- United States

- /

- Telecom Services and Carriers

- /

- NYSE:LUMN

Lumen Technologies (NYSE:LUMN) Stock Dips 16% Over Month As Acquisition Talks With AT&T Surface

Reviewed by Simply Wall St

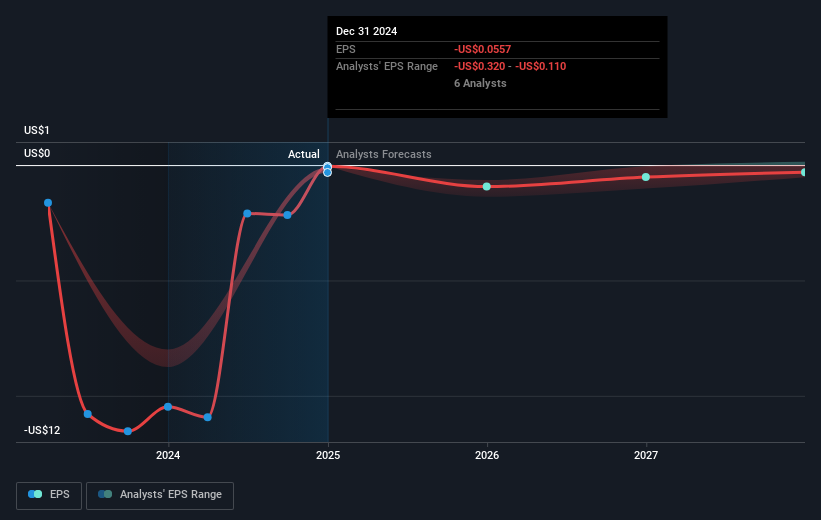

Lumen Technologies (NYSE:LUMN) experienced a 16% decline in its stock price over the past month. This movement coincides with recent collaborations and potential acquisition talks. The successful trial of a 1.2 terabit wavelength service in partnership with Ciena, which demonstrates Lumen's technological advancements, could have affected investor sentiment. Additionally, reports of acquisition discussions with AT&T for its consumer fiber operations may have added to market uncertainty. Broader market declines, reflected by a 1.8% fall over a weeklong period, alongside tariff-related economic concerns, also compounded pressures on Lumen's stock. These factors likely contributed to the company's overall price move.

Lumen Technologies achieved a significant total return of 152.56% over the last year. This performance surpassed both the US Telecom industry, which returned 29.1%, and the broader US market's 5.5%. Lumen's substantial debt reduction, including a US$1.6 billion decrease in 2024 and an additional US$200 million in redemption notices, bolstered its financial stability. Furthermore, partnerships with tech giants like Microsoft, AWS, and Meta improved its revenue prospects by generating US$8.5 billion in closed sales, supporting free cash flow amid ongoing strategic transformations.

The company's focus on expanding network capabilities included the addition of 500,000 new Quantum Fiber units, enhancing market presence. Collaborations, such as the trial deployment of a 1.2 terabit wavelength service with Ciena and integration with Flexential, positioned Lumen for future growth in AI and cloud demands. A US$4.3 million contract with the New Mexico Office of Broadband Access also underscored Lumen's commitment to expanding connectivity solutions. These initiatives contributed to the company's impressive long-term share performance.

Gain insights into Lumen Technologies' future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUMN

Lumen Technologies

A networking company, provides integrated products and services to business and mass customers in the United States and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives