- United States

- /

- Logistics

- /

- NYSE:FDX

How Leadership Change and Eurobond Offering at FedEx (FDX) Has Changed Its Investment Story

Reviewed by Simply Wall St

- FedEx recently announced a fixed-rate, unsecured Eurobond offering and confirmed the departure of Sriram Krishnasamy from his Chief Digital and Transformation Officer roles, with Krishnasamy remaining as an executive advisor for a transitional period.

- This combination of leadership transition and new debt issuance signals developments not just in FedEx’s financial strategy but also potential shifts in the company’s approach to technology transformation and long-term capital structure.

- Let's explore how the leadership change in FedEx’s digital transformation efforts may reshape the company’s investment case and outlook.

FedEx Investment Narrative Recap

At its core, being a FedEx shareholder means believing in the company’s ability to modernize its operations, deliver cost savings, and enhance earnings through transformation initiatives such as DRIVE and Network 2.0. The recent Eurobond offering and executive departure do not materially alter the company’s most pressing short-term catalyst, the success of its cost-cutting and network optimization efforts, or change the significant risk posed by weak B2B volumes and economic headwinds in the freight and industrial sectors.

Out of FedEx’s recent announcements, the separation of FedEx Freight by June 2026 stands out as the most relevant in light of the company’s transformation agenda. This structural change, together with ongoing capital raising, reflects the multifaceted efforts to reposition the business for long-term value creation, though execution risk remains a key point for investors to monitor.

By contrast, investors should also be aware of how execution risk in large-scale restructuring initiatives can…

Read the full narrative on FedEx (it's free!)

FedEx's narrative projects $96.5 billion in revenue and $5.9 billion in earnings by 2028. This outlook requires 3.2% annual revenue growth and a $2.0 billion increase in earnings from the current $3.9 billion level.

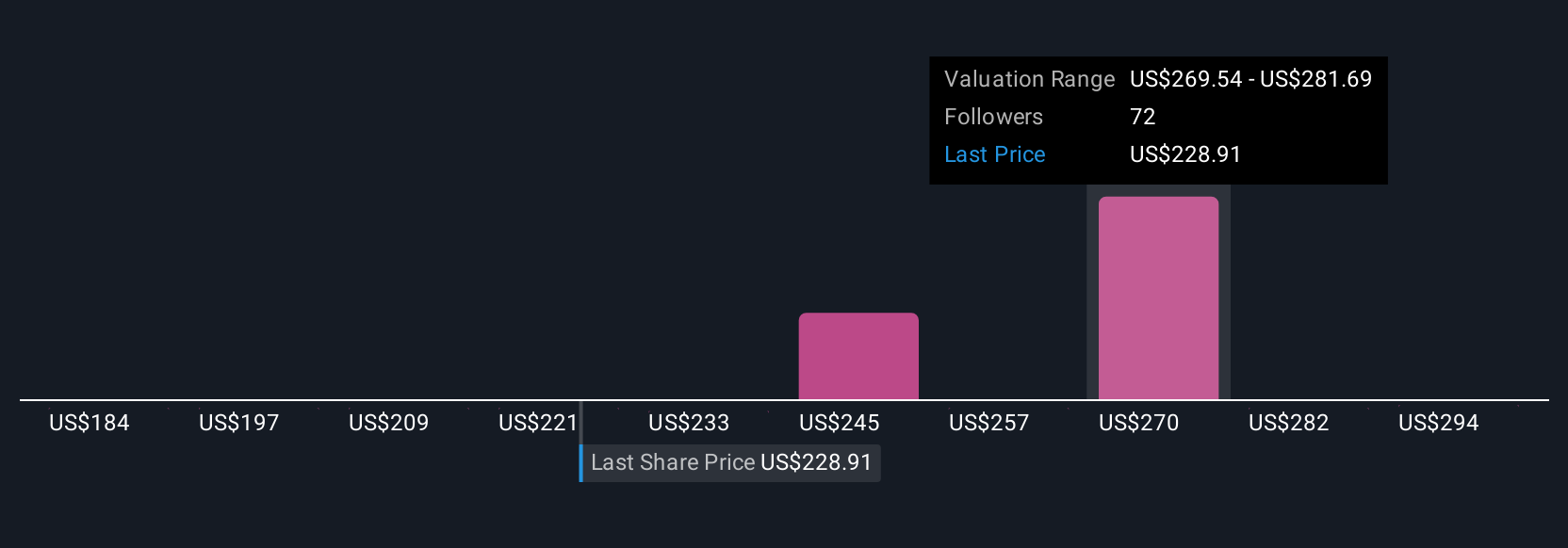

Uncover how FedEx's forecasts yield a $277.75 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Ten members of the Simply Wall St Community estimate FedEx’s fair value between US$211.92 and US$406.50. While many are focused on cost-saving catalysts and restructuring, execution challenges could have broader impacts on future performance, so explore a range of views before deciding.

Build Your Own FedEx Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FedEx research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FedEx research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FedEx's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDX

FedEx

Provides transportation, e-commerce, and business services in the United States and internationally.

Undervalued established dividend payer.

Market Insights

Community Narratives