- United States

- /

- Transportation

- /

- NasdaqGS:CSX

CSX (NasdaqGS:CSX) Secures Tentative Labor Deals as Share Price Dips 2%

Reviewed by Simply Wall St

CSX (NasdaqGS:CSX) shares declined by 2% last week amid an optimistic market trend, where major indexes like the S&P 500 and Nasdaq gained 0.1% and 0.3%, respectively. The company's announcement of a new collective bargaining agreement with the Brotherhood of Railroad Signalmen, pending union ratification, did not enhance its stock performance. While broader market optimism was fueled by tariff news potentially leading to economic stability, CSX's share movement did not align with these market gains, possibly reflecting investor cautiousness about labor cost implications from improved wages and benefits agreements.

Buy, Hold or Sell CSX? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

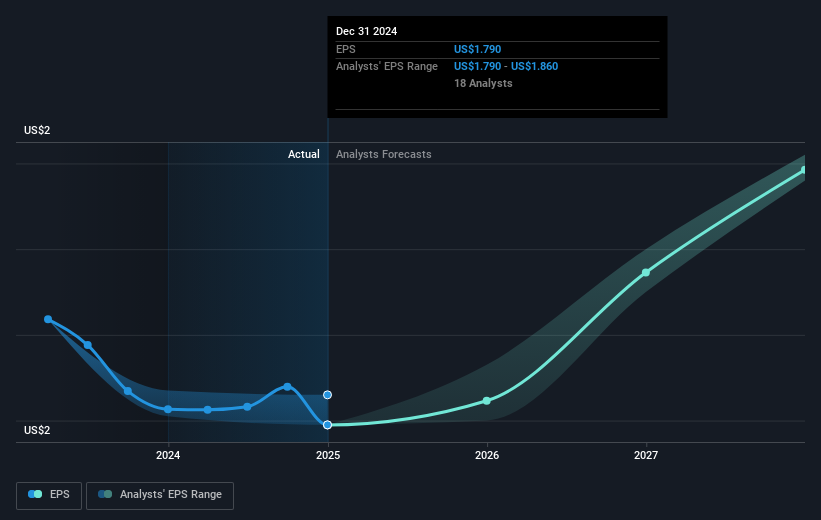

Over the past five years, CSX generated a total return of 64.75% for shareholders, combining share price appreciation with dividends. During this period, major initiatives like the Howard Street Tunnel Project have laid the groundwork for potential operational efficiency gains by removing bottlenecks to allow for greater capacity. Additionally, CSX's proactive approach to improving operational efficiency, highlighted by efforts such as the Cumberland site reconfiguration, aims to enhance network efficiency and net margins. Meanwhile, despite facing weaker commodity prices and higher interest rates, the company's infrastructure improvements are anticipated to bolster future revenue and earnings.

In recent times, CSX has taken significant steps that could influence its market position. For instance, the approval of an 8% increase in its quarterly dividend reflects the company's commitment to returning value to shareholders. Furthermore, strategic developments like unveiling a hydrogen-powered locomotive underline CSX's shift towards sustainable operations, which may appeal to environmentally conscious investors. Finally, the company's robust share buyback program, including the repurchase of over 41 million shares in 2024, underscores confidence in its long-term growth prospects.

Gain insights into CSX's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade CSX, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSX

CSX

Provides rail-based freight transportation services in the United States and Canada.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives