwest Airlines stock, an investor needs faith in the airline’s ability to adapt amid changing travel demand, manage operational costs, and leverage its scale, even as competitive and macroeconomic risks persist. While the recent rollout of digital airworthiness certification boosts supply chain security, the immediate impact on short-term catalysts, like demand recovery trends or cost pressures, appears limited, as this development is more about operational integrity than near-term revenue. The most material risk remains the macroeconomic uncertainty affecting bookings, which continues to weigh on revenue visibility and near-term results.

Among recent announcements, the unveiling of Southwest’s summer 2026 schedule, with expanded routes and enhanced service, including international launches and its inaugural Anchorage flights, serves as a relevant context for assessing near-term catalysts. While network growth signals bold intention, it intersects directly with the risk of softening demand and cost escalation, placing operational efficiency and capacity management in clear focus for investors tracking short-term performance. Yet, despite these new service opportunities, challenges could still arise from...

Read the full narrative on Southwest Airlines (it's free!)

Southwest Airlines' outlook anticipates $32.6 billion in revenue and $1.9 billion in earnings by 2028. This implies a 5.9% annual revenue growth rate and a $1.5 billion increase in earnings from the current $392.0 million.

Uncover how Southwest Airlines' forecasts yield a $33.06 fair value, in line with its current price.

Exploring Other Perspectives

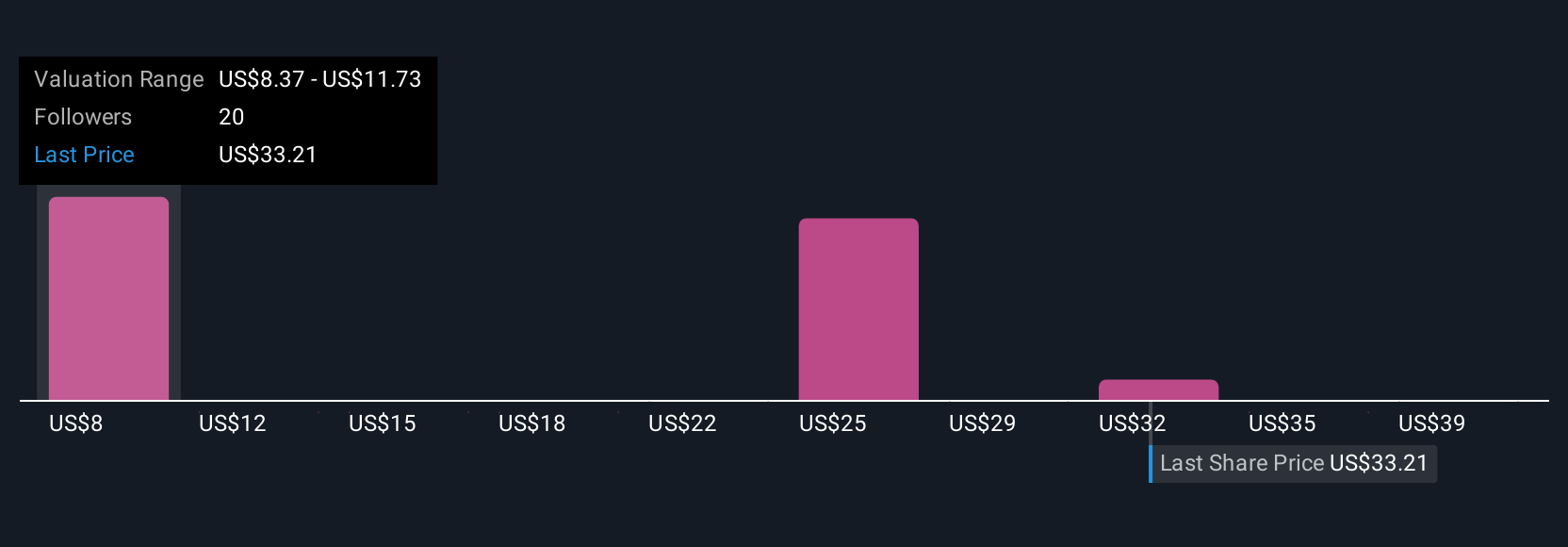

Eight members of the Simply Wall St Community have estimated fair values for Southwest Airlines ranging from US$7.59 to US$45.91 per share. While opinions diverge widely, the ongoing uncertainty around travel demand and booking trends could have broad implications on future earnings, offering several alternative viewpoints for you to explore.

Explore 8 other fair value estimates on Southwest Airlines - why the stock might be worth less than half the current price!

Build Your Own Southwest Airlines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southwest Airlines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southwest Airlines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southwest Airlines' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUV

Southwest Airlines

Operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives