Verizon Communications (NYSE:VZ) Shareholders Reject Civil Liberties Proposal And Approve Executive Pay

Reviewed by Simply Wall St

Verizon Communications (NYSE:VZ) recently tapped shareholders' approval for an advisory vote on executive compensation while rejecting two other proposals during its annual meeting on May 22, 2025. This development coincides with a quarter where Verizon introduced exciting new products, such as the Samsung Galaxy S25 Edge and the Verizon Frontline Network Slice, which may have supported investor sentiment. However, despite these events, Verizon's share price remained relatively flat, reflecting broader market trends during the last quarter amidst global trade tensions and market declines, including a 2.5% dip in major indexes like the Dow Jones and Nasdaq.

We've spotted 2 possible red flags for Verizon Communications you should be aware of.

The recent approvals and rejections from Verizon's annual meeting may influence investor perceptions concerning governance, potentially affecting long-term shareholder sentiment. This shareholder approval aligns with Verizon's goals of improving executive compensation linked to performance benchmarks, potentially impacting morale and productivity.

In contrast to Verizon's relatively flat short-term share performance amidst broader market dips, the company's total return, including dividends, marked a 16.75% increase over the past year. This performance context is crucial for investors evaluating Verizon's long-term position, especially when considering its recent underperformance against the US Telecom industry, which gained 28.8% over the same one-year period.

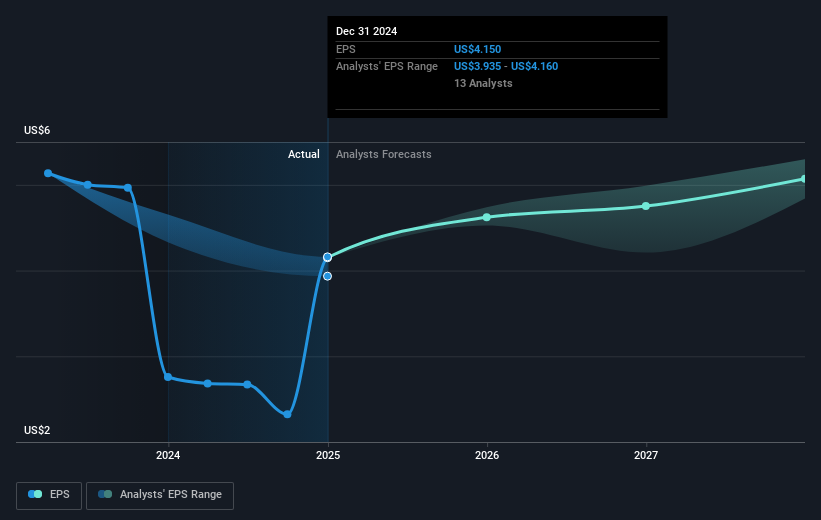

Verizon's focus on network expansion through new products and enhanced consumer offerings could bolster revenue, although projections indicate a growth rate of 1.7% per year, slower than the US market. Similarly, earnings forecasts suggest moderate growth at 5.8% annually. These factors could slightly influence the consensus price target, which stands at US$48.07, indicating a modest 8.1% premium over the current share price of US$44.15. Investors should weigh these projections and news alongside Verizon's proposed strategies for evolving market conditions, such as network convergence and service diversification, to understand the potential long-term impact on revenue and earnings.

Review our growth performance report to gain insights into Verizon Communications' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives