- United States

- /

- Airlines

- /

- NYSE:DAL

Delta Air Lines (DAL): Assessing Valuation After a 15% Share Price Climb and Strong Three-Year Returns

Reviewed by Simply Wall St

Delta Air Lines (DAL) has quietly outperformed many travel stocks over the past month, gaining around 15%, as investors reassess the carrier’s earnings power and valuation heading into the busy holiday travel season.

See our latest analysis for Delta Air Lines.

The recent 15.4% 1 month share price return has pushed Delta closer to its 69.81 dollar level highs for the year. That momentum builds on a three year total shareholder return of about 116.7%, suggesting investors are warming to its earnings recovery story.

If you are watching airlines regain altitude, it can be worth seeing what else is taking off in transport and travel linked names via aerospace and defense stocks.

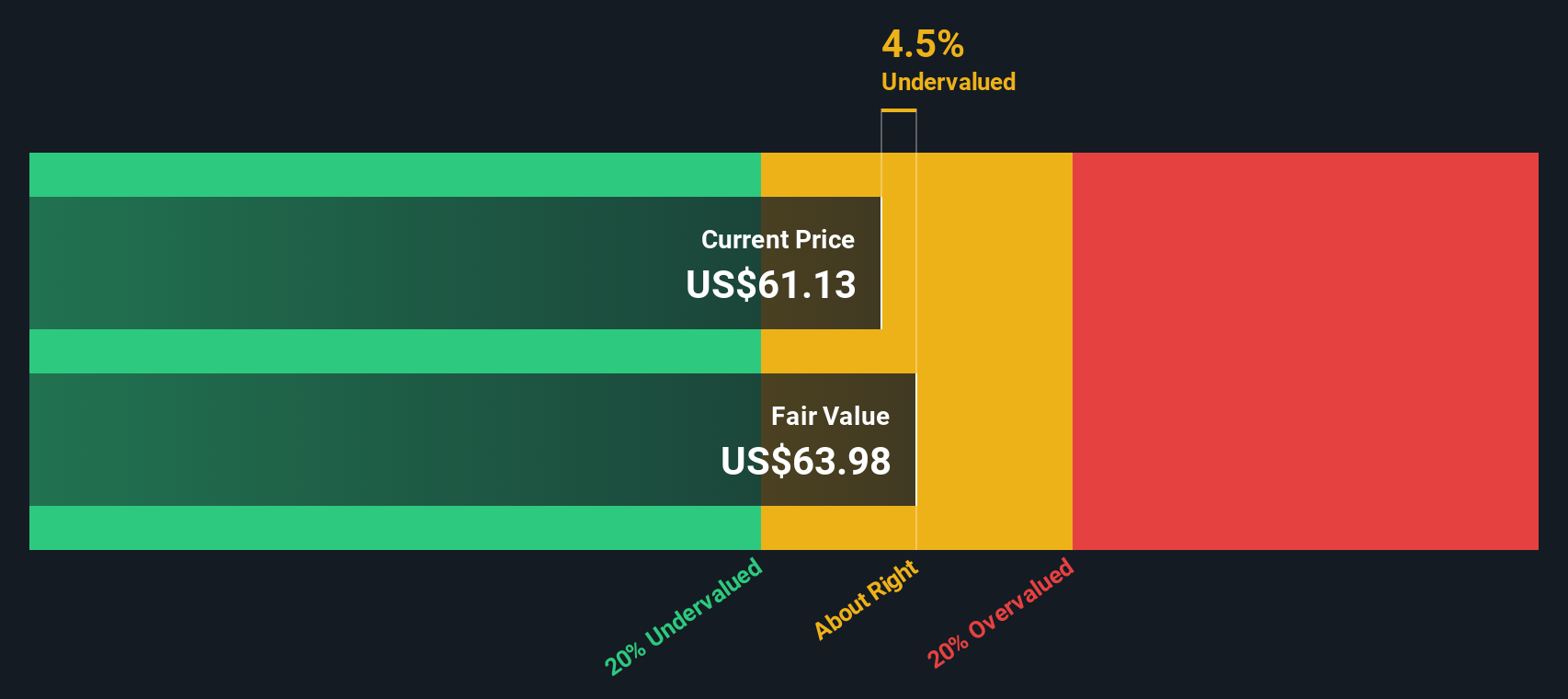

With shares hovering near yearly highs yet still trading at a sizable intrinsic discount, investors face a key question: Is Delta still underappreciated by the market, or are future gains already fully priced in?

Most Popular Narrative Narrative: 16.7% Overvalued

With Delta closing at 69.81 dollars, the most closely followed narrative pegs fair value lower, framing recent share strength as running ahead of fundamentals.

With any meaningful capacity expansion cancelled for the time being, DAL protects its average load factor and thus its yield, which is outstanding for a legacy carrier in a cut throat competition market such as air travel in the US, while roughly maintaining its market share. Yet, with its early warning about waning travel demand in March, my original assumptions in February regarding revenue growth and future PE had to be revised downwards from 4 to 2 per cent p.a. and 12, respectively, resulting in a fair value of about $53.50 a share.

According to PittTheYounger, this valuation leans heavily on disciplined margins, cooler growth and a reset profit multiple. Curious which assumptions really drive that gap?

Result: Fair Value of $59.84 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer travel demand or a renewed trade war hitting transatlantic routes could quickly pressure Delta’s thin margins and challenge this overvaluation narrative.

Find out about the key risks to this Delta Air Lines narrative.

Another View: Deep Discount on Fundamental Value

While the popular narrative calls Delta around 16.7% overvalued, our DCF model paints a very different picture, suggesting fair value near 140.98 dollars, roughly double the current 69.81 dollars price. That kind of gap hints at either a real bargain or serious skepticism about long term cash flows. Which do you believe?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Delta Air Lines Narrative

If our take does not quite fit your view, you can dig into the numbers yourself and craft a personalized thesis in minutes, Do it your way.

A great starting point for your Delta Air Lines research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at one opportunity. Use the Simply Wall St Screener to uncover fresh ideas before the crowd rushes in and prices move.

- Capitalize on mispriced opportunities by scanning these 903 undervalued stocks based on cash flows that the market may be overlooking despite strong cash flow potential.

- Tap into long-term structural changes by evaluating these 26 AI penny stocks positioned within the artificial intelligence ecosystem.

- Enhance your income strategy by identifying these 13 dividend stocks with yields > 3% that can support a long term, yield focused portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAL

Delta Air Lines

Provides scheduled air transportation for passengers and cargo in the United States and internationally.

Good value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)