- United States

- /

- Transportation

- /

- NasdaqGS:ARCB

ArcBest (ARCB): Exploring Valuation After $125 Million Share Buyback Boost

Reviewed by Simply Wall St

ArcBest (ARCB) just turned heads with its move to boost its share buyback authorization to $125 million, a signal that typically resonates with investors looking for management’s take on future prospects. This bump in the buyback plan often points to confidence from leadership. After all, companies tend to repurchase stock when they believe it is undervalued or want to signal stability. With the market watching closely, such decisions can shift investor sentiment and potentially act as a catalyst for renewed interest in the stock.

This announcement comes after a year that has tested patience. ArcBest’s shares have slipped 32% over the past twelve months, even as they have logged a 7% rebound in the past three months. That turnaround follows steady, if moderate, annual growth in both revenue and net income, underscoring the push and pull between recent caution and longer-term optimism. Investors have seen momentum shift, and now the question is how long this bounce might last.

After a year of volatility and a fresh commitment to buybacks, is the market still discounting ArcBest’s potential, or is investor confidence starting to price in a brighter future?

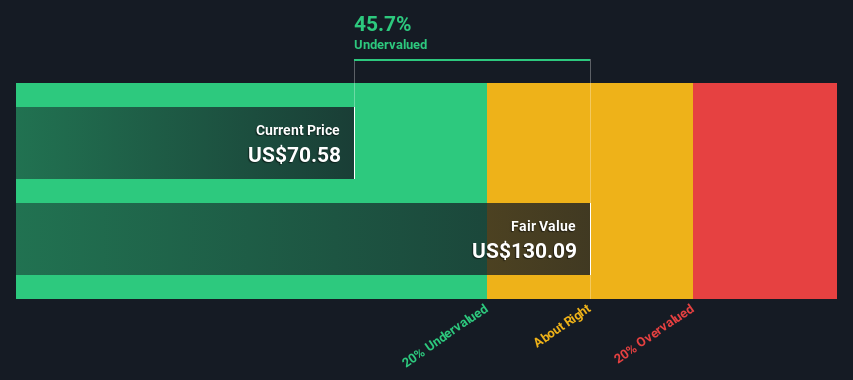

Most Popular Narrative: 17.4% Undervalued

According to the most widely followed narrative, ArcBest shares are currently trading well below what analysts believe to be their fair value. This suggests significant upside potential.

The company is seeing strong success capturing new core LTL customers and expanding its pipeline. In particular, investments in sales and integrated logistics solutions are setting the stage for future shipment growth and top-line revenue acceleration as e-commerce and domestic supply chain complexity increase.

Curious how ArcBest could turn the tide in the freight sector? The narrative hinges on an ambitious transformation playbook, bold sales forecasts, and optimism about tech-driven profit expansion. Want to know exactly which financial levers analysts are betting on and how these might change ArcBest’s entire profit profile? The details behind this valuation will surprise you and could redefine what’s next for the company.

Result: Fair Value of $88.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent freight market softness and ongoing competitive rate pressure could quickly disrupt the current optimism and challenge ArcBest’s projected profit growth.

Find out about the key risks to this ArcBest narrative.Another View: Looking Through a Different Lens

Our DCF model arrives at a similar conclusion, also indicating there is value not reflected in today's price. However, will the market agree, or could future shifts force a rethink?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ArcBest for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ArcBest Narrative

If you see things differently or want to dig deeper on your own, you can uncover fresh perspectives and craft your own take in just a few minutes. Do it your way.

A great starting point for your ArcBest research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Act now to discover exciting stocks that others might miss. The Simply Wall Street Screener provides tailored opportunities designed to fit your investment goals and curiosity.

- Explore the future of healthcare by searching companies pioneering medical AI and breakthroughs with our healthcare AI stocks.

- Find undervalued gems that are quietly building momentum and gain your edge through our rigorously assessed list of undervalued stocks based on cash flows.

- Discover potential high-yield picks and build your passive income stream using the latest lineup at dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARCB

ArcBest

An integrated logistics company, provides ground, air, and ocean transportation solutions worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives