- United States

- /

- Airlines

- /

- NasdaqGS:ULCC

Will Analyst Upgrades and Promotions Help ULCC Strengthen Its Competitive Position After Spirit's Bankruptcy?

Reviewed by Sasha Jovanovic

- In recent days, Frontier Group Holdings saw a shift in analyst sentiment, including an upgrade from Deutsche Bank citing possible advantages from Spirit Airlines’ bankruptcy, while Seaport Global initiated coverage with a neutral outlook due to significant debt and ongoing negative EBITDA.

- Amid these financial pressures, Frontier also introduced promotional sales and loyalty program improvements aiming to shore up customer engagement and position the airline more competitively during a challenging quarter.

- With analyst upgrades highlighting potential benefits from a competitor’s bankruptcy, we’ll consider how this affects Frontier’s future growth and profitability expectations.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Frontier Group Holdings Investment Narrative Recap

To be a Frontier Group Holdings shareholder, you need to believe that industry-wide capacity reductions and shifting demand in leisure markets can help Frontier overcome revenue and margin headwinds, even as rising costs and overcapacity linger. The recent upgrade by Deutsche Bank, driven by Spirit Airlines’ bankruptcy, may provide a short-term tailwind, but persistent negative EBITDA and high debt remain the most important risks, potentially outweighing the upside if capacity normalization remains slow.

Among the latest company announcements, Frontier’s launch of new promotional sales and loyalty program enhancements is closely linked to near-term performance, with these efforts potentially increasing load factors and customer retention, key ingredients if the industry’s oversupply begins to ease. These steps could influence both future demand and profitability, given the backdrop of current market challenges and competitive cost pressures.

In contrast, investors also need to keep an eye on Frontier’s significant fixed costs from surplus staff and underutilized aircraft, especially if...

Read the full narrative on Frontier Group Holdings (it's free!)

Frontier Group Holdings' narrative projects $4.9 billion revenue and $253.9 million earnings by 2028. This requires 9.2% yearly revenue growth and a $287.9 million increase in earnings from -$34.0 million.

Uncover how Frontier Group Holdings' forecasts yield a $5.39 fair value, a 10% upside to its current price.

Exploring Other Perspectives

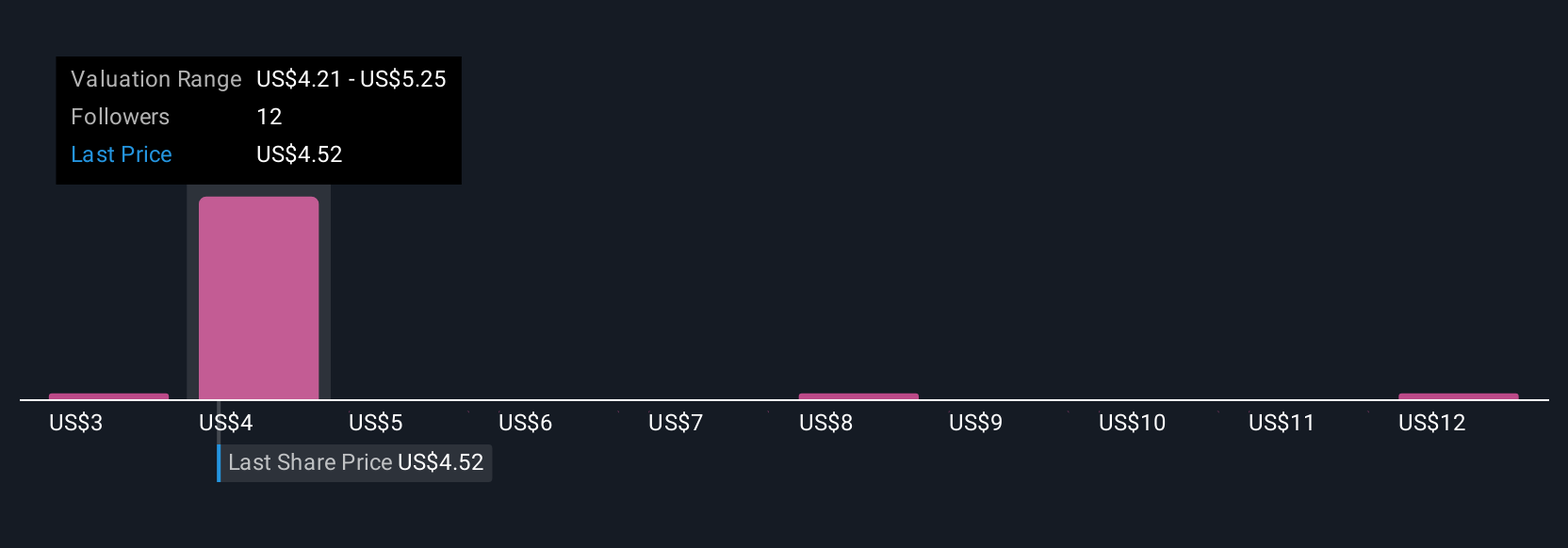

Four members of the Simply Wall St Community set fair value estimates for Frontier Group Holdings ranging from US$3.18 to US$13.52 per share. While some see higher potential, persistent negative EBITDA and high debt levels present ongoing questions for the coming quarters, so take time to review the spread of viewpoints.

Explore 4 other fair value estimates on Frontier Group Holdings - why the stock might be worth 35% less than the current price!

Build Your Own Frontier Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Frontier Group Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Frontier Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Frontier Group Holdings' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ULCC

Frontier Group Holdings

Provides low-fare passenger airline services to leisure travelers in the United States and Latin America.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives