- United States

- /

- Logistics

- /

- NasdaqGS:ATSG

Air Transport Services Group, Inc.'s (NASDAQ:ATSG) Earnings Are Not Doing Enough For Some Investors

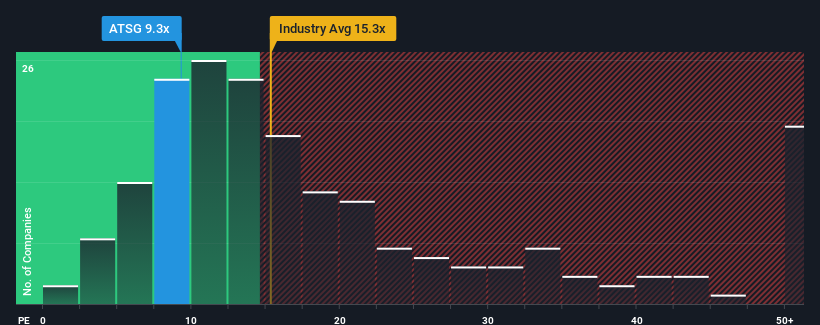

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may consider Air Transport Services Group, Inc. (NASDAQ:ATSG) as an attractive investment with its 9.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings that are retreating more than the market's of late, Air Transport Services Group has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Air Transport Services Group

What Are Growth Metrics Telling Us About The Low P/E?

Air Transport Services Group's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 38%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 13% as estimated by the six analysts watching the company. Meanwhile, the broader market is forecast to expand by 10%, which paints a poor picture.

With this information, we are not surprised that Air Transport Services Group is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Air Transport Services Group maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Air Transport Services Group has 2 warning signs we think you should be aware of.

If you're unsure about the strength of Air Transport Services Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ATSG

Air Transport Services Group

Provides aircraft leasing, and air cargo transportation and related services in the United States and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives