- United States

- /

- Beverage

- /

- NasdaqGS:COCO

Discover 3 US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape shaped by new tariffs and Federal Reserve policies, investors are closely watching for growth opportunities amid mixed performances across major indices. In this environment, companies with high insider ownership can offer unique insights into potential growth prospects, as insiders often have a deep understanding of their company's long-term value and strategic direction.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 25.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Astera Labs (NasdaqGS:ALAB) | 16.1% | 64.3% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.3% | 33.8% |

| Ryan Specialty Holdings (NYSE:RYAN) | 15.8% | 43.9% |

| Zscaler (NasdaqGS:ZS) | 37.2% | 39.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Coastal Financial (NasdaqGS:CCB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Coastal Financial Corporation is the bank holding company for Coastal Community Bank, offering a range of banking products and services to small and medium-sized businesses, professionals, and individuals in Washington's Puget Sound region, with a market cap of approximately $1.29 billion.

Operations: The company's revenue is primarily derived from three segments: CCBX ($192.73 million), Community Bank ($78.94 million), and Treasury & Administration ($12.45 million).

Insider Ownership: 14.6%

Revenue Growth Forecast: 40.9% p.a.

Coastal Financial is trading at a significant discount to its estimated fair value, positioning it as an attractive growth opportunity. The company's earnings and revenue are forecast to grow substantially faster than the US market over the next three years, with expected annual profit growth of 49.2%. Recent financials show improved net interest income and net income year-over-year, despite increased net charge-offs. A recent equity offering raised US$85.2 million, potentially supporting further expansion initiatives.

- Click here and access our complete growth analysis report to understand the dynamics of Coastal Financial.

- According our valuation report, there's an indication that Coastal Financial's share price might be on the expensive side.

Vita Coco Company (NasdaqGS:COCO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Vita Coco Company, Inc. develops, markets, and distributes coconut water products under the Vita Coco brand across various regions including the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of approximately $2.23 billion.

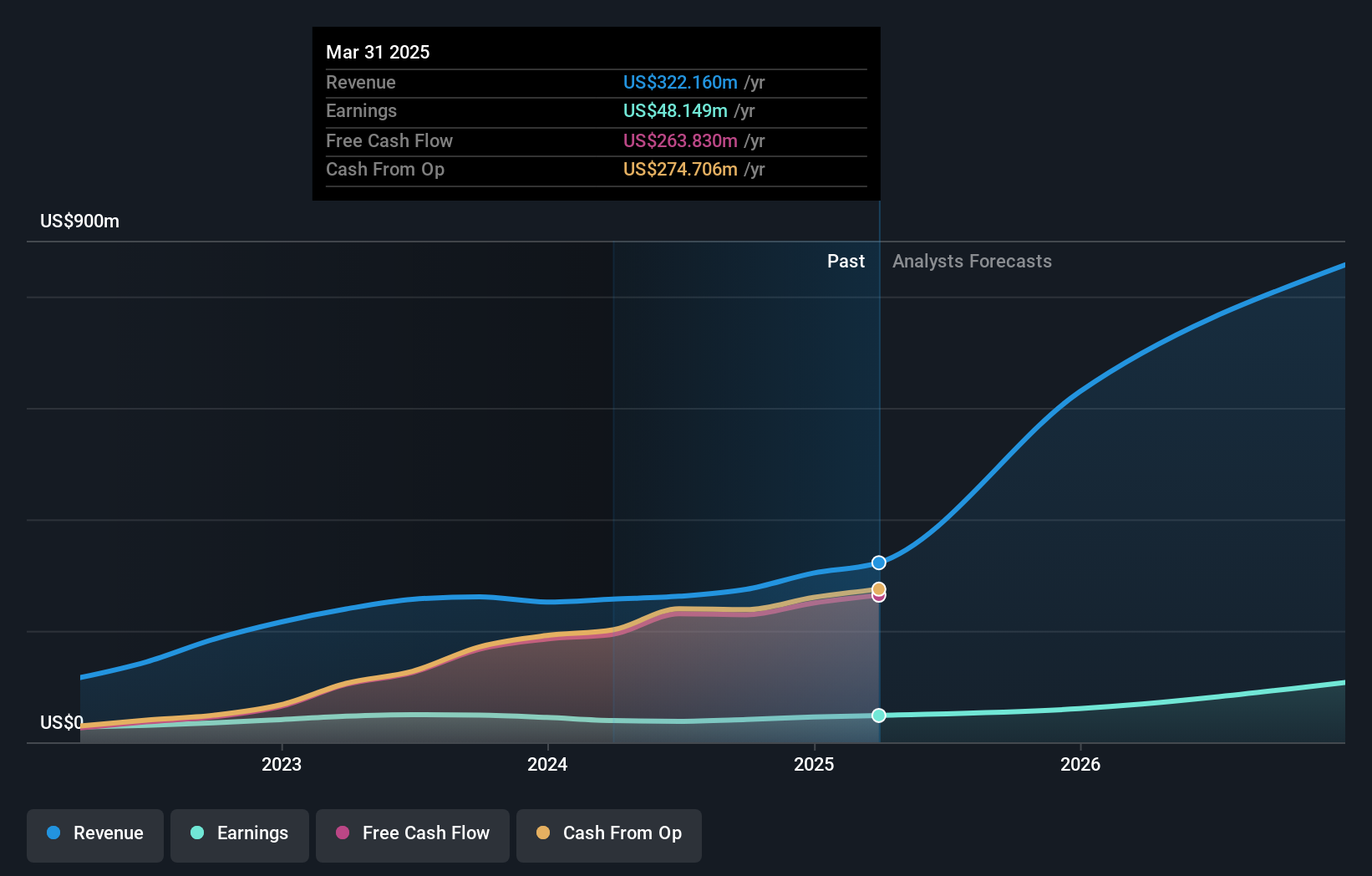

Operations: The company's revenue segments consist of $424.40 million from the Americas and $70.46 million from international markets.

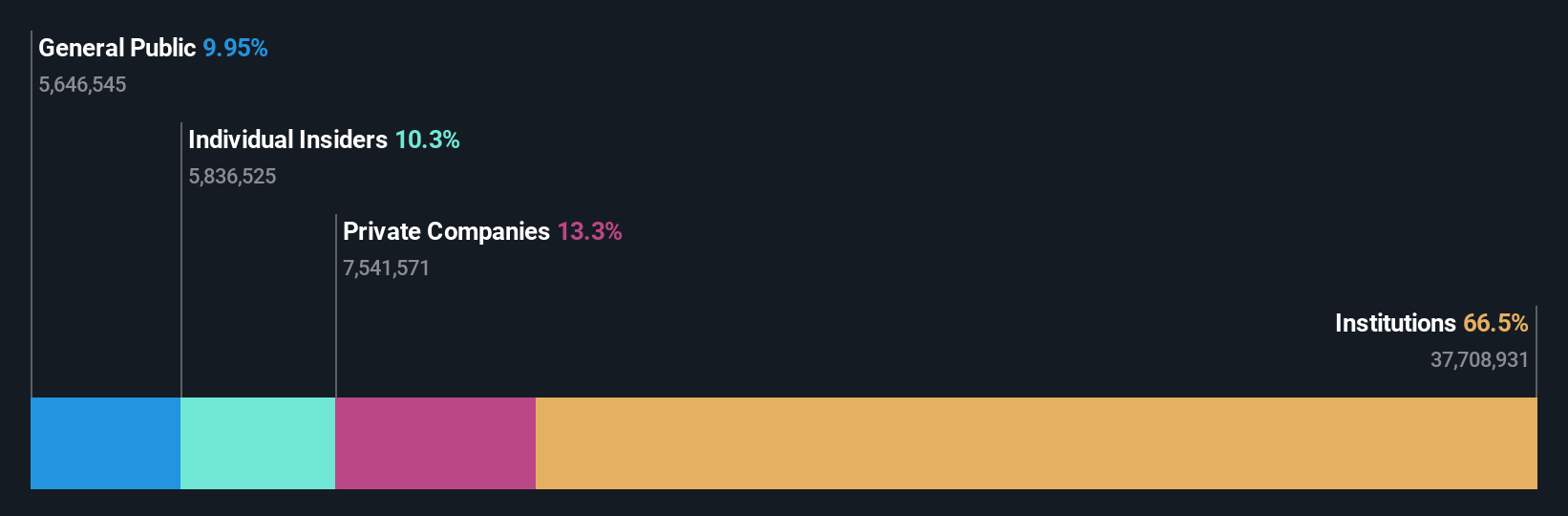

Insider Ownership: 10.9%

Revenue Growth Forecast: 10.9% p.a.

Vita Coco Company is trading at 31.2% below its estimated fair value, indicating potential growth prospects. Despite significant insider selling recently, the company expects its earnings to grow significantly over the next three years, outpacing the US market's average. While revenue growth is slower than 20% annually, it still surpasses the broader market's forecasted rate. Recent financial performance shows a substantial earnings increase of 60.2% year-over-year, highlighting strong operational momentum.

- Get an in-depth perspective on Vita Coco Company's performance by reading our analyst estimates report here.

- The analysis detailed in our Vita Coco Company valuation report hints at an deflated share price compared to its estimated value.

Proficient Auto Logistics (NasdaqGS:PAL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Proficient Auto Logistics, Inc. specializes in auto transportation and logistics services across North America with a market cap of $284.89 million.

Operations: Proficient Auto Logistics generates its revenue primarily from auto transportation and logistics services throughout North America.

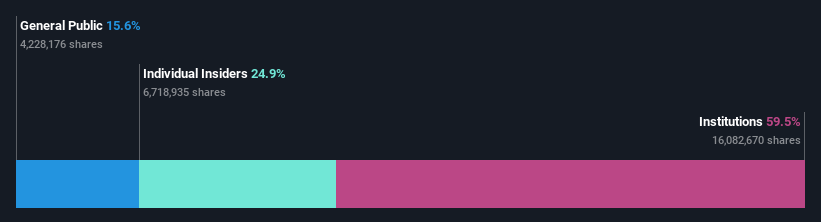

Insider Ownership: 25.1%

Revenue Growth Forecast: 33.6% p.a.

Proficient Auto Logistics is trading 68.4% below its estimated fair value, with insiders recently buying more shares than selling. The company forecasts annual revenue growth of 33.6%, significantly outpacing the US market, and anticipates becoming profitable within three years, exceeding average market growth rates. Despite a highly volatile share price recently, analysts expect a 45.7% stock price increase, suggesting potential for substantial returns if volatility stabilizes.

- Click to explore a detailed breakdown of our findings in Proficient Auto Logistics' earnings growth report.

- According our valuation report, there's an indication that Proficient Auto Logistics' share price might be on the cheaper side.

Seize The Opportunity

- Explore the 195 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COCO

Vita Coco Company

Develops, markets, and distributes coconut water products under the Vita Coco brand name in the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives