- United States

- /

- Transportation

- /

- NYSE:KNX

Does Knight-Swift (KNX) Revenue Beat but EPS Miss Reveal a Shift in Its Profit Strategy?

Reviewed by Sasha Jovanovic

- Knight-Swift Transportation Holdings recently reported quarterly revenue of US$1.93 billion that exceeded forecasts, while adjusted earnings per share came in below expectations, and its board confirmed a regular cash dividend to be paid on December 22 in the past.

- A director also gifted 2,800 Class A shares in a personal, non-market transaction, highlighting that insider activity can reflect financial planning rather than a view on company value.

- Next, we’ll examine how this revenue beat but earnings miss could influence Knight-Swift’s longer-term investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Knight-Swift Transportation Holdings Investment Narrative Recap

To own Knight-Swift, you need to believe its scale, LTL expansion and technology can eventually translate modest revenue growth into healthier margins. The latest quarter’s revenue beat but earnings miss underlines that profitability execution, not demand alone, is still the key near term catalyst, while weak freight pricing and volumes remain the biggest swing risk. This set of results does not materially change that balance.

The board’s decision to maintain a regular US$0.18 quarterly dividend, even as earnings came in below expectations, is the most relevant signal alongside this report. It points to continued confidence in cash generation, which matters for investors watching how Knight-Swift funds high capital needs for its LTL build out and technology investments while working through a still soft freight cycle.

Yet while revenue is holding up, investors should be aware that persistent freight softness could still...

Read the full narrative on Knight-Swift Transportation Holdings (it's free!)

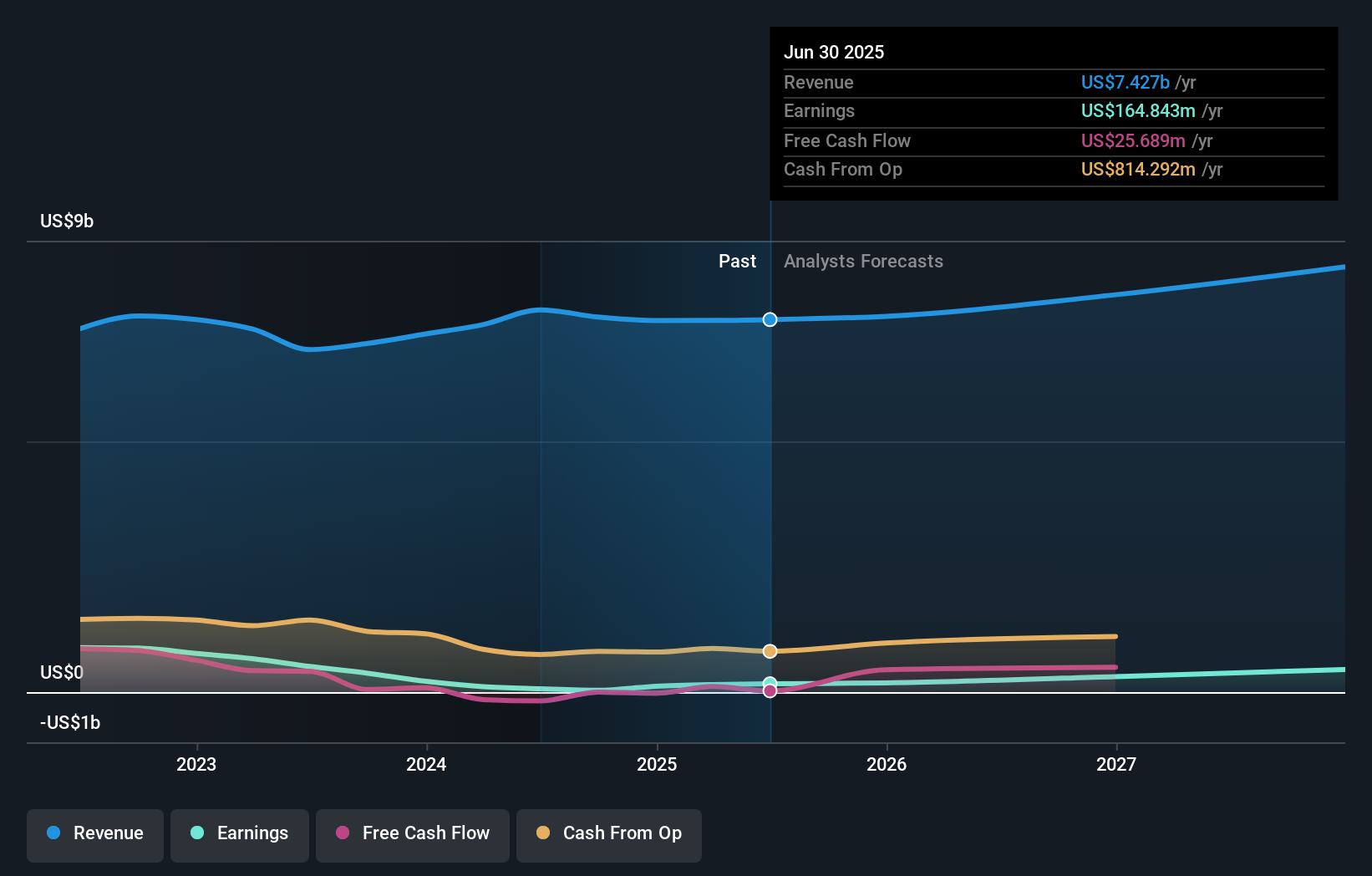

Knight-Swift Transportation Holdings' narrative projects $8.7 billion revenue and $524.7 million earnings by 2028.

Uncover how Knight-Swift Transportation Holdings' forecasts yield a $53.95 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community currently see fair value between US$53.95 and US$66.05, underscoring how far opinions can spread. You may want to weigh that against the risk that ongoing LTL integration costs and soft freight demand could keep pressure on near term earnings and return on equity, and then compare several viewpoints before deciding what this means for Knight-Swift’s longer term performance.

Explore 2 other fair value estimates on Knight-Swift Transportation Holdings - why the stock might be worth just $53.95!

Build Your Own Knight-Swift Transportation Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Knight-Swift Transportation Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Knight-Swift Transportation Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Knight-Swift Transportation Holdings' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Knight-Swift Transportation Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNX

Knight-Swift Transportation Holdings

Provides freight transportation services in the United States and Mexico.

Proven track record with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026