Verizon Shares Drop 10% in a Month Is the Recent Slide an Opportunity in 2025

Reviewed by Bailey Pemberton

If you have ever debated what to do with Verizon Communications stock, you are not alone. This is a company that likes to keep investors on their toes, thanks to its steady business, surprising resilience, and occasionally head-turning price swings. Over the last week, Verizon’s shares dipped by 4.1%, and over the past month, they are down nearly 10%. On the surface, that may sound worrying. But broaden your lens a bit, and the story becomes a lot more interesting. Over the last three years, Verizon investors have actually seen more than 30% return, even factoring in the occasional rough patch.

Major changes in the broader telecommunications market and investor perceptions of risk have pushed Verizon’s valuation into the spotlight. The company’s share price may have pulled back in the short term, but a lot of analysts are starting to see opportunity rather than danger. That is partly because, when you run the numbers, Verizon scores a perfect 6 out of 6 on standard undervaluation checks. This means that across six different valuation yardsticks, it passes each one for being priced attractively.

In this article, I will walk you through just what those checks are and how Verizon fares on each. Of course, scores and math can only tell part of the story. Later on, I will share a different approach to valuation that could give you an even deeper read on where Verizon stands today.

Why Verizon Communications is lagging behind its peers

Approach 1: Verizon Communications Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s true value by extrapolating its expected future cash flows and then discounting those back to today’s dollars. This approach evaluates how much cash Verizon Communications is expected to generate and considers what all those future amounts would be worth if you had them in your possession right now.

Currently, Verizon produces Free Cash Flow of about $15.28 billion. Analysts expect this number to steadily climb, with projections reaching $23.93 billion in annual Free Cash Flow by 2029. While direct analyst estimates typically cover five years, further projections rely on reputable data modeling using industry-standard methods.

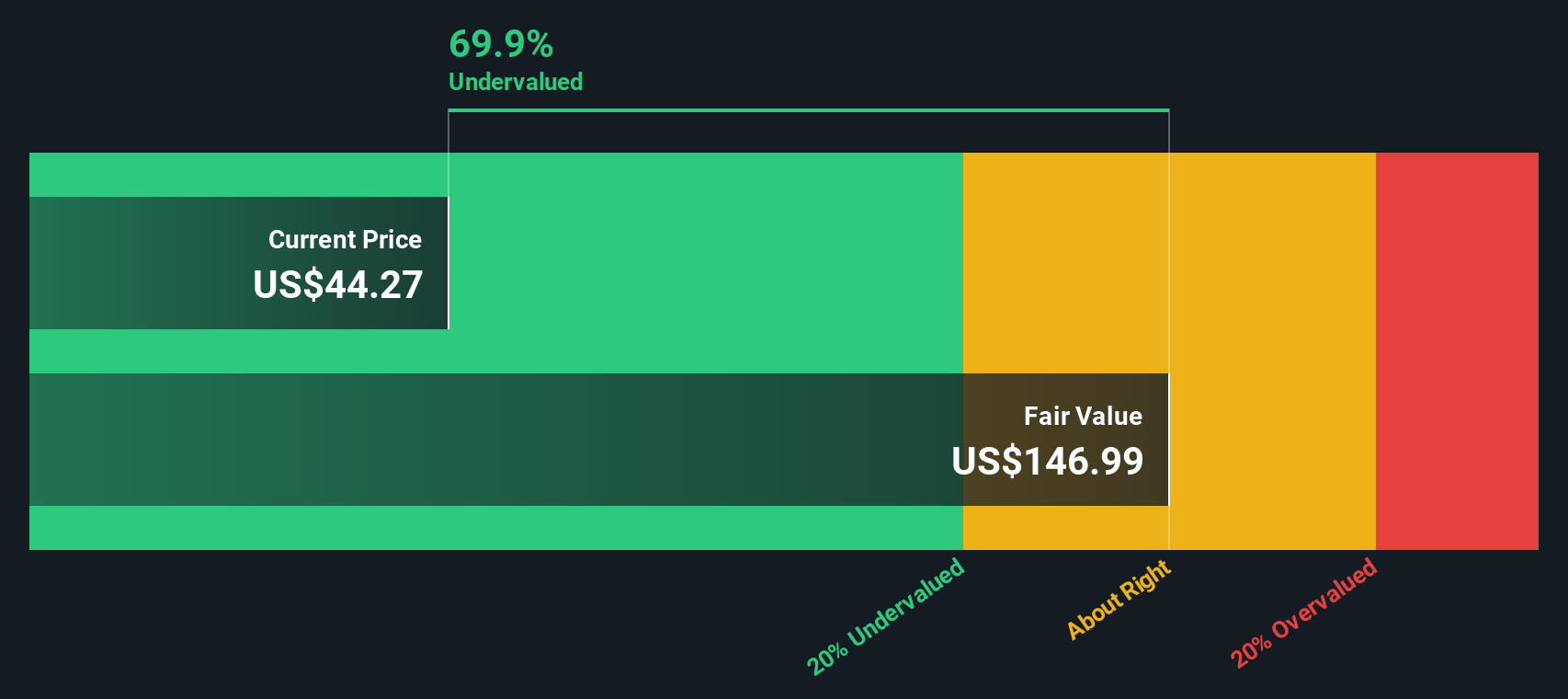

In Verizon’s case, this DCF model, which uses two stages of Free Cash Flow to Equity, calculates the company’s fair value at $128.61 per share. This is a significant difference compared to the current trading price, suggesting that Verizon stock is trading at a 69.1% discount to its intrinsic value.

Simply put, based on projected cash flows and standard valuation techniques, Verizon’s shares appear deeply undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Verizon Communications is undervalued by 69.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Verizon Communications Price vs Earnings

The Price-to-Earnings (PE) ratio is an established valuation metric and a strong choice for companies like Verizon Communications that generate reliable profits. It helps assess what investors are willing to pay today for a dollar of the company's current or future earnings. A lower PE can suggest a stock is undervalued, but only when taking into account the company's growth prospects and risk profile. Typically, higher growth and lower perceived risk result in a higher "normal" PE ratio, while slower growth or elevated risks result in a lower one.

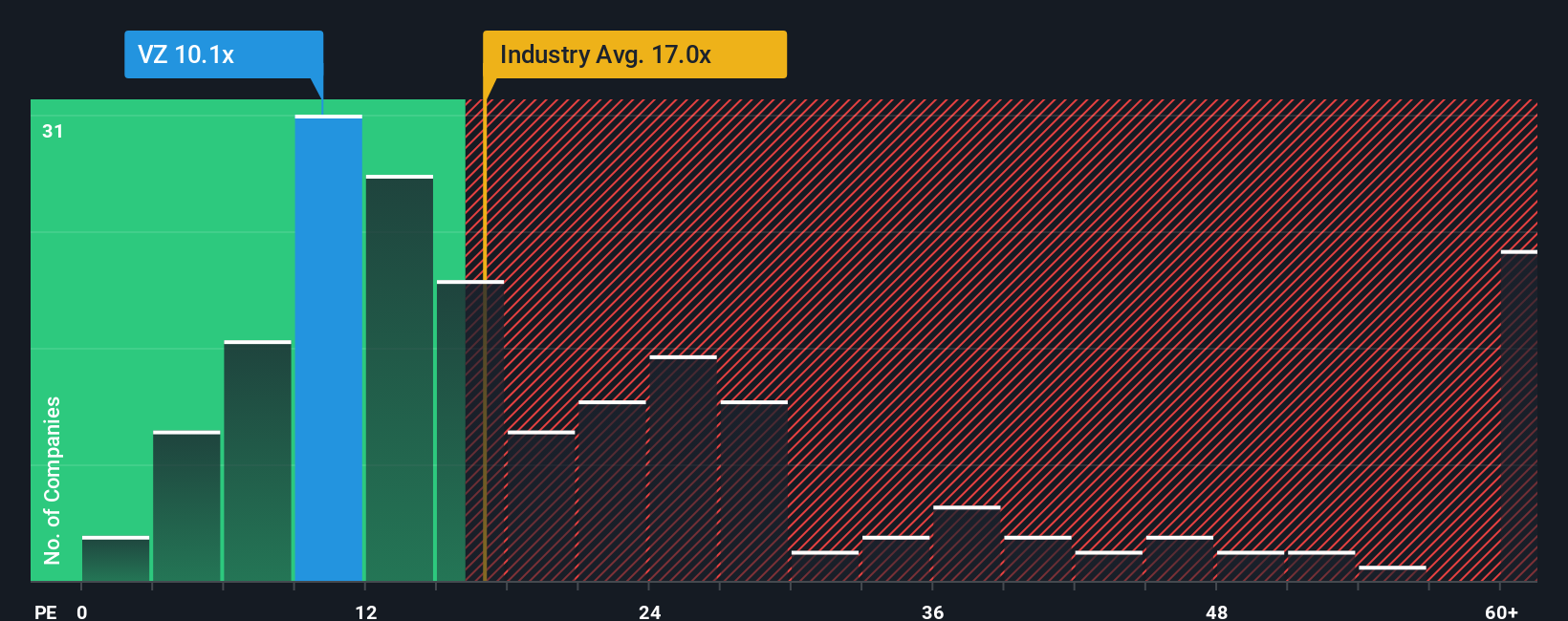

Verizon trades at a PE ratio of 9.2x. To put this in perspective, the broader telecom industry averages a PE of 17.0x, and Verizon's peers are even higher at 23.3x. At first glance, Verizon appears attractively priced among its competitors. However, a truly fair PE ratio should also reflect factors like the company’s growth outlook, profit margins, industry nuances, and size.

This is where the Simply Wall St "Fair Ratio" offers a more tailored benchmark. Unlike a simple peer or industry comparison, the Fair Ratio, calculated as 15.7x for Verizon, integrates its growth prospects, profit margins, risk factors, market capitalization, and industry context. This makes it a more comprehensive and realistic reference for valuation. Since Verizon's actual PE of 9.2x is significantly below the Fair Ratio, it suggests the company is trading at a meaningful discount to what would be considered a fair price based on its characteristics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Verizon Communications Narrative

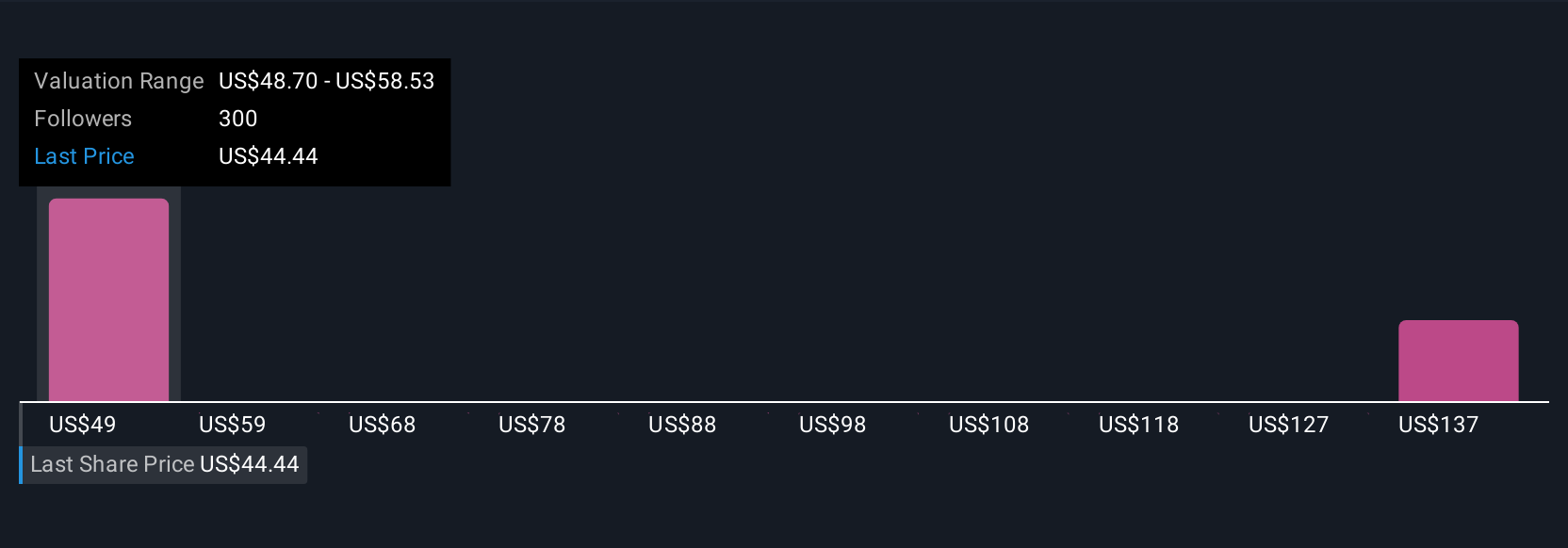

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a tool that empowers you to shape the story behind a company’s numbers. It lets you combine your own perspective on a business with assumptions for future revenue, earnings, and margins, helping you estimate its fair value.

Narratives make investing personal and practical, connecting Verizon’s real-world story to a financial forecast and then straight to a fair value you can act on. This feature is readily available within the Simply Wall St Community page, where millions of investors easily build or follow Narratives that reflect changing news or earnings updates. By comparing each Narrative’s Fair Value to the current market price, you can quickly decide if and when it might be time to buy or sell, while benefiting from insights that automatically update as new information comes in.

For example, with Verizon Communications, some Narratives emphasize expanding broadband and enterprise solutions to support higher future earnings and a $58.00 price target. Others point to rising debt and market saturation, resulting in a more cautious $42.00 target, allowing you to follow the story that fits your outlook.

Do you think there's more to the story for Verizon Communications? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

Very undervalued 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives