- United States

- /

- Tobacco

- /

- NYSE:RLX

3 Promising Penny Stocks With Market Caps Under $4B

Reviewed by Simply Wall St

As February comes to a close, the U.S. stock market has experienced a mix of gains and losses, with major indexes posting declines for the month despite some positive inflation data. In this context, investors often seek opportunities in lesser-known areas of the market that might offer growth potential. Penny stocks, although an older term, still represent an intriguing investment avenue for those interested in smaller or newer companies with the possibility of strong financial health and long-term growth. Let's explore several penny stocks that stand out due to their financial strength and potential for future performance.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $118.58M | ★★★★★★ |

| Safe Bulkers (NYSE:SB) | $3.74 | $393.82M | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.8526 | $6.19M | ★★★★★☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.50 | $75.83M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.45 | $47.85M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $4.04 | $151.42M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.30 | $23.06M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8126 | $73.08M | ★★★★★☆ |

| TETRA Technologies (NYSE:TTI) | $3.79 | $501.77M | ★★★★☆☆ |

Click here to see the full list of 748 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

High-Trend International Group (NasdaqCM:HTCO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: High-Trend International Group, with a market cap of $168.60 million, operates through its subsidiaries to provide ocean transportation services in Hong Kong, Singapore, and internationally.

Operations: High-Trend International Group has not reported any specific revenue segments.

Market Cap: $168.6M

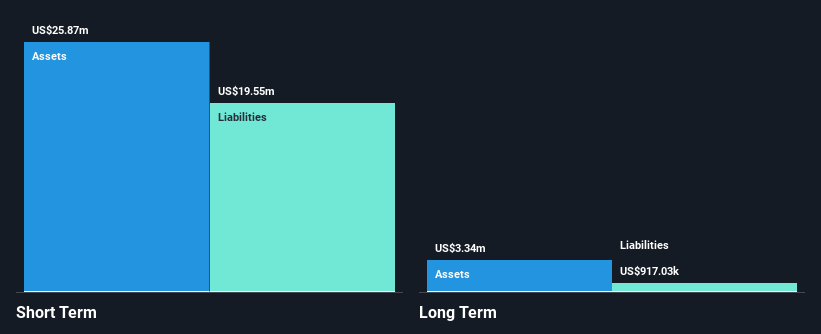

High-Trend International Group, with a market cap of US$168.60 million, recently reported revenue of US$108.18 million for the year ending October 2024, up from US$95.26 million the previous year, despite a net loss increase to US$23.6 million. The company has more cash than total debt and short-term assets exceeding liabilities, indicating some financial stability amidst challenges like high volatility and an inexperienced board with an average tenure of 0.5 years. Recent leadership changes aim to enhance sustainable maritime practices and management systems under new CEO Shixuan He’s strategic vision and extensive industry experience.

- Get an in-depth perspective on High-Trend International Group's performance by reading our balance sheet health report here.

- Evaluate High-Trend International Group's historical performance by accessing our past performance report.

RLX Technology (NYSE:RLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RLX Technology Inc. manufactures and sells e-vapor products in China and internationally, with a market cap of approximately $3.17 billion.

Operations: The company generates revenue primarily from its Personal Products segment, which amounted to CN¥2.16 billion.

Market Cap: $3.17B

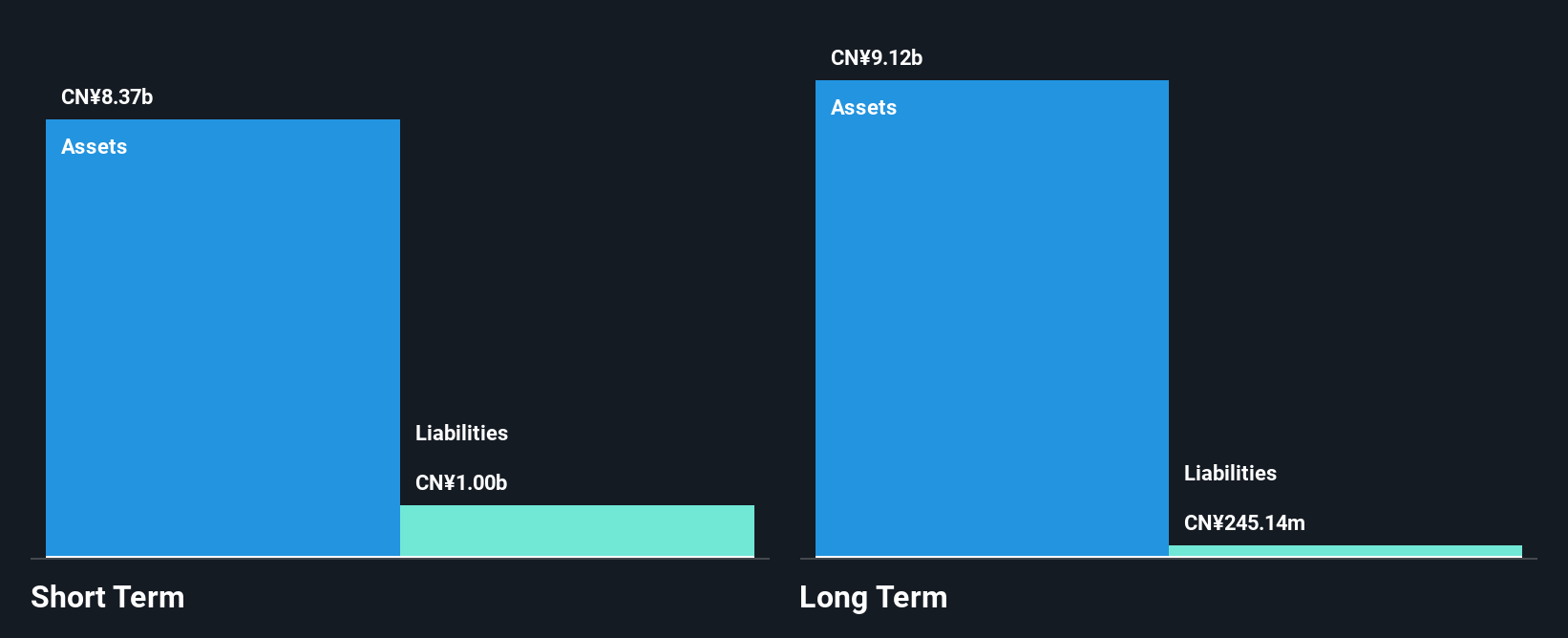

RLX Technology, with a market cap of approximately $3.17 billion, operates debt-free and has not diluted shareholders over the past year. Its earnings have grown significantly by 596.5% over the past year, surpassing both its five-year average growth rate of 9.5% and the Tobacco industry’s growth rate of 6.6%. The company’s net profit margins improved to 29.8%, up from last year's 8.5%. RLX is currently trading at a significant discount to its estimated fair value while maintaining high-quality earnings and stable weekly volatility at around 5%.

- Click here to discover the nuances of RLX Technology with our detailed analytical financial health report.

- Gain insights into RLX Technology's future direction by reviewing our growth report.

SelectQuote (NYSE:SLQT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SelectQuote, Inc. operates a technology-enabled, direct-to-consumer distribution platform selling insurance policies and healthcare services in the United States, with a market cap of approximately $784.98 million.

Operations: The company generates revenue through its Life segment ($161.91 million), Senior segment ($666.89 million), and Healthcare Services segment ($608.54 million).

Market Cap: $784.98M

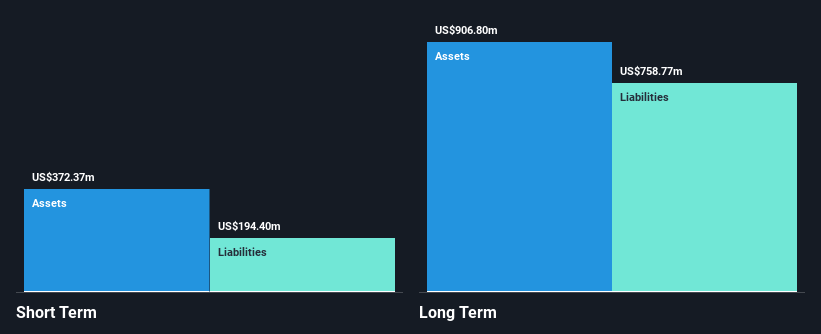

SelectQuote, Inc., with a market cap of approximately US$784.98 million, has been navigating the penny stock landscape with a focus on strategic financial maneuvers. Recent private placements raised US$350 million through preferred stock issuance, strengthening its liquidity position despite high net debt to equity ratio of 214.6%. The company's revenue streams from Life (US$161.91 million), Senior (US$666.89 million), and Healthcare Services (US$608.54 million) segments indicate diversification, though profitability remains elusive as losses have increased over five years by 20.8% annually. The board's recent expansion aims to leverage seasoned expertise for future growth initiatives amidst volatile share prices.

- Navigate through the intricacies of SelectQuote with our comprehensive balance sheet health report here.

- Gain insights into SelectQuote's outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Jump into our full catalog of 748 US Penny Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade RLX Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RLX

RLX Technology

Develops, manufactures, and sells e-vapor products in the People's Republic of China and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives