- United States

- /

- Airlines

- /

- NasdaqGS:AAL

How Investors Are Reacting To American Airlines Group (AAL) Expanding Transborder Network With Porter Codeshare

Reviewed by Sasha Jovanovic

- On September 29, 2025, American Airlines and Porter Airlines jointly announced a new codeshare partnership to broaden travel options between the United States and Canada, with immediate booking availability across select destinations on both carriers’ platforms.

- This collaboration lays the groundwork for further network, loyalty program, and transborder route expansion, deepening connectivity throughout North America and potentially enhancing customer value for both leisure and business travelers.

- We'll examine how the expanded codeshare partnership with Porter Airlines could influence American Airlines Group's broader investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

American Airlines Group Investment Narrative Recap

For investors considering American Airlines Group, the core belief centers on a recovery in domestic demand, enhanced by network strength and loyalty initiatives, with financial flexibility remaining a primary short-term catalyst. The recently announced codeshare with Porter Airlines could incrementally support transborder and premium growth, but it does not materially alter the immediate focus on improving U.S. market performance or the overarching concern regarding American’s high debt load.

Among recent developments, the expanded partnership with STARLUX Airlines, announced in August 2025, aligns closely with the push for international diversification, a catalyst that can complement network enhancements like the Porter codeshare by broadening American’s access to high-yield routes beyond North America.

Yet, despite this widening global access, investors should still keep in mind American's substantial net debt and sustained capital spending commitments, which could…

Read the full narrative on American Airlines Group (it's free!)

American Airlines Group's narrative projects $61.8 billion in revenue and $1.8 billion in earnings by 2028. This requires 4.5% yearly revenue growth and a $1.23 billion increase in earnings from the current $567.0 million.

Uncover how American Airlines Group's forecasts yield a $13.88 fair value, a 19% upside to its current price.

Exploring Other Perspectives

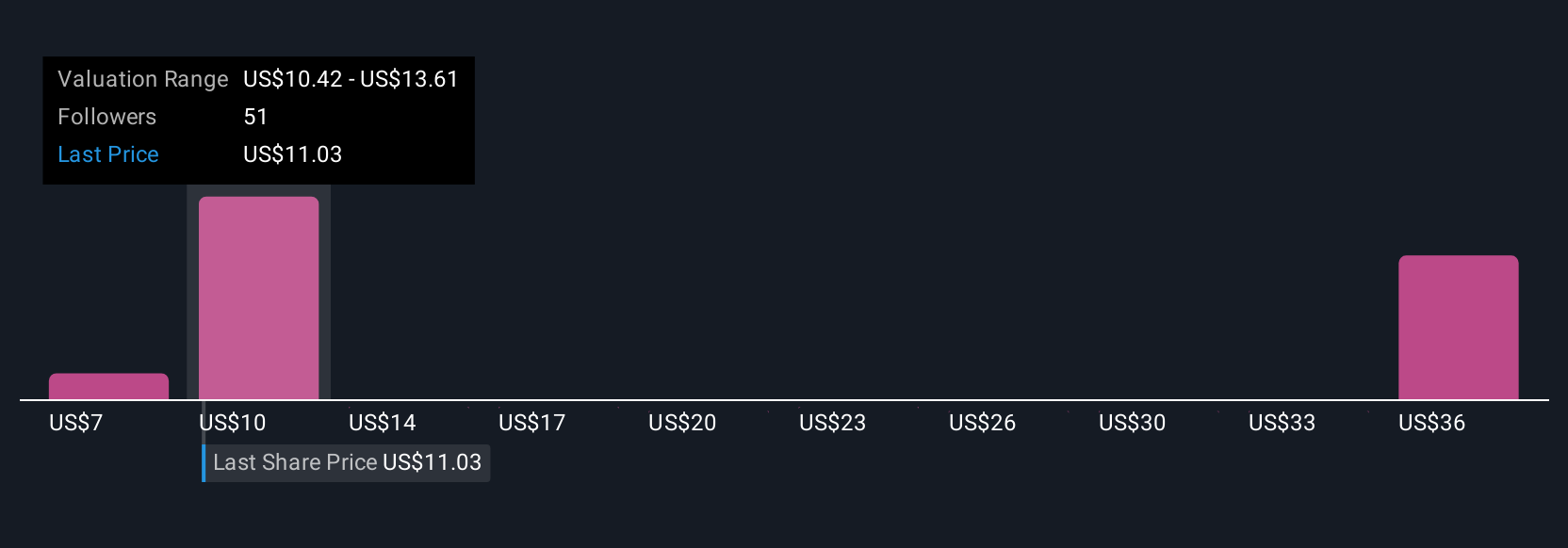

Simply Wall St Community members provided 13 fair value estimates for American Airlines Group, ranging from US$9 to nearly US$49 per share. While opinions widely differ, recent focus on high debt and cost pressures may weigh on performance outlook and highlight the need to compare multiple viewpoints.

Explore 13 other fair value estimates on American Airlines Group - why the stock might be worth 23% less than the current price!

Build Your Own American Airlines Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free American Airlines Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Airlines Group's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives