Verizon Communications (NYSE:VZ) Appoints Schulman as Lead Director, Affirms Dividend Despite Challenges

Reviewed by Simply Wall St

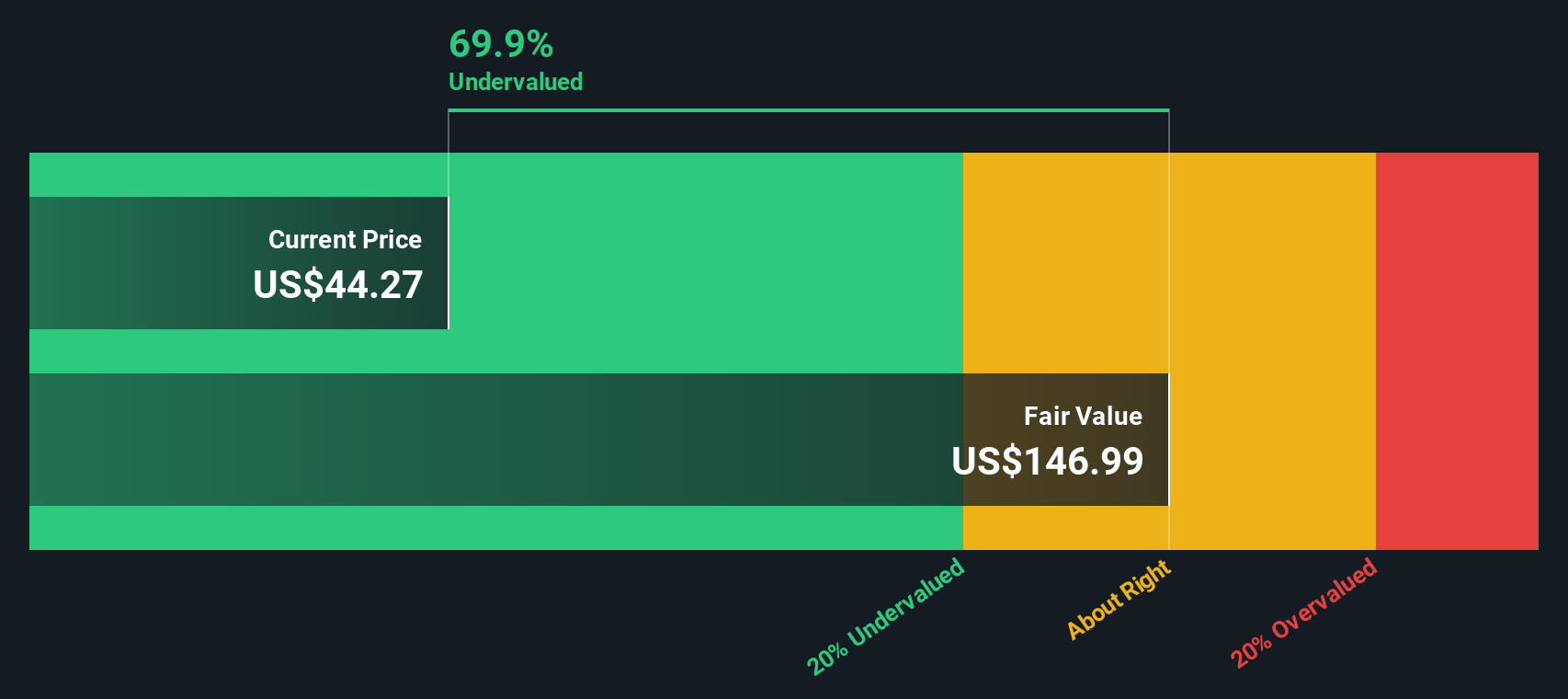

Click to explore a detailed breakdown of our findings on Verizon Communications.

Innovative Factors Supporting Verizon Communications

Verizon has demonstrated strong financial performance, highlighted by a 2.7% increase in wireless service revenue. CEO Hans Vestberg proudly announced the largest EBITDA in the company's history at $12.5 billion, signifying strong profitability and operational efficiency. The company's ability to generate substantial cash flow, with $6 billion in the recent quarter, further underscores its financial health. Additionally, Verizon's strategic initiatives, such as the successful launch of products like fixed wireless access, myPlan, and myHome, have fortified its market position. The appointment of Daniel H. Schulman as lead director, known for his transformative leadership at PayPal, is expected to bolster Verizon's strategic direction. The company's valuation, with a Price-To-Earnings Ratio of 18.2x, aligns well with its peers, reflecting its solid market standing.

Critical Issues Affecting the Performance of Verizon Communications and Areas for Growth

Verizon faces challenges, including a high net debt to equity ratio of 151%, which is considered elevated. The company's dividend payments, with a payout ratio of 115%, are not covered by earnings, posing potential risks to dividend sustainability. Additionally, Verizon's return on equity is relatively low at 10.5%, with forecasts indicating only a modest increase to 16.6% in three years. The firm has also experienced a 53.1% decline in earnings growth over the past year, with a 5.9% annual decrease in profits over the last five years. These financial metrics suggest areas where Verizon needs to focus on improving efficiency and profitability.

Growth Avenues Awaiting Verizon Communications

Verizon is poised for expansion, particularly in broadband and fiber, with plans to double its fixed wireless access targets by 2028, aiming for 8 to 9 million subscribers. The pending acquisition of Frontier offers a significant opportunity to expand Fios to 35 to 40 million homes, as noted by Joseph Russo. Furthermore, Verizon's collaboration with EBARA Corporation to enhance cybersecurity capabilities exemplifies its commitment to leveraging innovative technologies. The partnership with Office Depot to offer Verizon products in select stores further enhances its market reach, providing seamless access to 5G internet and other services.

Competitive Pressures and Market Risks Facing Verizon Communications

Verizon must navigate various external challenges, including regulatory hurdles associated with the BEAD program, as acknowledged by Hans Vestberg. Economic uncertainties, such as changes in tax regimes and inflation, pose additional risks, with concerns raised about rising cash taxes and capital expenditures. The telecommunications sector's competitive nature requires Verizon to differentiate its offerings, as emphasized by Vestberg, to maintain its leadership position. The company also faces slow revenue growth forecasts of 1.8% annually, compared to the U.S. market's 9.1%, which could impact its long-term growth prospects.

Conclusion

Verizon Communications exhibits strong financial health, as evidenced by its record EBITDA and substantial cash flow generation, which support its strategic initiatives and market positioning. However, the company's elevated net debt to equity ratio and unsustainable dividend payout ratio highlight areas of financial strain that could impact future profitability and shareholder returns. Verizon's expansion plans in broadband and fiber, alongside strategic partnerships, present promising growth opportunities that could enhance its competitive edge. Trading at a Price-To-Earnings Ratio of 18.2x, Verizon is well-valued compared to its peers, indicating market confidence in its ability to navigate external risks and capitalize on growth avenues, although it remains pricier than the global industry average, suggesting room for improvement in operational efficiency.

Key Takeaways

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Verizon Communications, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives