- United States

- /

- Airlines

- /

- NYSE:CPA

The Bull Case For Copa Holdings (CPA) Could Change Following September Load Factor Improvement and Passenger Growth

Reviewed by Sasha Jovanovic

- Copa Holdings, S.A. recently reported preliminary consolidated traffic results for September 2025, with available seat miles reaching 2,628.2 million and revenue passenger miles totaling 2,283.1 million, both showing year-over-year growth.

- This announcement highlights a meaningful improvement in load factor to 86.9%, suggesting stronger passenger demand and operational efficiency compared to the same period last year.

- We’ll explore how this uptick in load factor may influence Copa’s investment narrative and long-term growth outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Copa Holdings Investment Narrative Recap

To believe in Copa Holdings as a shareholder, you need confidence in the company’s ability to drive sustained traffic and load factor growth while controlling costs, especially amid yield pressures in Latin American aviation. The latest uptick in load factor signals healthy demand and efficient capacity management, but it doesn’t fundamentally alter the company’s most pressing near-term catalyst, continued route and hub expansion, or its biggest risk, which remains margin erosion from competitive and yield pressures.

Among recent announcements, the ongoing series of quarterly dividends, with the most recent at US$1.61 per share, stands out as the most relevant. Strong and steady operational performance, as indicated in September’s preliminary results, supports this level of shareholder return, reinforcing management’s current confidence in Copa’s cash generation and financial health as it invests in future network growth and efficiency initiatives.

However, while operational momentum is encouraging, investors should also keep an eye on the risk of prolonged pricing pressure and what it could mean for Copa’s future profitability if...

Read the full narrative on Copa Holdings (it's free!)

Copa Holdings' narrative projects $4.4 billion in revenue and $855.0 million in earnings by 2028. This requires 8.4% yearly revenue growth and a $217.5 million earnings increase from $637.5 million today.

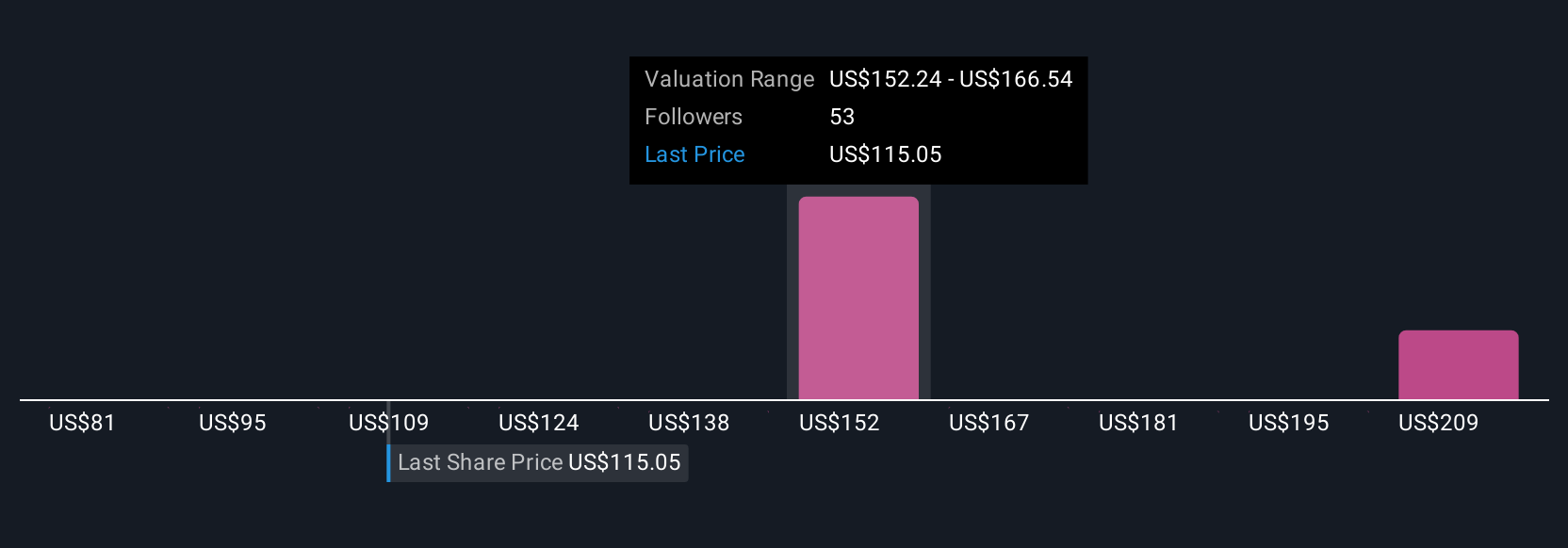

Uncover how Copa Holdings' forecasts yield a $154.20 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair value estimates between US$32.20 and US$154.20 across nine unique perspectives. Despite strong operational data, many highlight ongoing yield and margin risks that could affect the company’s returns over time; explore these viewpoints to see how your outlook compares.

Explore 9 other fair value estimates on Copa Holdings - why the stock might be worth less than half the current price!

Build Your Own Copa Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Copa Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Copa Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Copa Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPA

Copa Holdings

Through its subsidiaries, provides airline passenger and cargo transport services.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives