- United States

- /

- Marine and Shipping

- /

- NasdaqCM:USEA

United Maritime Corporation's (NASDAQ:USEA) Subdued P/S Might Signal An Opportunity

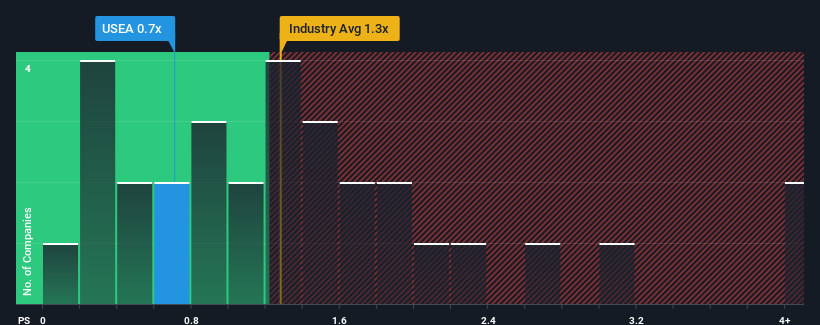

When close to half the companies operating in the Shipping industry in the United States have price-to-sales ratios (or "P/S") above 1.3x, you may consider United Maritime Corporation (NASDAQ:USEA) as an attractive investment with its 0.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for United Maritime

How United Maritime Has Been Performing

United Maritime certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on United Maritime will help you shine a light on its historical performance.How Is United Maritime's Revenue Growth Trending?

In order to justify its P/S ratio, United Maritime would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 45% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to decline by 3.2% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's quite peculiar that United Maritime's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at the figures, it's surprising to see United Maritime currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. We think potential risks might be placing significant pressure on the P/S ratio and share price. Amidst challenging industry conditions, perhaps a key concern is whether the company can sustain its superior revenue growth trajectory. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

It is also worth noting that we have found 5 warning signs for United Maritime that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:USEA

United Maritime

A shipping company, offers seaborne transportation services worldwide.

Low and slightly overvalued.

Market Insights

Community Narratives