- United States

- /

- Transportation

- /

- NasdaqGS:ODFL

Old Dominion Freight Line (ODFL): Evaluating Valuation as Analyst Sentiment Softens and Freight Demand Weakens

Reviewed by Kshitija Bhandaru

Old Dominion Freight Line (ODFL) is navigating a tough stretch as revenue pressures mount. This is driven by ongoing geopolitical uncertainty, elevated inflation, and softer demand across the freight industry.

See our latest analysis for Old Dominion Freight Line.

Even with Old Dominion Freight Line’s ongoing efforts to navigate an uncertain freight market, the stock hasn’t found much momentum recently. The 1-year total shareholder return sits at -0.26%, highlighting a period of persistent headwinds. While the company’s financial stability remains a plus, momentum in the share price appears to be fading for now.

If you’re interested in broadening your search, now is a great time to see which other fast-moving companies boast both growth and strong insider conviction—discover fast growing stocks with high insider ownership

With the share price still lagging after a string of lowered analyst targets, the key question for investors is whether Old Dominion Freight Line is undervalued today or if the market has already anticipated any potential rebound.

Most Popular Narrative: 12.2% Undervalued

The most widely watched narrative points to a fair value estimate that sits about 12% higher than Old Dominion Freight Line’s last close. This raises a lively debate on whether the company’s current performance aligns with expectations for earnings and expansion ahead.

Continued investments in capacity through their capital expenditure plan, even amidst macroeconomic uncertainty, position Old Dominion to capture significant market share as the economy rebounds. This could potentially increase revenue. The company's dedication to superior service and disciplined yield management supports long-term market share gains and operational density improvements, which could enhance operating leverage and improve earnings.

How does a turbulent freight market and bold capital plans set up Old Dominion’s next act? One critical assumption powers this valuation: it revolves around ambitious improvements to margins and consistent profit strength. Curious which projected milestone tips the balance? Don’t miss the full breakdown behind this surprising fair value projection.

Result: Fair Value of $160.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in freight demand and rising overhead costs could easily derail Old Dominion's ambitious growth and margin assumptions.

Find out about the key risks to this Old Dominion Freight Line narrative.

Another View: Rethinking Valuation Through Market Ratios

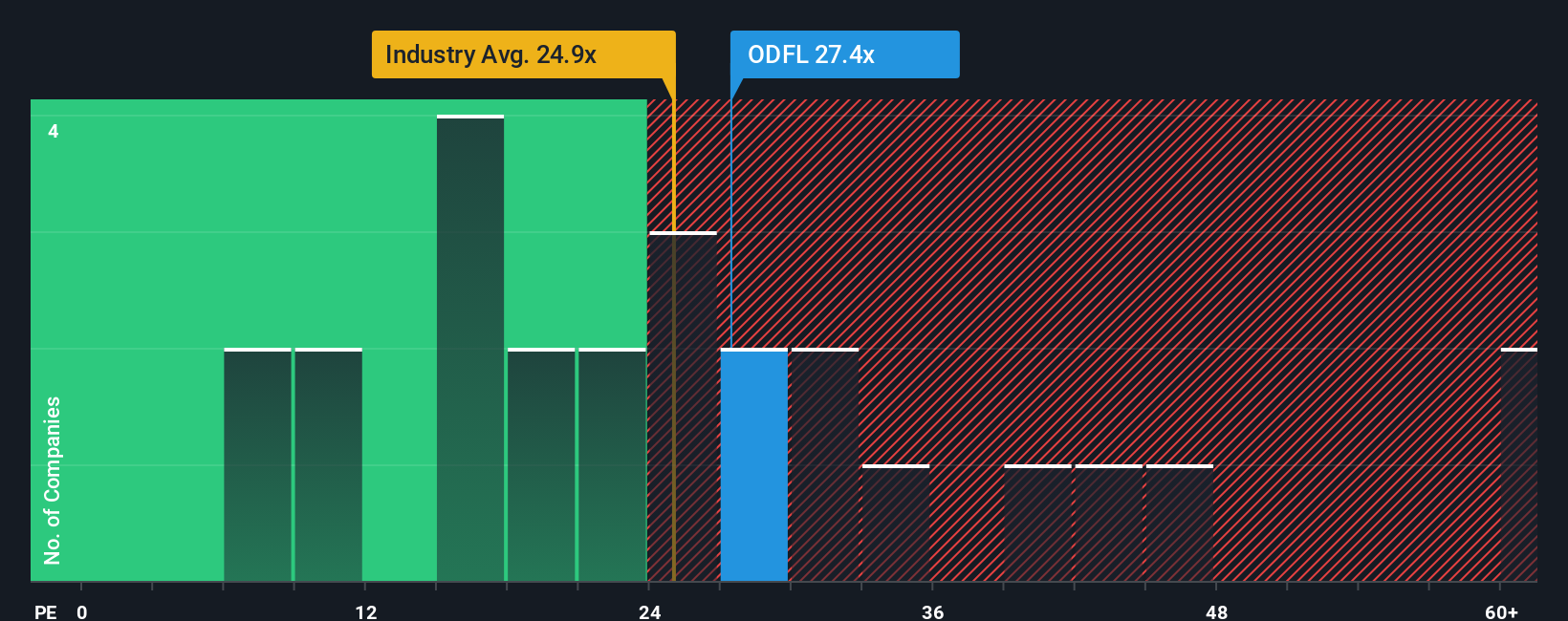

Looking from another angle, Old Dominion’s price-to-earnings ratio stands at 27x. That’s higher than the U.S. transportation industry average of 23.2x and well above its calculated fair ratio of 16x. This difference suggests investors may be paying a significant premium. Could sentiment or expectations be outpacing reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Old Dominion Freight Line Narrative

If these perspectives don’t match your own thinking, take a few minutes to dive into the numbers and form your own view. You can Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Old Dominion Freight Line.

Looking for more investment ideas?

Why settle for just one opportunity? Set yourself up for the next big win by checking top-performing stocks in sectors firing up global markets right now.

- Snag high yields for your portfolio with these 19 dividend stocks with yields > 3%. These stocks consistently deliver payouts above 3% and stand out for shareholder rewards.

- Capitalize on the AI surge by targeting these 24 AI penny stocks. These companies are set to disrupt everything from robotics to healthcare analytics.

- Step ahead of the crowd by searching for hidden bargains among these 909 undervalued stocks based on cash flows, which are primed for upside based on real cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ODFL

Old Dominion Freight Line

Operates as a less-than-truckload motor carrier in the United States and North America.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives