- United States

- /

- Transportation

- /

- NasdaqGS:LYFT

Engine Capital Targets Governance At Lyft (NasdaqGS:LYFT) As Shares Rise 8%

Reviewed by Simply Wall St

Lyft (NasdaqGS:LYFT) witnessed an 8% price increase last week amid heightened investor activism led by Engine Capital Management, which pressed for strategic and governance changes to tackle the company's declining stock performance. The demand for boardroom changes and nominations of two director candidates added momentum to the stock. This move stands out as the broader market experienced volatility with tech leaders like Tesla and Nvidia leading declines, while major indexes like the Nasdaq Composite saw a 1.9% drop. Despite a challenging market backdrop, Lyft's rising stock price underscores the influence of investor activism and possible strategic shifts.

Buy, Hold or Sell Lyft? View our complete analysis and fair value estimate and you decide.

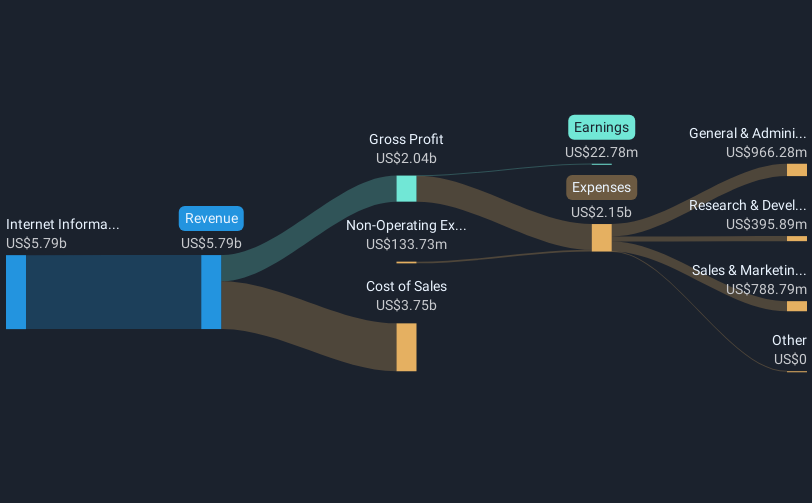

Over the past year, Lyft's total shareholder returns, including share price and dividends, saw a sharp decline of 36.37%. This performance notably lags behind the broader US Transportation industry, which experienced a 5.7% decline over the same period. Several factors seem pivotal in this downturn. Despite achieving profitability, as reflected in a net income of US$22.78 million for 2024, Lyft's overall revenue growth (9.7% per year) lagged behind market expectations. Furthermore, executive shake-ups, with the departure of President Kristin Sverchek in August 2024 and Chief Accounting Officer Lisa Blackwood-Kapral in March 2025, likely contributed to investor uncertainty.

The company's attempt to boost value through a US$500 million share repurchase program announced in February 2025 may not have immediately buoyed investor sentiment. Additionally, while partnerships with Mobileye to integrate autonomous vehicles and Cash App to enhance payment systems appeared promising, the market's reaction remained cautious, perhaps due to ongoing competitive pressures and governance challenges. These elements together paint a challenging year for Lyft within its sector.

Unlock comprehensive insights into our analysis of Lyft stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Lyft, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LYFT

Lyft

Operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives