- United States

- /

- Logistics

- /

- NYSE:FDX

What the Latest FedEx Rally Means for Investors in 2025

Reviewed by Bailey Pemberton

If you have been watching FedEx lately, you know just how lively things can get with this shipping giant’s stock price. Maybe you are asking yourself whether now is the right time to buy, hold, or simply watch from the sidelines. After a bumpy ride earlier in the year, FedEx is showing signs of a comeback. Over just the last week, the stock has climbed 4.4%, and in the past month, it is up a solid 8.5%. That said, it is not all blue skies. Year-to-date, shares are still down 9.9%, and over the past year, the stock is off by 2.9%. Zoom out to three years, though, and you are looking at a hefty 72.3% gain. This shows that longer-term investors have been rewarded for their patience, despite recent turbulence.

All these moves are happening as investors try to make sense of global supply chain shifts, changing trade policies, and evolving consumer habits. The company has had to adapt quickly, and many investors seem to be recalibrating their risk and growth expectations. Behind the headlines, though, is the big question: what is FedEx actually worth at this moment?

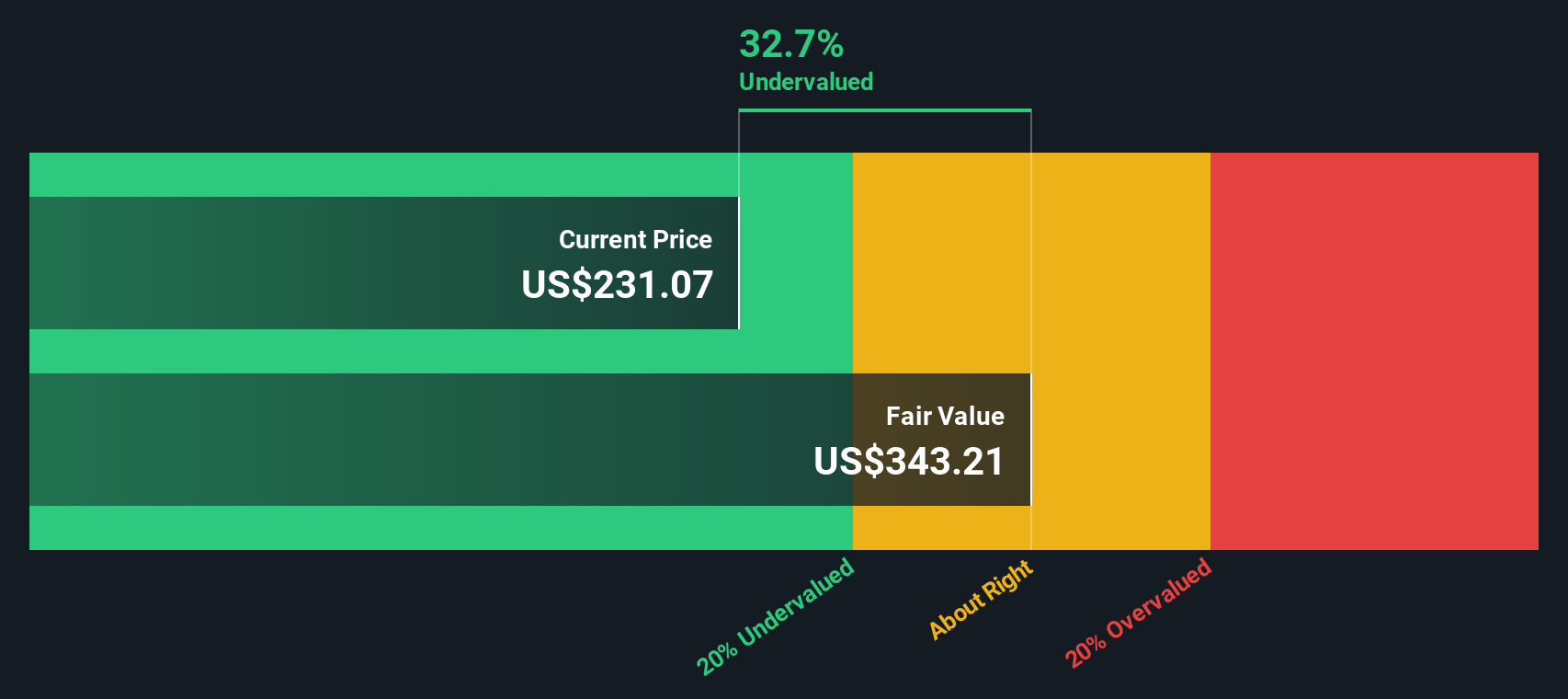

To answer that, we have to dig into how the company measures up on valuation. By classic standards, FedEx currently notches a score of 5 out of 6 for undervaluation, which is a strong showing. In the next section, I will break down what drives that score, looking at the most widely used approaches for figuring out whether FedEx is genuinely undervalued or just appears that way on the surface. Keep in mind, there is an even more insightful way to think about FedEx’s true worth that we will get to at the end.

Approach 1: FedEx Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation method that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's values. In other words, it answers the question: what are all of FedEx's expected future profits actually worth in today's dollars?

For FedEx, the model starts with its latest free cash flow of $2.63 billion and forecasts how this could grow over the next decade. Analysts project a steady ramp-up, with next year's free cash flow expected around $3.28 billion and reaching $4.63 billion by 2028. From there, the DCF model applies further extrapolations based on industry estimates and eventually projects that FedEx could be generating upwards of $7.10 billion in free cash flow by 2035. All these amounts are calculated in US dollars.

Aggregating these projections and discounting them to the present, the DCF arrives at an estimated fair value for FedEx of $388.51 per share. This value suggests that, compared to its current market price, the stock is trading at a 36.4% discount. In simple terms, if these assumptions hold, the shares appear considerably undervalued at the moment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests FedEx is undervalued by 36.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: FedEx Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies, such as FedEx. It essentially tells investors how much they are paying for each dollar of the company’s reported earnings. For established businesses with steady profits, PE ratios are especially useful, since they reflect both current performance and expectations for future growth.

Growth prospects and risk are two key factors that influence what counts as a "normal" or "fair" PE ratio. Companies with higher expected growth typically command higher PE multiples, as investors are willing to pay a premium for brighter futures. Conversely, greater risks can dampen the PE ratio that investors are willing to accept.

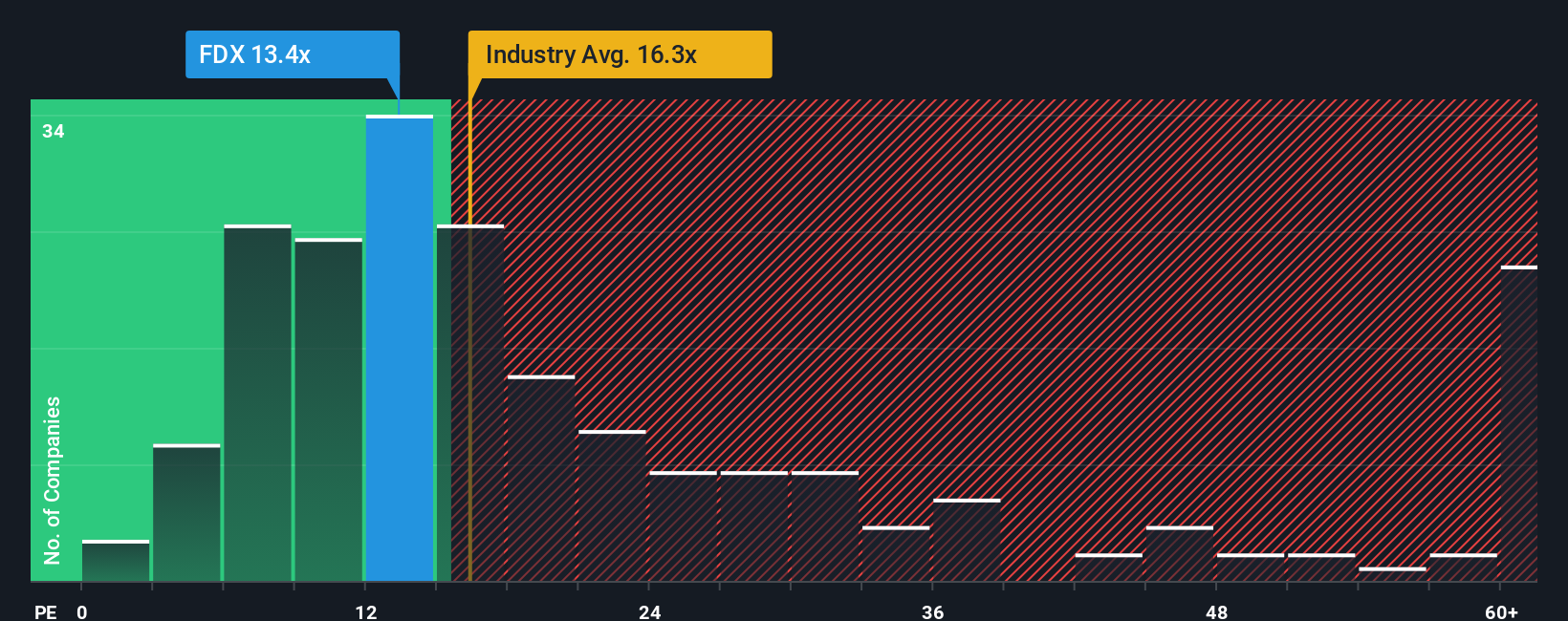

FedEx currently trades on a PE ratio of 14.2x. To put that in context, the logistics industry averages 15.9x, while peers in the sector are at 18.7x. On the surface, FedEx appears to be trading at a discount to these benchmarks, which might signal an attractive opportunity.

Simply Wall St’s proprietary “Fair Ratio” provides a more nuanced valuation benchmark, in this case 17.8x. Unlike a simple comparison with industry or peers, the Fair Ratio blends in FedEx’s earnings growth outlook, market cap, profit margins, and risk profile. It combines essentially all the factors that truly shape what investors should pay. This gives a more tailored perspective on valuation than industry averages alone.

Comparing FedEx’s current PE of 14.2x to the Fair Ratio of 17.8x shows the stock is trading well below where it might be expected, based on its fundamentals and unique characteristics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your FedEx Narrative

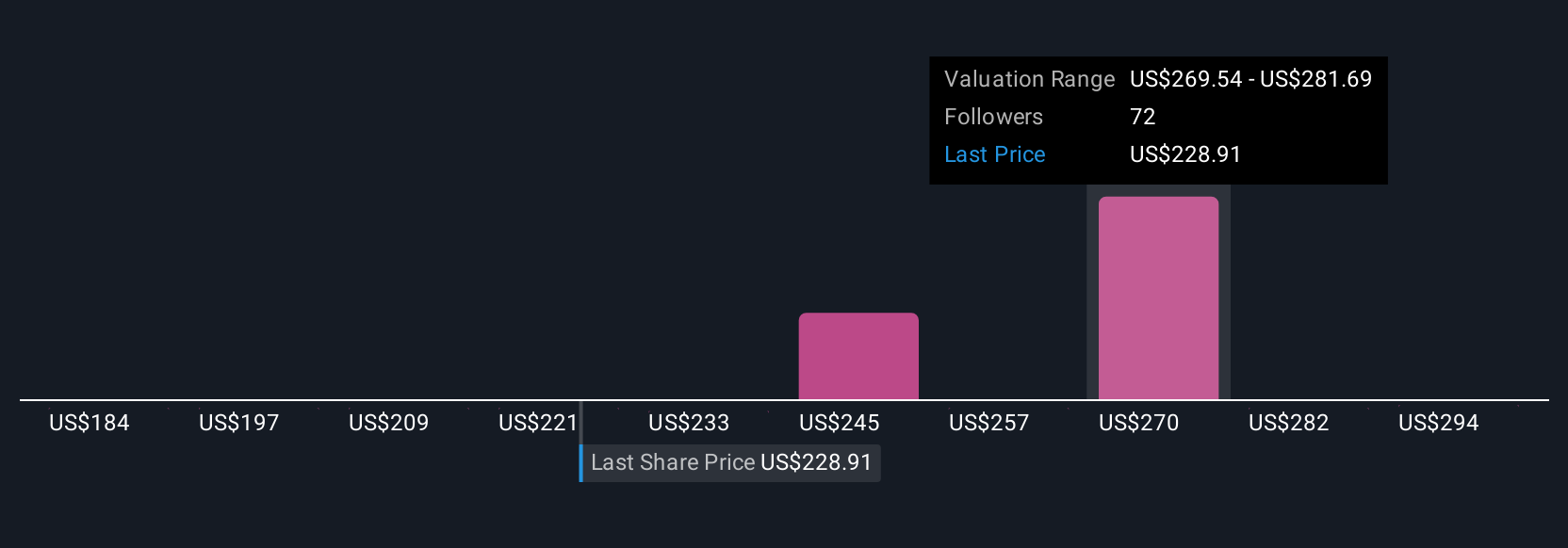

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple way to connect your perspective on a company's future to the numbers behind it, linking the company's story and key business drivers with a forward-looking forecast and a calculated fair value. Unlike traditional metrics, Narratives help you easily see how your outlook on FedEx’s revenue growth, earnings, and margins would translate into a share price you believe is “fair.”

Narratives are available on Simply Wall St’s Community page and are used by millions of investors, making them an accessible way to test your own views and see what others are thinking. They let you compare your calculated Fair Value to the current share price, helping you make better buy or sell decisions based on your scenario. Since Narratives update dynamically whenever fresh news or earnings are released, you will always have an up-to-date view.

For example, some investors believe FedEx’s fair value could be as high as $320.00 if ambitious margin expansion plays out. Others see the risk of a much lower $200.00 if headwinds disrupt revenue and profitability. This shows that with Narratives, you can align your investments with your own real-world expectations.

Do you think there's more to the story for FedEx? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDX

FedEx

Provides transportation, e-commerce, and business services in the United States and internationally.

Undervalued established dividend payer.

Market Insights

Community Narratives