- United States

- /

- Airlines

- /

- NYSE:CPA

Copa Holdings (NYSE:CPA) Valuation: Gauging 2025 Upside as Traffic and Travel Demand Strengthen

Reviewed by Kshitija Bhandaru

Investors are watching Copa Holdings (NYSE:CPA) as new data shows growing air travel demand and improved August 2025 traffic figures across the sector. With earnings approaching, expectations are focused on higher revenue and profits.

See our latest analysis for Copa Holdings.

Copa Holdings’ share price has climbed alongside industry optimism, supported by strong August traffic figures and lower fuel costs that have improved the outlook for airline stocks. The stock’s 1-year total shareholder return of 35% reflects solid progress, especially as recent momentum suggests renewed enthusiasm compared to earlier this year.

If growing travel demand has you looking for your next opportunity, consider broadening your search and discover fast growing stocks with high insider ownership

With Copa Holdings trading near recent highs and analyst targets still signaling upside, investors may wonder if strong earnings and industry momentum indicate there is more room to run or if the market has already priced in continued growth.

Most Popular Narrative: 22% Undervalued

Analyst consensus points to significant upside, with a narrative fair value notably above Copa Holdings’ last close. Momentum goes hand in hand with expectations for network expansion, technological upgrades, and disciplined cost controls.

Strategic network expansion, digitalization, and disciplined cost management position Copa for long-term revenue growth and operational resilience in a competitive market. Strong financial flexibility and developing partnerships support investment in innovation and access to underserved markets, diversifying and sustaining future earnings.

Curious how Copa’s multiple revenue pillars all play into that bullish price? The narrative focuses on standout forecasts for growth, margins, and fleet efficiency. Want to see exactly which financial levers drive the fair value call and why analysts believe it could break out from here? The answers are in the full narrative.

Result: Fair Value of $154.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. Sustained competition or unexpected disruptions at the Panama hub could pressure Copa's margins and challenge its projected growth.

Find out about the key risks to this Copa Holdings narrative.

Another View: Discounted Cash Flow Perspective

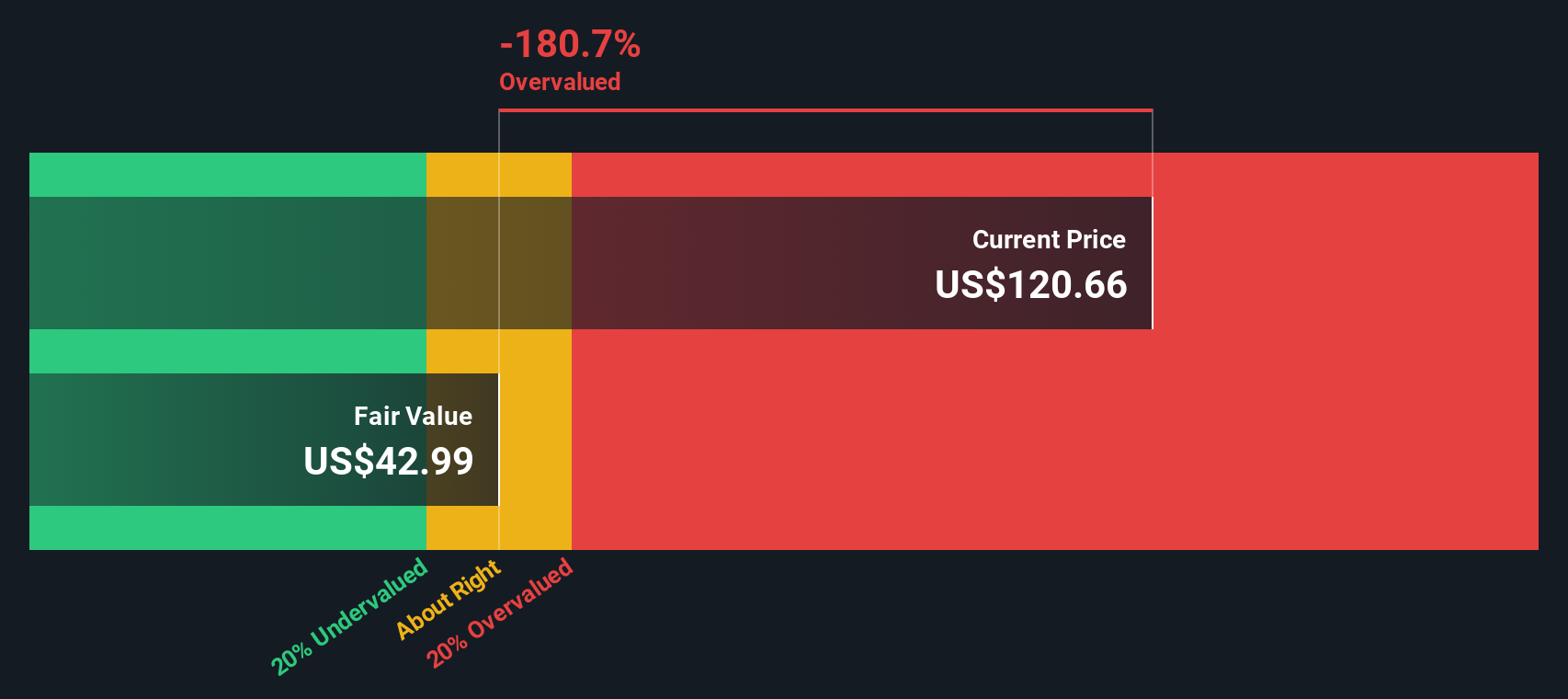

While analysts are bullish based on future earnings and price targets, the SWS DCF model offers a much more conservative lens. According to this approach, Copa Holdings appears overvalued, with a fair value of $43.27, which is far below its current share price. Is the market simply more optimistic, or are there hidden risks baked in?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Copa Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Copa Holdings Narrative

If you see the story differently or prefer to dig into the numbers yourself, it takes less than three minutes to shape your own perspective and Do it your way

A great starting point for your Copa Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit yourself; there are high-potential opportunities waiting beyond Copa Holdings. Take charge of your research with these handpicked ways to expand your strategy:

- Unlock yield potential and steady passive income by evaluating these 19 dividend stocks with yields > 3% boasting attractive dividend returns above 3%.

- Capitalize on advancements in medicine by checking out these 31 healthcare AI stocks with breakthroughs at the intersection of healthcare and artificial intelligence.

- Be among the first to tap into rising tech by tracking these 24 AI penny stocks that are pioneering artificial intelligence transformations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPA

Copa Holdings

Through its subsidiaries, provides airline passenger and cargo transport services.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives