- United States

- /

- Airlines

- /

- NasdaqGS:UAL

United Airlines Holdings (UAL) Expands Winter Schedule With New Flights to 15 Cities

Reviewed by Simply Wall St

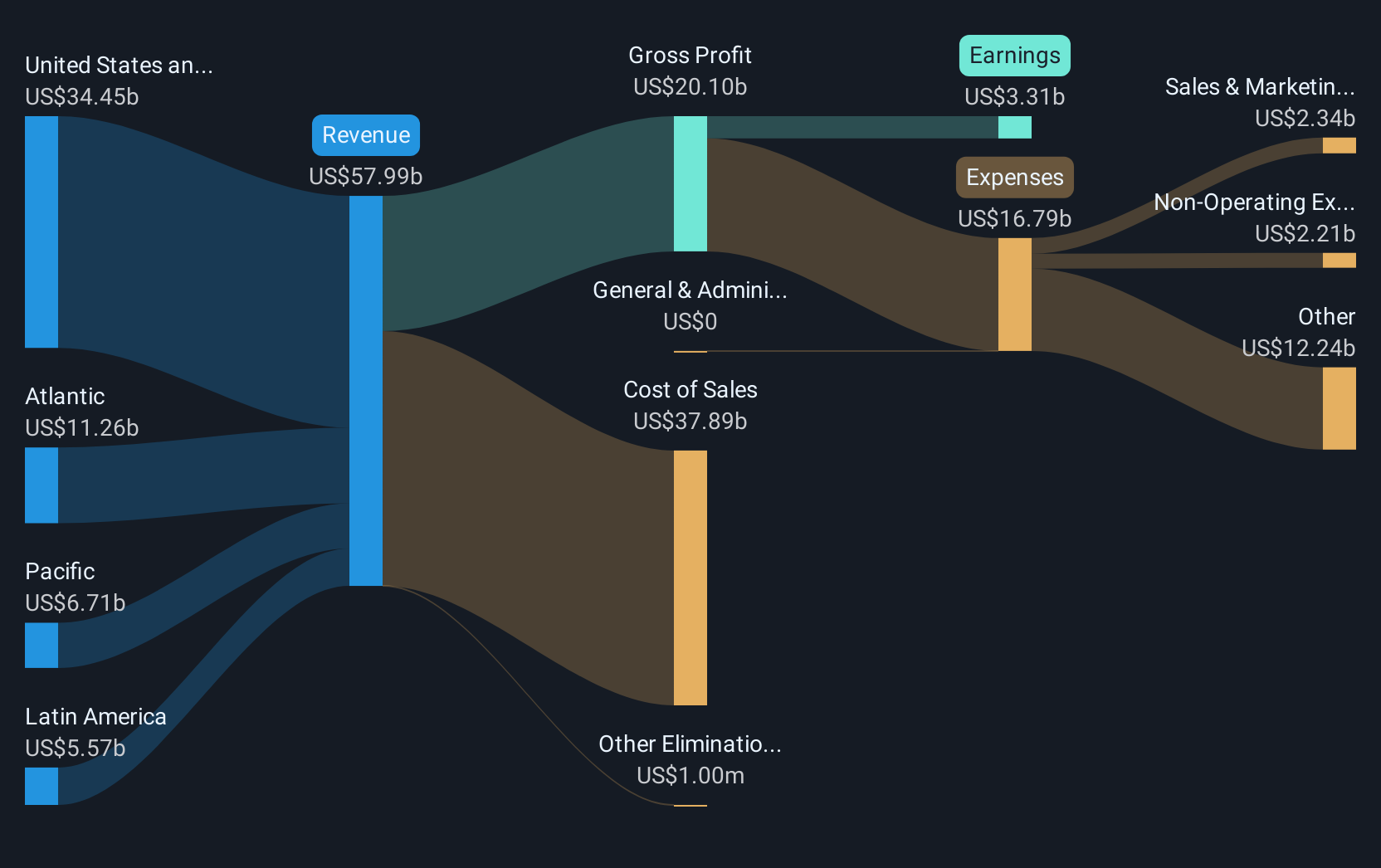

United Airlines Holdings (UAL) recently announced an expansion of its winter flight schedule, adding routes to 15 cities, set to commence in January 2026. This move coincided with a significant 32% rise in UAL's share price over the past quarter. During this period, UAL's financial updates revealed positive revenue growth but a decline in quarterly net income. The company's share repurchase program, along with its collaboration with JetBlue, likely added weight to the price rise. As the market has experienced overall gains in the past year, these developments may have amplified UAL's stock performance within the broader market context.

United Airlines Holdings' recent flight schedule expansion announcement, set for January 2026, supports its growth narrative centered around premium offerings and operational upgrades. These strategic moves could positively impact United's revenue and earnings forecasts by aligning with increasing global demand for air travel, especially in premium segments. This expansion complements United's ongoing modernization efforts and yields-focused strategies, potentially enhancing both customer satisfaction and financial performance.

Over the past five years, United Airlines has achieved a substantial total return of 194.64%, including share price and dividends. This long-term performance contextualizes its short-term fluctuations, showcasing resilience and growth capability amidst industry dynamics. In comparison, United's stock outperformed the US Airlines industry over the last year, as well as the broader US market, reflecting strong investor confidence in the company's strategic direction.

In terms of its recent price movement, United's shares, currently at US$106.16, are slightly below the consensus analyst price target of US$107.55. This minimal variance suggests that the company's valuation aligns closely with market expectations, reflecting analysts' forecasts of stable earnings growth and revenue expansion over the coming years. However, the competitive pressures and operational challenges outlined in the narrative remain key factors influencing these projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UAL

United Airlines Holdings

Through its subsidiaries, provides air transportation services in the United States, Canada, Atlantic, the Pacific, and Latin America.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives