- United States

- /

- Airlines

- /

- NasdaqGS:AAL

American Airlines (AAL): Valuation Check as In‑Flight WiFi Talks With Amazon’s Leo Draw Investor Focus

Reviewed by Simply Wall St

American Airlines Group (AAL) is back in the spotlight as investors weigh its talks with Amazon’s Leo satellite unit for faster in flight WiFi, especially with Elon Musk touting Starlink’s deal with United.

See our latest analysis for American Airlines Group.

The latest WiFi talks come as American’s 30 day share price return of 25.31 percent and 90 day share price return of 28.12 percent suggest momentum is rebuilding, even though the 1 year total shareholder return is still slightly negative.

If this shift in sentiment around American has your attention, it could be a good moment to see what else is setting up in aerospace and defense stocks.

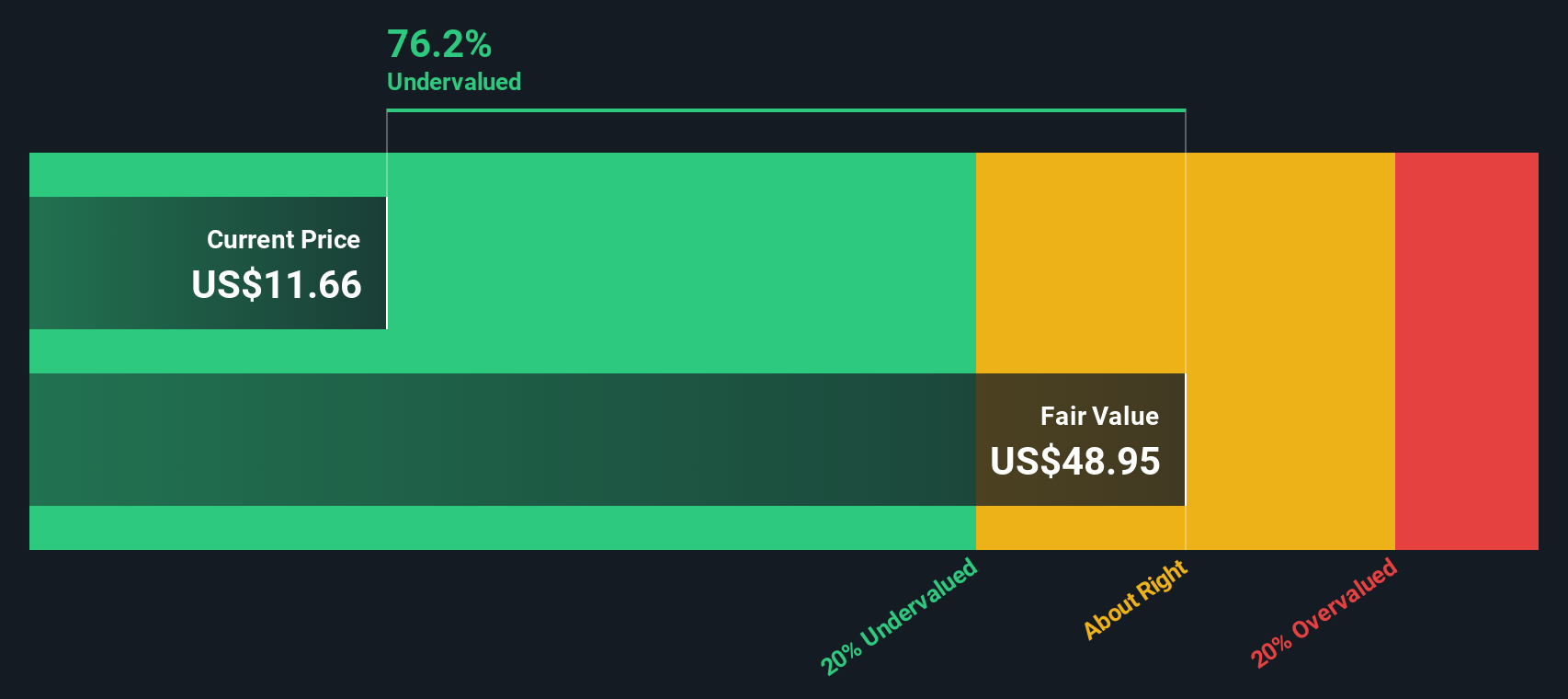

With shares still trading at a steep discount to some intrinsic value estimates but hovering near analyst targets, investors now face a key question: is American Airlines genuinely undervalued, or is the market already pricing in its next leg of growth?

Price-to-Earnings of 17.5x: Is it justified?

American Airlines last closed at $15.99, and on a price to earnings ratio of 17.5x the stock screens as modestly valued against peers but rich versus the wider airline sector.

The price to earnings ratio compares the current share price to annual earnings per share, and for airlines it is a quick shorthand for how much investors pay for each dollar of profit in a cyclical, capital intensive business.

In American’s case, the current 17.5x multiple sits well below the peer average of 28.7x. This suggests the market is not giving it the same credit for future earnings power. Yet that same multiple is almost double the global airlines industry average of 9.3x, implying investors are still paying a premium relative to many carriers worldwide.

Compared with our estimated fair price to earnings ratio of 24x, the current 17.5x looks materially lower. This hints at room for the valuation to re rate if American continues to deliver on its strong earnings growth profile.

Explore the SWS fair ratio for American Airlines Group

Result: Price-to-Earnings of 17.5x (UNDERVALUED)

However, risks linger, including execution missteps on premium WiFi investments and any sharp slowdown in travel demand that could quickly pressure margins and earnings.

Find out about the key risks to this American Airlines Group narrative.

Another View: DCF Paints a Far Deeper Discount

While the 17.5x earnings multiple makes American look only modestly cheap, our DCF model goes much further, pointing to a fair value of $44.52 versus today’s $15.99. That is a hefty implied upside, but is the cash flow outlook really that dependable in such a cyclical business?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Airlines Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Airlines Group Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes by starting with Do it your way.

A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before the market’s next swing catches you off guard, put your capital to work with focused screeners that surface quality opportunities others are overlooking.

- Target high potential small caps by scanning these 3627 penny stocks with strong financials built on solid fundamentals instead of pure hype.

- Capitalize on the AI wave by reviewing these 25 AI penny stocks that pair powerful technology with compelling growth trajectories.

- Lock in stronger income streams by narrowing in on these 13 dividend stocks with yields > 3% that can bolster your portfolio’s cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)