- United States

- /

- Airlines

- /

- NYSE:DAL

Delta Air Lines (NYSE:DAL) Dips 11% After Lawsuit Over Flight 4819 Incident

Reviewed by Simply Wall St

Delta Air Lines (NYSE:DAL) faced a challenging week with its share price declining by 11%. This can be attributed to the recent lawsuit filed against the company and its subsidiary, Endeavor Air, following the incident involving Delta Flight 4819, which overturned upon landing in Toronto. The allegation of negligence may have spurred investor concern regarding potential financial liabilities and reputational impact. This occurred despite the company's Board of Directors declaring a quarterly dividend of $0.15 per share, indicating a degree of financial stability. Meanwhile, the broader market experienced a 3% decline amid uncertainties about tariffs and economic health, yet Delta's sharper drop suggests factors specific to the company played a significant role. As major stock indices fluctuated, Delta's legal challenges emerged as a pivotal event impacting its shareholder returns, overshadowing the broader market dynamics and dividend news.

Get an in-depth perspective on Delta Air Lines's performance by reading our analysis here.

Over the three years leading to March 2025, Delta Air Lines' total shareholder return, combining share price appreciation and dividends, reached 78.36%. During the past year, Delta's performance surpassed the US Airlines industry, which saw a 28.3% return, and the broader US Market, which achieved a 13.1% return. Among the drivers of Delta's longer-term performance was the company's consistent dividend policy, with increases and affirmations occurring multiple times, such as the 50% dividend hike in June 2024. Additionally, Delta's strategic alliances, like the cooperation agreement with Riyadh Air in July 2024, played a role in strengthening its market position and connectivity.

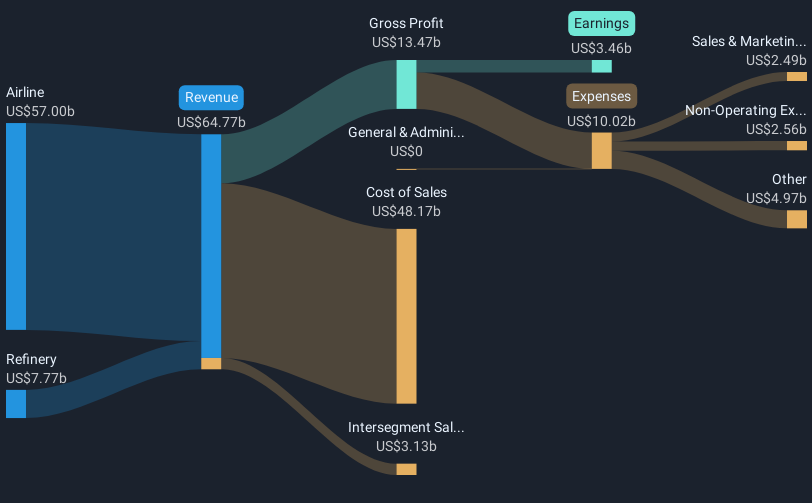

Moreover, earning announcements highlighted revenue growth in some quarters, such as the increase to US$15.68 billion in Q3 2024, although net income during some periods, like Q4 2024, declined to $843 million from the previous year. Despite challenges, including recent legal issues and changes in leadership, Delta's ability to maintain good value, suggested by its trading below estimated fair value and competitive price-to-earnings ratio, provided attractive investment prospects for some shareholders.

- See how Delta Air Lines measures up with our analysis of its intrinsic value versus market price.

- Analyze the downside risks for Delta Air Lines and understand their potential impact—click to learn more.

- Invested in Delta Air Lines? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAL

Delta Air Lines

Provides scheduled air transportation for passengers and cargo in the United States and internationally.

Very undervalued second-rate dividend payer.