- United States

- /

- Airlines

- /

- NYSE:CPA

Should Strong Profitability and Rising Demand Prompt Action From Copa Holdings (CPA) Investors?

Reviewed by Sasha Jovanovic

- Copa Holdings recently attracted investor attention with forecasts for a 15.43% year-over-year rise in earnings per share and a 7.25% increase in quarterly revenue ahead of its past earnings announcement.

- The airline stands out for its industry-leading 25% return on equity and has reported net income growth of 59% over the last five years, well above sector averages.

- We’ll explore how Copa Holdings’ robust profitability and growing passenger demand could influence its long-term investment case.

Find companies with promising cash flow potential yet trading below their fair value.

Copa Holdings Investment Narrative Recap

To be a shareholder in Copa Holdings, you have to believe that the company’s disciplined cost structure, resilient hub-based network, and consistent profitability will help it sustain growth amid fluctuating Latin American airline demand. The recent news of stronger-than-expected EPS and revenue forecasts may reinforce investor focus on Copa’s operating momentum, but it does not materially shift the key short-term catalyst: passenger yield stabilization in the face of mounting competition and cost pressures, while ongoing yield declines remain the biggest risk.

Among recent announcements, Copa's August operating results stand out: capacity was up 5.8% and revenue passenger miles increased nearly 10% year-over-year, lifting load factor to 88.3%. These figures support optimism around demand trends and capacity utilization, both of which are critical to offsetting risks from weaker yields and maintaining profitability momentum for upcoming quarters.

But despite the encouraging outlook, investors should pay close attention to how continued downward pressure on yields could eventually undermine Copa’s long-term revenue growth if...

Read the full narrative on Copa Holdings (it's free!)

Copa Holdings' narrative projects $4.4 billion revenue and $855.0 million earnings by 2028. This requires 8.4% yearly revenue growth and a $217.5 million earnings increase from $637.5 million currently.

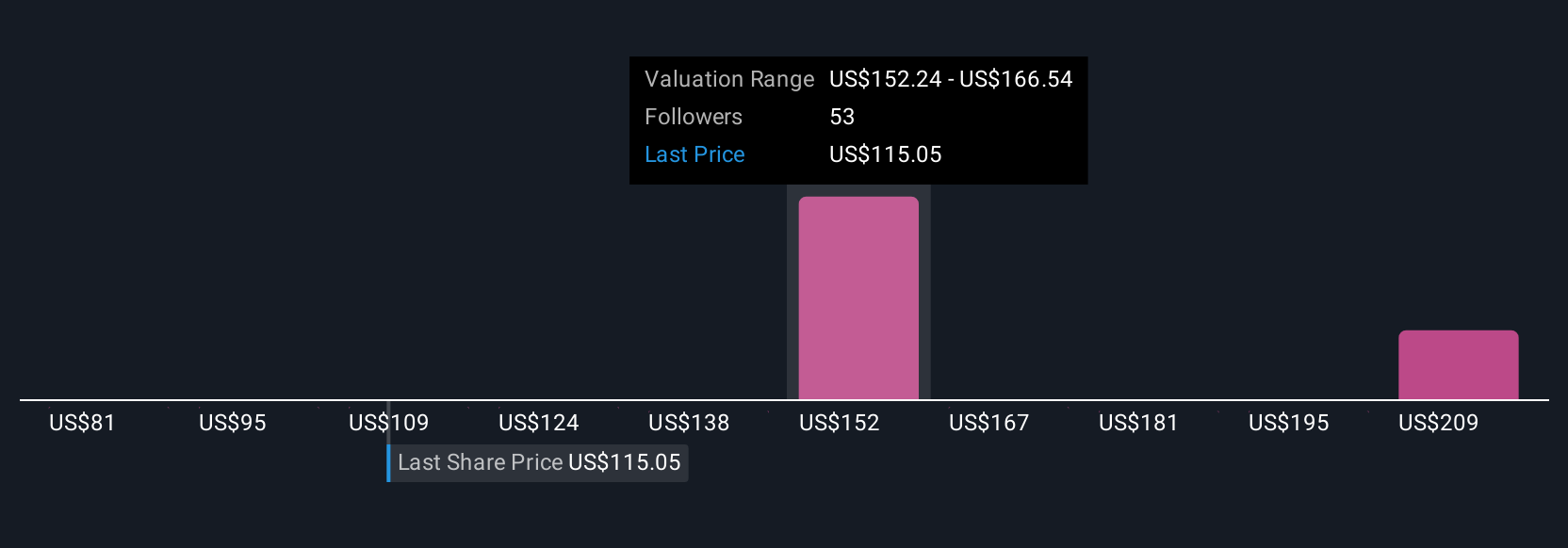

Uncover how Copa Holdings' forecasts yield a $154.20 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provide nine fair value estimates for Copa Holdings ranging from US$43 to US$154. Some see upside potential, but ongoing yield declines and strong competition may still weigh on future results. Explore these varied outlooks and see which best aligns with your own perspective.

Explore 9 other fair value estimates on Copa Holdings - why the stock might be worth less than half the current price!

Build Your Own Copa Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Copa Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Copa Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Copa Holdings' overall financial health at a glance.

No Opportunity In Copa Holdings?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPA

Copa Holdings

Through its subsidiaries, provides airline passenger and cargo transport services.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives