- United States

- /

- Airlines

- /

- NYSE:ALK

Alaska Air Group (ALK): Examining Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

See our latest analysis for Alaska Air Group.

After strong total shareholder gains over the past several years, Alaska Air Group’s share price has pulled back sharply this month, reflecting shifting sentiment as travel demand and operational costs fluctuate. Investors have seen momentum waver, but the 1-year total shareholder return of 5.8% still outpaces the recent 1-month share price fall of 25.5%.

If you’re keen on discovering other opportunities outside of airlines, this could be a great moment to broaden your search and uncover fast growing stocks with high insider ownership

With shares sitting well below analyst price targets and solid revenue and net income growth showing through, investors are left to wonder if Alaska Air Group is an overlooked bargain or if the market has already accounted for the next chapter of its growth story.

Most Popular Narrative: 32.5% Undervalued

Alaska Air Group’s latest fair value estimate from the most popular narrative stands at $69.93, giving it a significant premium to the recent closing price of $47.22. This large gap highlights the market’s skepticism compared to a more optimistic consensus on future prospects.

The expansion and optimization of the Seattle international gateway, including new long-haul routes and a growing fleet of Boeing 787s, positions Alaska Air Group to benefit from sustained urban growth and increasing travel demand in West Coast cities. This is anticipated to drive higher passenger volumes and top-line revenue growth. The successful integration of Hawaiian Airlines and realization of synergy initiatives, particularly in network connectivity and premium offerings, are unlocking incremental profit, enhancing operational efficiency, and supporting margin expansion throughout the next several years.

Just what growth projections justify such a sharp upside? There are bold numbers behind this price, including ambitious profit margins and a dramatic increase in earnings power. Think you know what’s powering this valuation? The full narrative breaks down the financial leaps analysts are betting on. Find out what might spark the next big move.

Result: Fair Value of $69.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation or integration challenges from the Hawaiian acquisition could quickly shift sentiment. This could put pressure on growth expectations and limit valuation upside.

Find out about the key risks to this Alaska Air Group narrative.

Another View: What Does the SWS DCF Model Show?

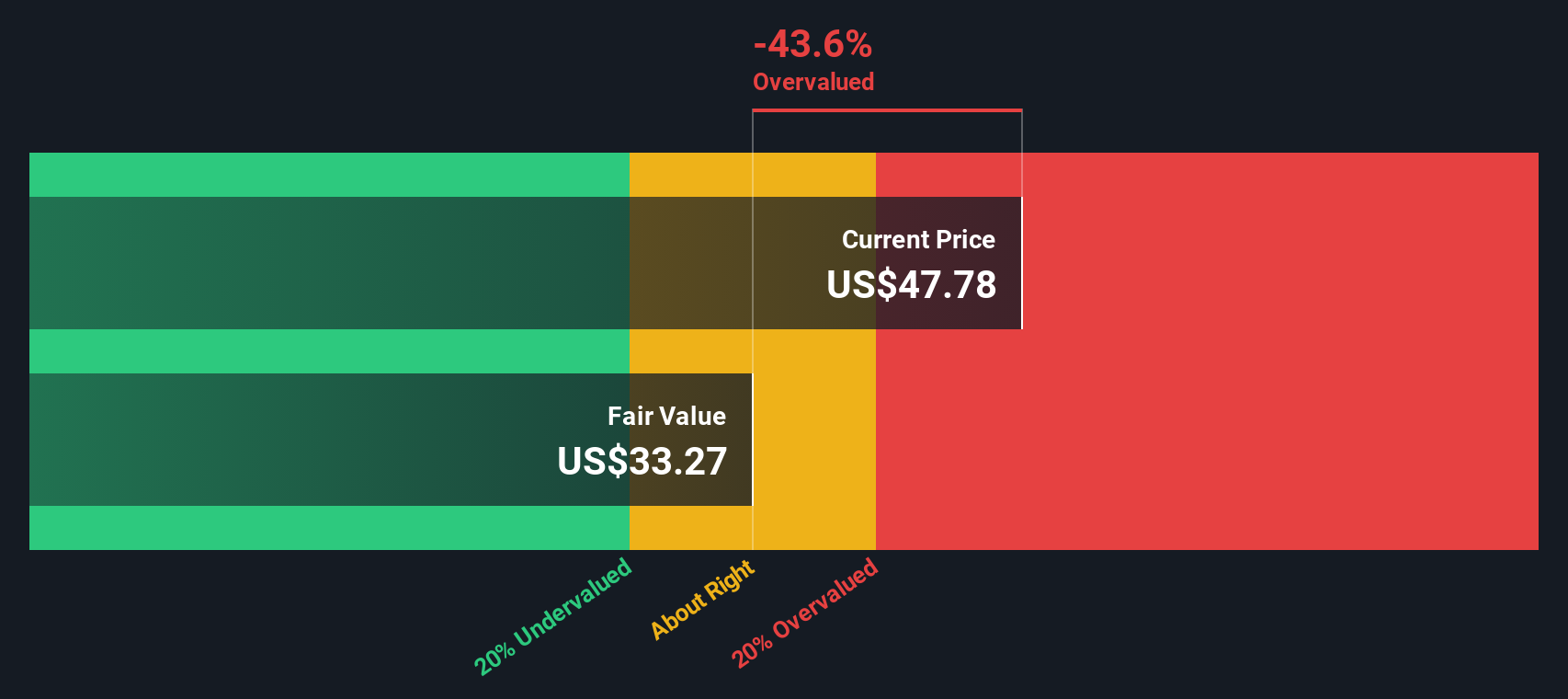

While the most popular narrative suggests Alaska Air Group is meaningfully undervalued, our SWS DCF model paints a more cautious picture, estimating fair value at just $33.43 per share. This is well below the current market price. Could the optimistic forecasts be overlooking underlying risks, or does the market see a different future?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alaska Air Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alaska Air Group Narrative

If you see things differently or want to test your own perspective, you can dive into the company data and shape a custom narrative in just minutes. Do it your way

A great starting point for your Alaska Air Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your investing strategy to the next level by reviewing handpicked opportunities you won’t want to overlook. The next winning stock might be just a click away.

- Secure higher income streams and access these 19 dividend stocks with yields > 3%, which features companies with robust dividend yields and steady payouts.

- Tap into the AI surge and see which innovators are delivering rapid user growth among these 24 AI penny stocks, making headlines this year.

- Catch bargain opportunities by evaluating these 892 undervalued stocks based on cash flows, trading well below their intrinsic value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALK

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives