- United States

- /

- Airlines

- /

- NYSE:DAL

Delta Air Lines (NYSE:DAL) Shares Drop 14% As Sales And Profit Guidance Reduced

Reviewed by Simply Wall St

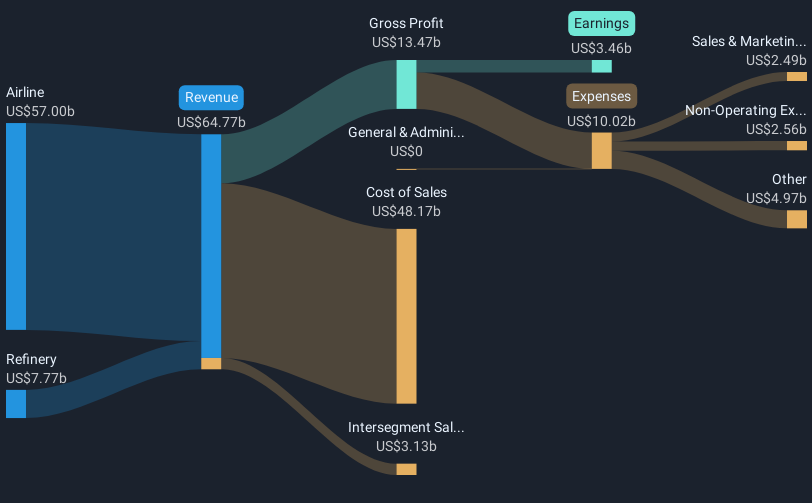

Delta Air Lines (NYSE:DAL) recently announced a partnership with JetZero to develop a more fuel-efficient aircraft, reflecting its focus on sustainability and innovation. However, the company's shares fell 13.89% over the past week amid broader market downturns and specific challenges. Notably, a federal lawsuit concerning a crash landing at Toronto Pearson International Airport places legal and reputational pressures on Delta. Furthermore, airline stocks, including Delta, were adversely affected by the company's reduced sales and profit guidance amidst economic uncertainty impacting travel demand. The market as a whole faced volatility with a 4.6% decline due to heightened concerns over tariffs announced by the Trump administration, which added to the negative sentiment. These combined factors contributed to Delta's significant share price drop, despite market enthusiasm over its innovative aircraft development partnership with JetZero.

Dig deeper into the specifics of Delta Air Lines here with our thorough analysis report.

Over the last three years, Delta Air Lines has achieved a total shareholder return of 59.79%. During the year, the company has outpaced the US market, which returned 8.8%, and matched the US Airlines industry's 17% return. Key factors influencing this performance include Delta’s value proposition, trading at good value compared to peers with a Price-To-Earnings Ratio of 9.3x, under the industry average of 10.2x. Additionally, despite a 25% decline in earnings growth last year, Delta's long-term earnings have grown significantly by 49.8% per year over five years.

Delta’s innovative collaboration with JetZero in the sustainable aircraft project, aligned with its net-zero emissions target for 2050, underscores its commitment to leadership in sustainability. However, challenges such as legal pressures from a lawsuit about a crash landing in Toronto and its recent revenue and profit declines continue to impact performance. These events, coupled with strategic alliances like the deal with Riyadh Air, reflect Delta's efforts to sustain growth amidst a dynamic market landscape.

- Get the full picture of Delta Air Lines' valuation metrics and investment prospects—click to explore.

- Understand the uncertainties surrounding Delta Air Lines' market positioning with our detailed risk analysis report.

- Shareholder in Delta Air Lines? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAL

Delta Air Lines

Provides scheduled air transportation for passengers and cargo in the United States and internationally.

Very undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives