- United States

- /

- Transportation

- /

- NasdaqGS:CSX

CSX (CSX) Valuation Check After a Steady Share Price Climb

Reviewed by Simply Wall St

CSX (CSX) shares have quietly climbed in the past month, and that move has investors asking whether this rail giant’s recent momentum reflects improving fundamentals or simply a broader market tailwind.

See our latest analysis for CSX.

Zooming out, CSX’s recent climb to a share price of $37.09 extends a steady upward trend, with a roughly mid-teens year to date share price return and a double digit one year total shareholder return that together signal gradually improving sentiment rather than a speculative spike.

If CSX’s run has you thinking about what else could quietly rerate higher, it might be worth exploring fast growing stocks with high insider ownership as a curated way to uncover the next set of potential winners.

Yet with CSX trading just below analyst targets and modestly richer than some historical valuation markers, the key question now is whether the stock still trades at a discount or whether the market has already priced in its next leg of growth.

Most Popular Narrative Narrative: 6% Undervalued

With CSX last closing at $37.09 against a most-followed fair value estimate near $39, the narrative frames today’s price as leaving modest upside on the table.

Improved service metrics and customer satisfaction, reflected in high Net Promoter Scores despite recent operational challenges, suggest potential for reclaimed market share and increased customer volumes, positively impacting both revenue and margin.

Want to see what powers that upside case? The narrative focuses on steady revenue expansion, rising margins, and a future earnings multiple usually reserved for market darlings. Curious how those moving parts stack up over the next few years, and what kind of profit trajectory would need to play out to justify that valuation gap? Dive in to unpack the full playbook behind this fair value call.

Result: Fair Value of $39.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering infrastructure disruptions and volatile commodity markets could still derail margin gains and challenge the modest undervaluation implied by today’s price.

Find out about the key risks to this CSX narrative.

Another View: Market Ratios Flash Caution

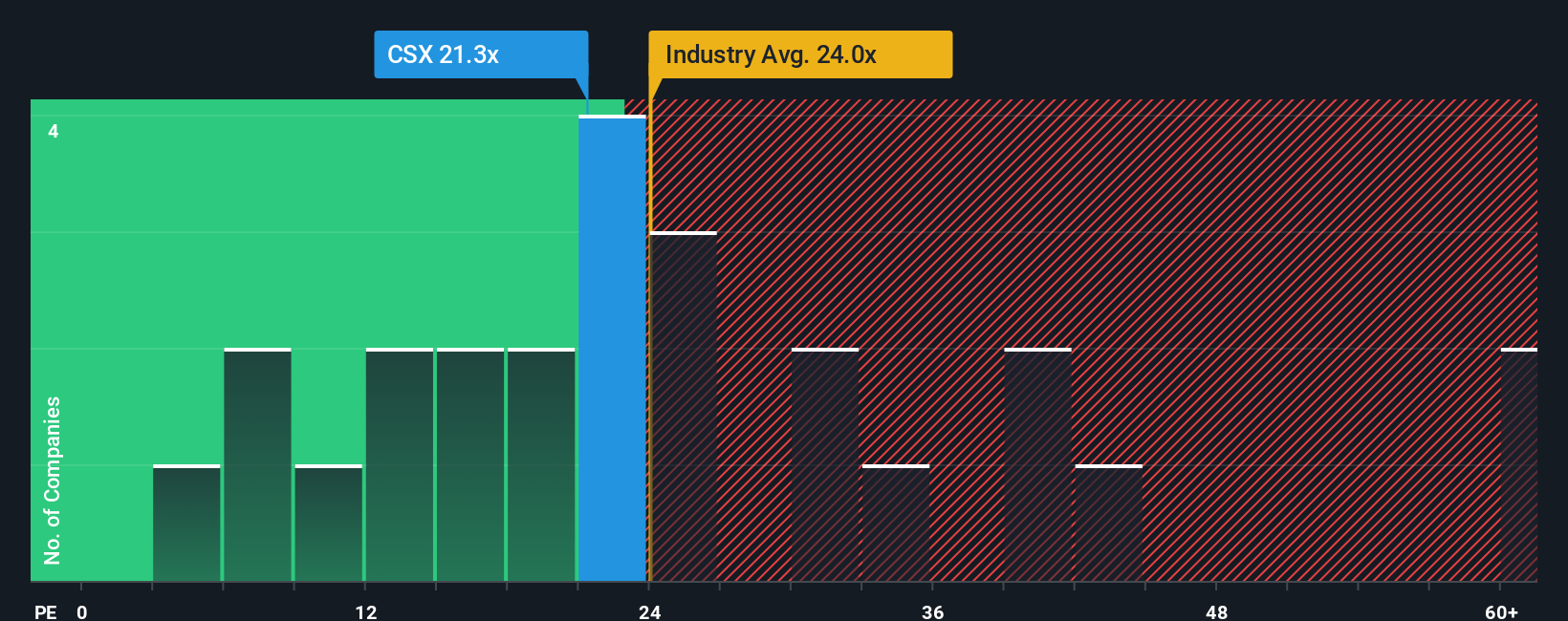

While the narrative pegs CSX about 6% below fair value, its 23.8x earnings ratio sits above a fair ratio of 20.3x and slightly richer than the 22.4x peer average, even if still cheaper than the 30.9x industry. Is the market already paying up for that story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CSX Narrative

If you see the story differently or simply want to test your own assumptions against the numbers, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your CSX research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put the numbers to work for you by scanning targeted stock ideas in minutes, instead of waiting for the next opportunity to appear.

- Capture potential multi-baggers early by scanning these 3602 penny stocks with strong financials that already show financial strength instead of speculative hype.

- Ride powerful structural trends by targeting these 26 AI penny stocks positioned at the crossroads of data, automation, and scalable software models.

- Lock in value-focused opportunities by reviewing these 904 undervalued stocks based on cash flows where discounted cash flows hint at a wider margin of safety than the market currently recognizes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSX

CSX

Provides rail-based freight transportation services in the United States and Canada.

Average dividend payer with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026