- United States

- /

- Airlines

- /

- NasdaqGS:AAL

American Airlines Group (AAL) Reveals Q2 Revenue Growth But Decline In Net Income

Reviewed by Simply Wall St

American Airlines Group (AAL) experienced a notable price movement with a 18% increase over the last quarter, aligning well with buoyant market trends as major indexes witnessed gains due to robust corporate earnings and market optimism. During this period, AAL announced a slight revenue increase for Q2 2025 while net income declined, suggesting mixed financial performance, which contrasts with the overall earnings momentum. Additionally, American Airlines extended their partnership with Mastercard, aiming to enhance customer experiences, potentially boosting investor confidence. Despite these mixed financial signals, AAL's price move appears to have broadly aligned with positive market trends.

The recent news surrounding American Airlines, particularly its partnership extension with Mastercard and mixed financial performance, could play an essential role in shaping its long-term narrative. This collaboration aims to enhance customer experiences, potentially driving revenue growth through increased airline loyalty program participation. However, the decline in net income might temper investor enthusiasm if not appropriately counterbalanced by additional revenue streams.

Over the past year, American Airlines' total shareholder returns, including share price and dividends, amounted to 8.11%. This performance lags behind the broader US market, which saw an 18% increase, as well as the US Airlines industry with a 43.5% rise over the same period. Such underperformance relative to industry peers and the market suggests that the company faces competitive and operational challenges that go beyond immediate news events.

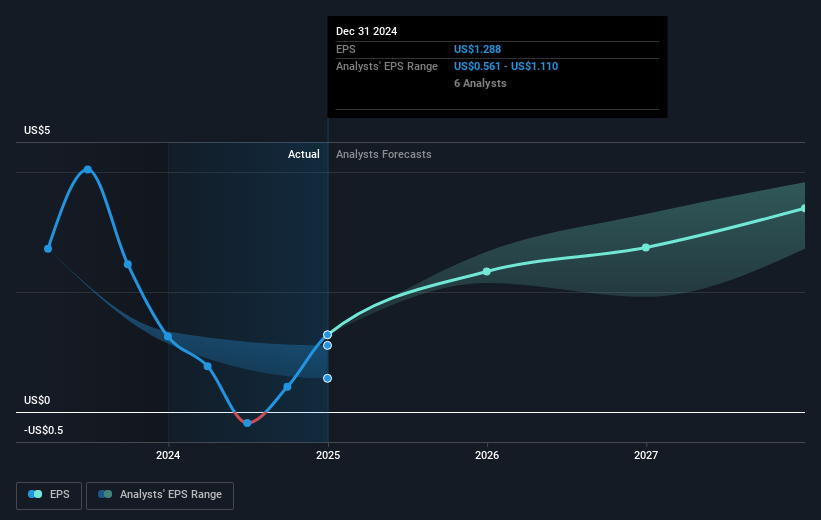

In terms of revenue and earnings forecasts, the mixed Q2 earnings report, coupled with the potential benefits from the Mastercard deal, may influence analysts' future expectations. The company's anticipated revenue and earnings improvements hinge on its successful execution of cost management and fleet renewal strategies, as well as capitalizing on demand in international markets. The current share price of US$11.46 remains below the analyst consensus price target of US$13.70, reflecting a 19.59% discount to this target. This suggests that investors might be cautiously optimistic about the company's ability to achieve its projected earnings and revenue growth in the coming years.

Learn about American Airlines Group's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives